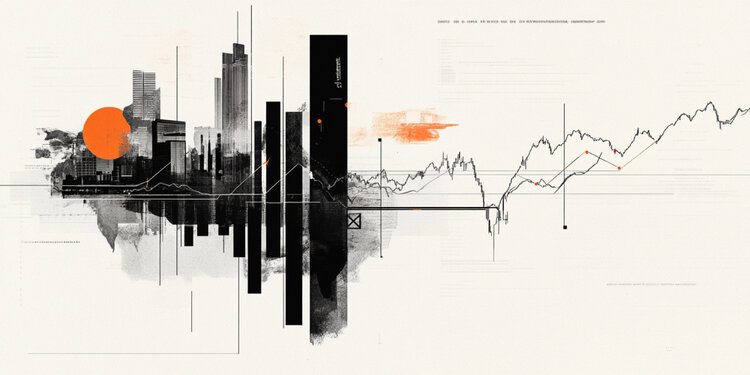

The Dollar Index is holding steady after last week’s choppiness. OCBC Bank economists warn that a head and shoulders pattern could be forming, which implies a reversal in the trend in the DXY.

A forming head and shoulders pattern?

“On the weekly chart, the bearish momentum remains intact and should support the overall downtrend. Price action on the weekly chart also showed a head and shoulders (H&S) pattern with neckline around 104.10.”

“We do not rule out a consolidation play with bounce risk as the DXY approaches key support levels. Support at 104.1 (recent low, H&S neckline) and 102.15. But assuming what we are looking at is eventual replay from an H&S, then the textbook price target of the breakout should be somewhere closer to the 95-96 levels.”

“Resistance at 105.75 (200-day SMA), 106 (21-day SMA), and 107.”

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.