- The Dow Jones tests 39,060.00 before returning to the opening range.

- US CPI inflation continues to decline overall, but headline CPI month-over-month rose.

- Stock indices rise across the board, but DJIA remains capped.

He Down Jones Industrial Index (DJIA) rose moderately on Tuesday, with US stocks gaining ground after the Consumer Price Index (CPI) The U.S. will show a pick-up in inflation in the near term, but investor sentiment remains optimistic as core CPI inflation continues to decline.

Markets continue to trust in a rate cut by the Federal Reserve (Fed) sooner rather than later. According to CME's FedWatch tool, rates markets continue to price in a 70% chance that the Fed will cut rates by at least 25 basis points at its June policy meeting. Looking at the details, around 63% of rate futures traders expect a 25 basis point cut, while 7% expect a 50 basis point cut in June.

Dow Jones News: 3M rises almost 5%, Boeing continues to lose weight

3M Co. (MMM) is the most bullish stock in the Dow Jones Industrial Average, up 4.8% at midday to trade at $98.60. 3M gained ground after the company announced that William Brown, former CEO of L3Harris Technologies (LHX), will take over as head of 3M effective May 1.

Boeing Co. (BA) continues to decline as the company is buried under negative headlines. The death of a former whistleblower who worked at the aerospace company adds more negative pressure to the already battered stock and adds to BO's 10% drop in the last month.

US CPI inflation continues to moderate, but near-term heat persists

US month-on-month CPI inflation rose to 0.4% in February, accelerating from 0.3% previously, and year-on-year CPI inflation rose to 3.2%, compared to the expected 3.1%. Core CPI numbers fell, but not as much as markets expected, with month-on-month core CPI remaining at 0.4% rather than falling to the expected 0.3%. The year-on-year core CPI fell to 3.8% from 3.9% previously, but missed market forecasts of 3.7%.

A spike in energy costs drove the headline CPI higher in the short term, as more than 60% of the increase in month-on-month CPI inflation came from gasoline and homeowners' equivalent rental accommodation costs.

According to Robert Frick, corporate economist at Navy Federal Credit Union, “inflation continues to hover above 3%, and once again housing costs were the main villain. With housing prices expected to rise this year and As rents fall only slowly, the long-awaited drop in home prices is not going to come to the rescue any time soon.” Frick continued, “Reports like those in January and February are not going to prompt the Fed to lower rates quickly.” .

Dow Jones Industrials Technical Outlook

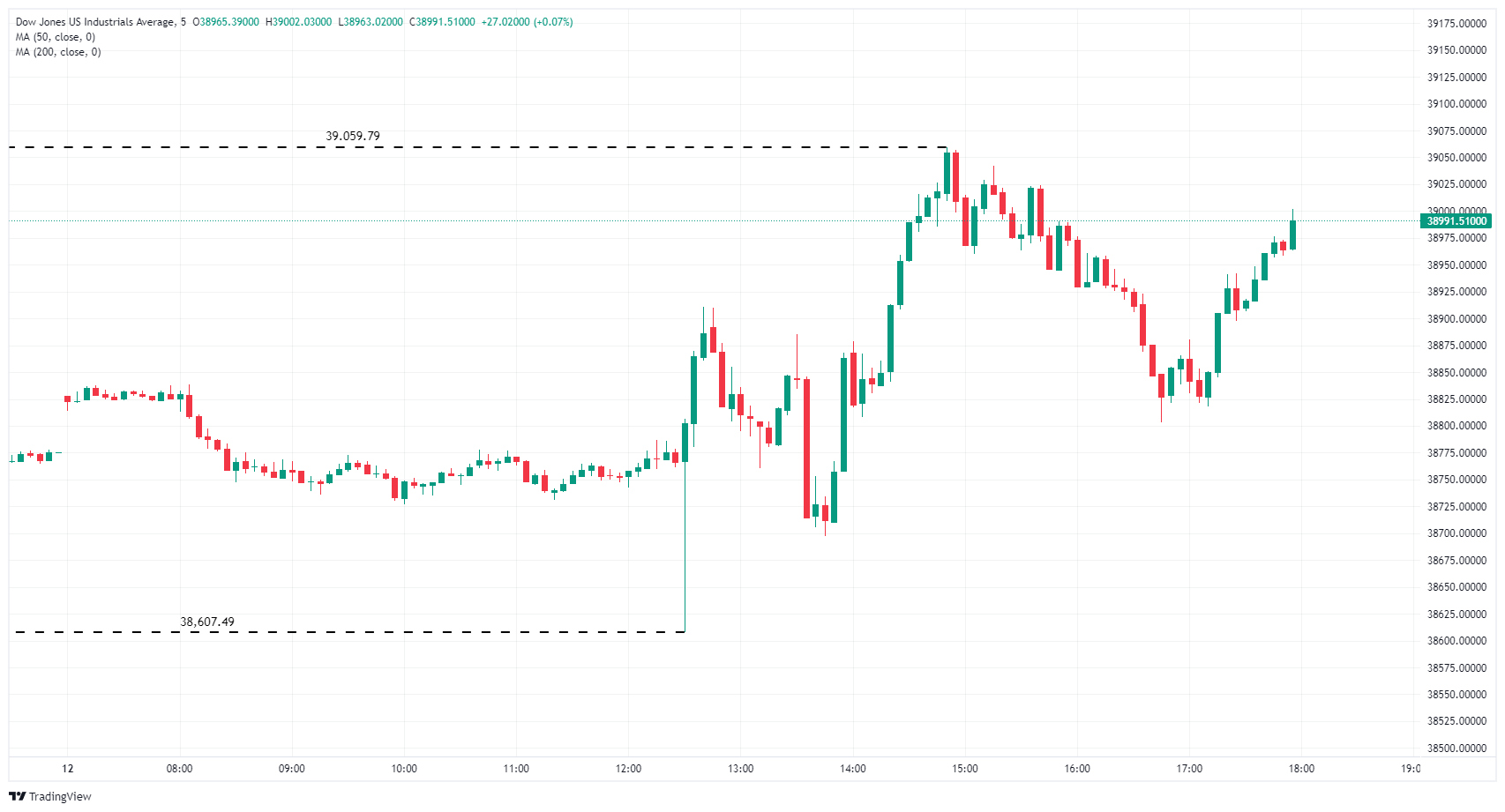

The Dow Jones Industrial Average (DJIA) began Tuesday's session near 38,820.00 points, setting a daily low around 38,600.00 points in reaction to the US mixed CPI, before recovering and staging a slight rebound to 39,060.00 points.

Profit taking and fading headlines dragged the equity index back into the day's opening range and the main index is now grappling with the chart territory around the main price level of $39,000.00.

Dow Jones chart, 5 minutes

Frequently Asked Questions About the Dow Jones

The Dow Jones Industrial Average, one of the world's oldest stock indices, is made up of the 30 most traded securities in the United States. The index is price-weighted rather than capitalization-weighted. It is calculated by adding the prices of the securities that comprise it and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, also founder of the Wall Street Journal. In recent years it has been criticized for not being sufficiently representative, as it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

There are many factors that influence the Dow Jones Industrial Average (DJIA). The main one is the aggregate performance of its component companies, revealed in the companies' quarterly earnings reports. US and global macroeconomic data also contribute, influencing investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA, as it affects the cost of credit, on which many companies largely depend. Therefore, inflation can be a determining factor, as well as other parameters that influence the Fed's decisions.

The Dow Theory is a method for identifying the main trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmation criterion. The theory uses elements of maximum and minimum analysis. Dow theory postulates three trend phases: accumulation, when the smart money starts buying or selling; public participation, when the general public joins in; and distribution, when the smart money comes out.

There are several ways to trade the DJIA. One is to use ETFs that allow investors to trade the DJIA as a single security, rather than having to buy shares of the 30 companies that comprise it. A prominent example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts allow speculation on the future value of the index, and options give the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds allow investors to purchase a portion of a diversified portfolio of DJIA securities, providing exposure to the global index.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.