- The Dow Jones found a support point near the level of 42,000 on Thursday.

- President Trump’s fiscal bill survived the Chamber and now addresses the Senate.

- The US PMI figures regained firmly in May, challenging market forecasts.

The industrial average Dow Jones (DJIA) bounced from a new minimum on Thursday, leaving the basement after a strong fall during the negotiation window in the middle of the week. On Wednesday, the bond yields rose and the actions suffered a blow as new concerns arose about the growing debt burden of the United States Government (USA). Investors have apparently ignored their concerns and resume offers for Actions After the Republicans of the Congress managed to promote the “great and beautiful bill” of President Trump on the federal budget and taxation, which Billions are expected to add to the federal deficit over the next ten years.

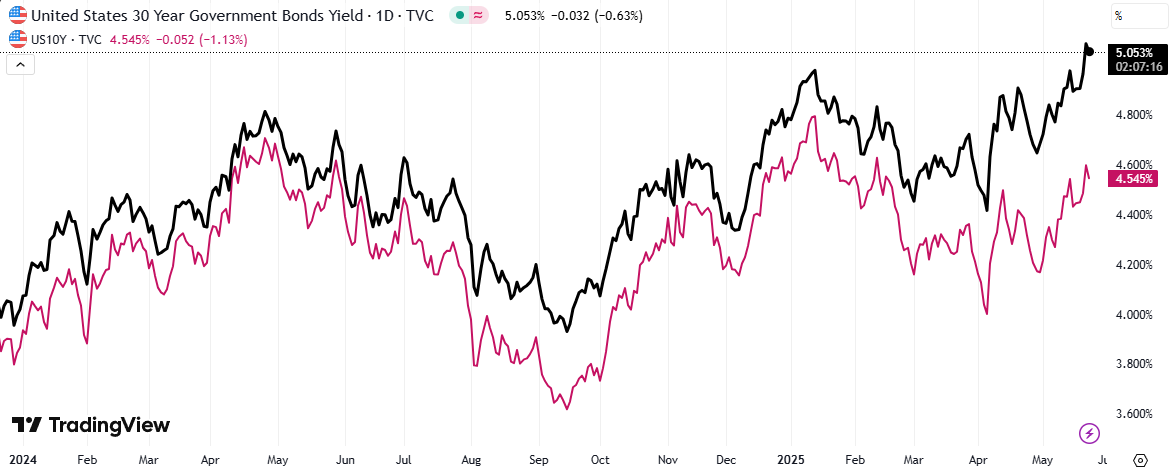

The bond markets are still in an unstable position, limiting the upward impulse and excluding Dow Jones from a clear bull reversal. The 30 -year Treasury yield remains above 5%, and despite a slight relief, 10 -year yield is maintained above 4.5%. The increase in financing costs comes at a time when the Trump administration expects to help relieve the budget pressure of its planned tax cuts pronounced using cheap debt. However, the increase (or at least the persistence) of the yields of the bonds, together with a Federal Reserve (Fed) that remains firmly apprehensive about cutting interest rates in the face of possible economic repercussions of Trump’s tariffs, are systematically ruining those plans.

The figures of the US Purchase Management Index (PMI) increased in May as business operators bowed towards optimism more than expected in the aggregate. The components of services and manufacture of the results of the Indexed Business Survey both rose to 52.3, from 50.2 for services and 50.8 for manufacturing.

Dow Jones price forecast

The Dow Jones industrial average tested the 200 -day exponential (EMA) mobile average of about 41,640 on Thursday before the shares markets found their stability and pushed the offers intradicted again to the area of 42,000. The price action remains in general Alcista, but a short -term decline has deflated part of the wind of the Dow Jones candles.

Dow Jones daily graphics

Economic indicator

PMI Global S&P manufacturing

The manufacturing purchase managers index (PMI), published by Markit Economicscapture business conditions in the manufacturing sector. As the manufacturing sector dominates a large part of the total GDP, the PMI is an important indicator of the business conditions and the economic conditions of the United States. Reading above 50 implies that the economy is expanding, so investors understand as a bunder for the dollar, while a result below 50 points for economic contraction, and weighs negatively in the currency.

Read more.

Last publication:

play May 22, 2025 13:45 (PREL)

Frequency:

Monthly

Current:

52.3

Dear:

50.1

Previous:

50.2

Fountain:

S&P global

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.