- The DXY index extends the corrective move to 103.30.

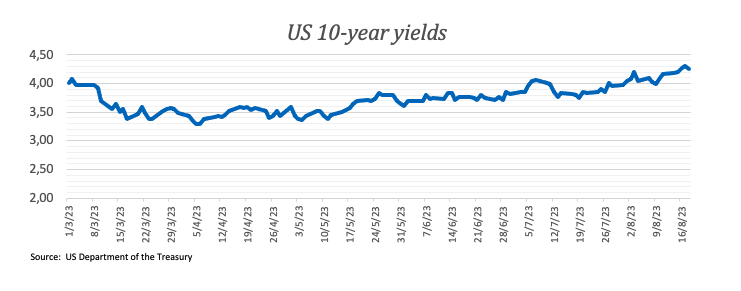

- US yields start the week on a positive note.

- The markets’ attention will be on the Jackson Hole event.

He dollar extends bearish tone at the start of the new week and drags the DXY Dollar Index to the 103.30 zone.

The DXY index centered on Jackson Hole and Powell

The index follows correcting downward after fresh monthly highs hit last week near 103.70 (August 18) amid generally improving risk appetite.

The dollar, meanwhile, seems to have found decent initial resistance near 103.70 against the background of relentless upward movement of US yields across the entire curveas well as the growing speculation that the Federal Reserve could maintain the position of “higher rates for longer“for an extended period.

No data will be released on the US agenda on Monday, while market participants are expected to remain focused on the Symposium on jackson holeas well as in the Fed Chairman’s comments, Jerome Powellscheduled for the second half of the week.

What can we expect around the DXY index?

The DXY index seems to have entered a consolidation phase below recent multi-week highs around 103.70.

Additional support for the dollar comes from the good health of the US economywhich seems to have revived the narrative around the Federal Reserve tightening stance.

On the other hand, the idea that the dollar could face headwinds in response to the Fed data-dependent stance in the current context of persistent disinflation and cooling of the labor market seems to be running out of steam of late.

Relevant DXY Index Levels

At time of writing, the DXY Index is down 0.10% on the day, trading at 103.32. Initial support is at 102.32 (55-day SMA), followed by 101.74 (4 Aug low) and 100.55 (27 Jul low). Elsewhere, a break of 103.68 (18 Aug high) would open the door to 104.69 (31 May high) and ultimately 105.88 (8 Mar high).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.