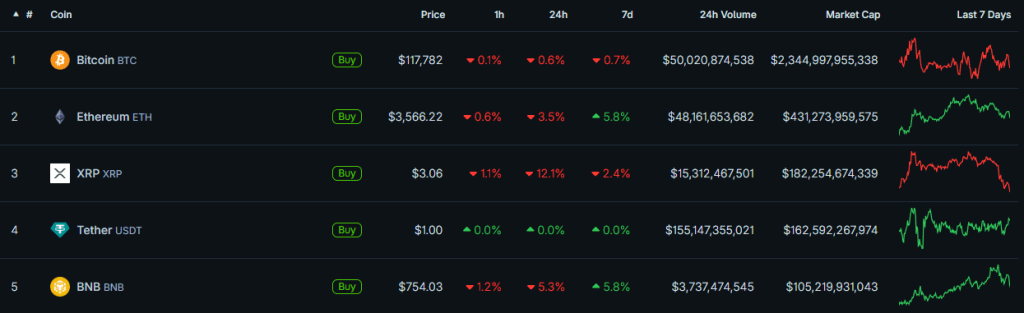

For the first time in a long time, the trading turnover of the second in capitalization of cryptocurrency surpassed the digital gold indicator, Cryptoquant experts wrote.

Over the past day, Ethereum has fallen in price by about 3% with respect to bitcoin. Growth has stopped after a long movement towards $ 4000. At the time of writing, the weighted average price of the ether is in the area of $ 3566.

However, Santiment analysts are convinced that the upward trend will continue.

Reasons for correction

Analyst Presto Research Ming Jeon believes that the correction in the market occurred without an obvious trigger – it is more like a fixation of profit:

A similar point of view was expressed by Coinw Director Nassar al-Achkar:

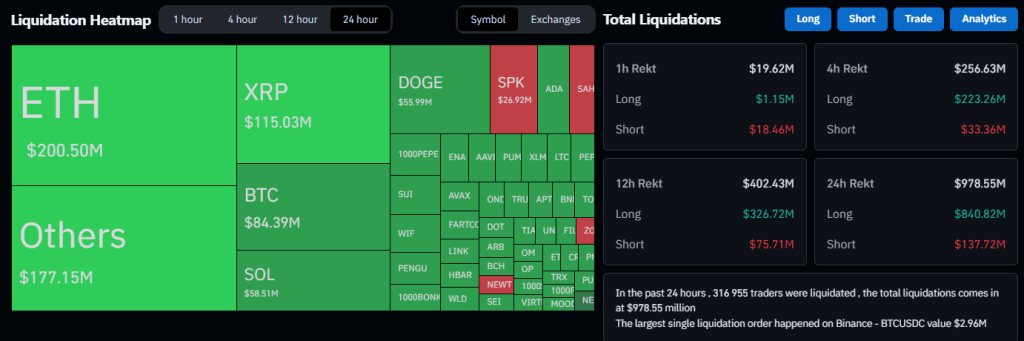

Investment Director of Kronos Research Vincent Liu believes that the correction is largely due to the Cascade of Liquidations [лонгов с высоким кредитным плечом] and a decrease in liquidity. “

Altcoins remain under pressure against the backdrop of a decrease in interest from retail investors. At the same time, traders are focused on geopolitical risks, an influx of funds in the ETF institutions and the key levels of technical support, said Nick Cancer Director LVRG Research.

According to Ming Jeon, the market picture remains generally stable:

Two-week tributary in Ethereum-ETF

The net inflow of capital in spot exchange funds based on the broadcast lasts 14 days in a row. However, the graph shows that over the past seven trading days, volumes are declining:

According to the results of July 23, the influx of capital amounted to $ 332 million. The BlackRock Flagship Foundation was ~ $ 325 million.

The cumulative clean influx since the launch of tools last July reached $ 8.65 billion. Assets of $ 8.65 billion – 4.57% of the total offer of Ethereum at the disposal of funds. It is noteworthy that spot-bitcoin -etf records the outflow for the third day in a row-only in the last day investors have withdrawn $ 86 million.

Fashion for air?

Meanwhile, corporations continue to increase reserves – the total cost of Ethereum on the balance sheets exceeded 2 million ETH.

The greatest activity in this direction is manifested:

- Sharplink Gaming – +91.43% over the past 30 days;

- BITMINE IMMERSION NECH – +84.29%;

- Bit Digital – +335.53%;

- BTCS Inc. – +282.11%.

This strategy adheres to 61 companies, which have at their disposal 1.69% of the total supply of the second in capitalization of cryptocurrency. Recall that the Cryptoquant analyst under the nickname Crypto Dan predicted a short -term correction, but doubted the change in the more long -term trend of the price of Ethereum.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.