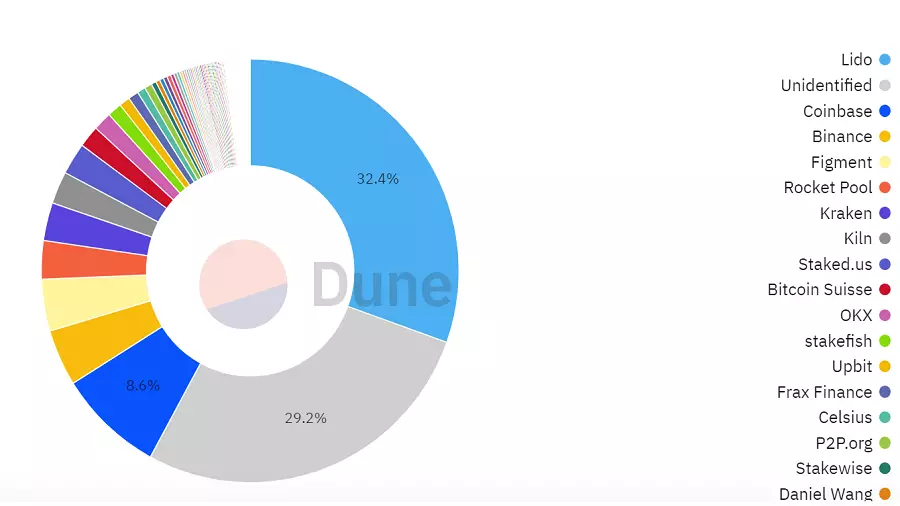

The decentralized liquid staking protocol Lido Finance has accumulated more than a third of all Ethereum stakes on its platform.

“While everyone is silent, the unregulated growth of Lido Finance could be the biggest attack on Ethereum decentralization and “true neutrality” in the history of the blockchain,” — declared

Evan Van Ness, Chief Ethereum Decentralization Specialist.

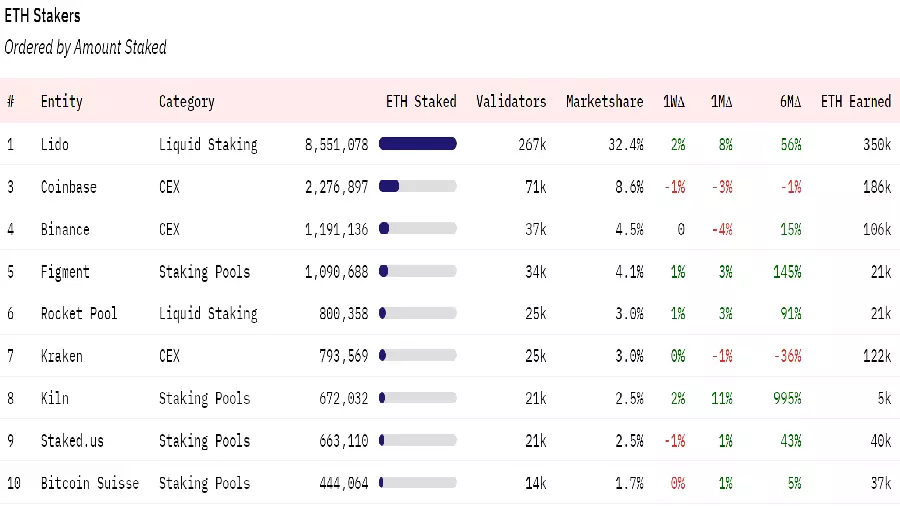

Over the past year, total ETH staking has grown by almost 95%, from $22 billion to around $41.6 billion, according to blockchain explorer Dune Analytics. four times the amount raised by Coinbase, which comes in second with 8.7%.

Evan van Ness’ concerns are shared by cryptocurrency investor Ryan Berckman, who said the Ethereum community has no right to ignore the growing dominance of Lido Finance. Otherwise, Lido “jeopardizes” Ethereum’s reputation as a “decentralized network, which in the future may become a global settlement layer in the financial system,” the expert said.

“Such a scenario could negatively impact the growth rate of the network and therefore the benefit of Ethereum for humanity, as well as the number of zeros in the long-term valuation of ETH,” warns Berkman.

Delphi Digital experts were the first to sound the alarm about the growing centralization of the Ethereum network. They drew the attention of the crypto community that most of the “staken ethers” are at the disposal of only four of the largest network players.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.