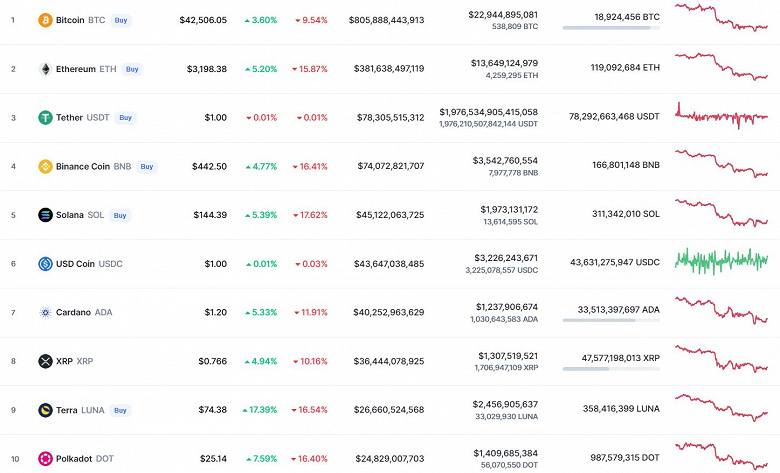

If even in early 2022 nothing foreshadowed the collapse of the cryptocurrency market, by the end of this week the quotes went into a protracted peak. As a result, Bitcoin sank by more than 9% over the week, while the cost of Ethereum dropped by 15%.

Now for one BTC they give about $ 42,500 – and this is taking into account the daily growth of about 3.5%. Ethereum also went up in price over Sunday, by 5%, but over the week the second most important cryptocurrency in the world still sank more. The fall of the rest of the cryptocurrencies in the top 10 is within 10-17%: negative factors have spread throughout the market.

There are two factors. The first is the riots in Kazakhstan and the subsequent shutdown of the Internet. After the exodus of miners from China, this country became a real haven for cryptocurrency miners, and so much so that by the end of the summer Kazakhstan had become the second largest Bitcoin producer in the world. Then it accounted for about 18% of the world hash rate.

The second factor is the willingness of the US regulator, the Fed, to start raising the interest rate faster and to do it earlier against the backdrop of very high inflation in the US. When the rate rises, investors leave risky assets, which include cryptocurrencies. And although it is unlikely that the rate will be revised earlier than March, investors are already worried: as a result, both the stock market and the crypto market fell.

.

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.