Ethereum survived a significant drop in price, decreasing from $ 4,750 to $ 4,200. However, this may not be the end

In the coming days, Ethereum can continue the recent fall, as several indicators indicate the possible pressure of sales.

Ethereum Hodler can cause a collapse

Long -term holders (LP) Ethereum are now seeing an increase in profit. This is confirmed by the MVRV Long/Short Difference indicator, which has reached the annual maximum.

Usually, when the indicator goes into the negative zone, this is a signal that short -term holders make a profit and can start selling. However, now the meaning of the metric is in the positive area. This indicates a significant profit of LP. This usually indicates strength, but may also indicate the possibility of fixing profit. In this case, the pressure on the sale will increase. Therefore, the current huge profit LTH puts token in a potentially vulnerable position.

Clean unrealized profits/losses LTH (Net Unrealized Profit/Loss, NUPL) are now at an 8-month maximum. The metric shows the difference between the profit and losses of long -term holders. Recent growth indicates significant income for them.

However, history shows that when NUPL exceeds 0.60, the price may turn around. This means that ETH can decrease if the current trend continues, as holders can start selling, fixing profit. Cast experience shows that this is a signal for a possible drop in prices, and ETH may again be in a similar situation.

ETH price can fall to $ 3,000

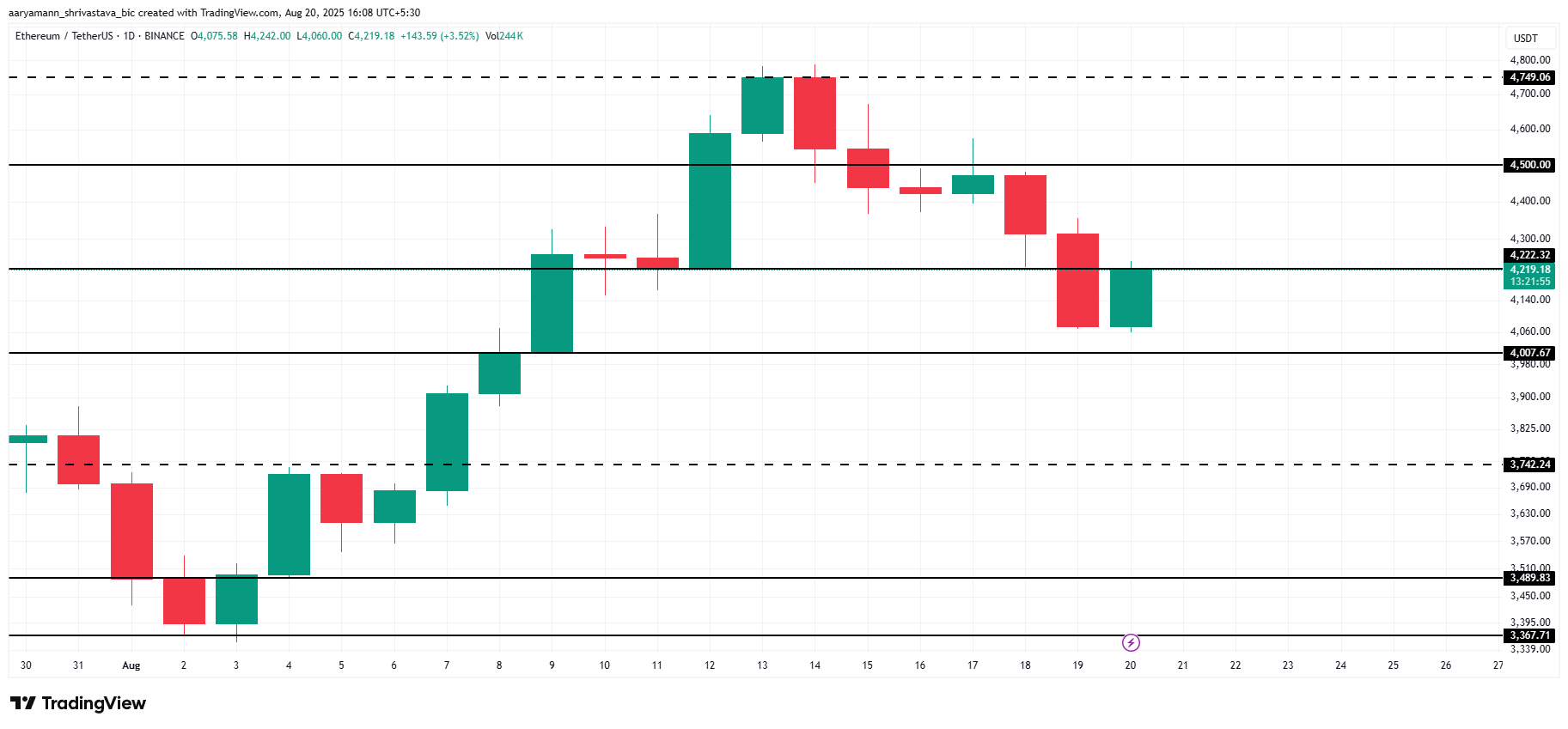

The price of Ethereum has already decreased to $ 4,219. If the descending trend continues, it can fall below $ 4,000. However, a more serious problem will be a possible decrease due to sales of long-term holders. If they begin to fix the profit, this can exert significant pressure on the price.

The history of the NUPL canine indicator shows that when LP formed the market peak, the price of Ethereum fell below $ 3,000, reaching minimums of about $ 2,800. If the situation is repeated, ETH can decrease again, and the level of $ 3,000 will become the key to observation.

On the other hand, if long -term holders retain their positions and do not begin to sell, the market can make a rebound. If the price manages to recover over the support of $ 4,222, it can reach $ 4,500, refuting the current bear scenario. However, for this it is necessary that long -term holders believe in the asset and do not create pressure on the sale.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.