Today, Ethereum finally overcame $ 3,000, which he fought for several months. The main question is: will this impulse be held.

The reason for today’s growth of Ethereum was the revival of short -term wallets. This indicates the growth of retail demand, which was recently weak. Sustainable tributaries in ETF and testing of important resistance levels support ETH growth potential.

Retail demand for Ethereum wakes up

Overcoming the price of ETH $ 3,000 is not only a technical, but also a behavioral aspect. The Glassnode Hodl Waves indicates the percentage of tokens held in different time ranges. He shows that short -term holders (especially in the ranges of 1 week – 1 month, 1 month-3 months and even 10 years) steadily increased their presence in the past few days. This surge shows the growth of the activity of new wallets, which reflects retail demand.

Compared to the All-Time Hodl Wave graph, where long-term ranges usually dominate, such a sudden jump in short-term groups attracts attention. This signals the transition to active trading behavior.

Hodl Waves show how long coins remain in wallets. Growth in short -term ranges signals the resumption of retail activity (new ETH purchases), and long -term ranges indicate cold storage and confidence. In the case of Ethereum, both of these phenomena are observed.

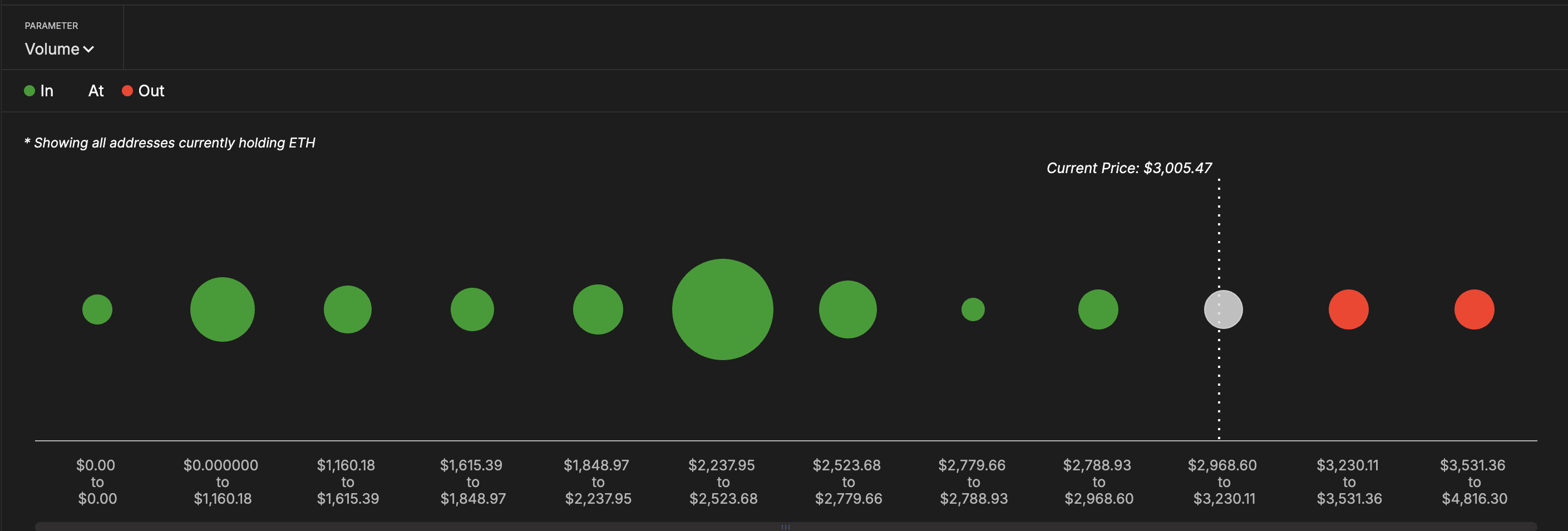

Classes of wallets can set the following price.

Now the largest cluster of onchans are located in the range from $ 2,237 to $ 2,523. Here, millions of addresses are now in profit. This range serves as the basis for the current movement. If the impulse weakens, this level will probably become strong support, since the holders in profit are inclined to hold positions, and not sell it.

Above the current levels of Ethereum, it is included in the zone with a high concentration of breaketing positions between $ 2,968 and $ 3,230. For it, above $ 3,230, the next red zone of holders who are at a loss (Out-The-Money) is located. Here the risk of fixing profit is increasing.

The IN/out of the Money indicator shows where the current ETH holders bought their coins. Clusters of purchasing activity often serve as weak support or resistance depending on mood. Now Ethereum is a break -in zone, where the pulse is checked for strength. Her breakthrough will open the way to $ 3,500. In the event of an unsuccessful attempt by a breakdown, the rally can roll back to stronger zones about $ 2,523.

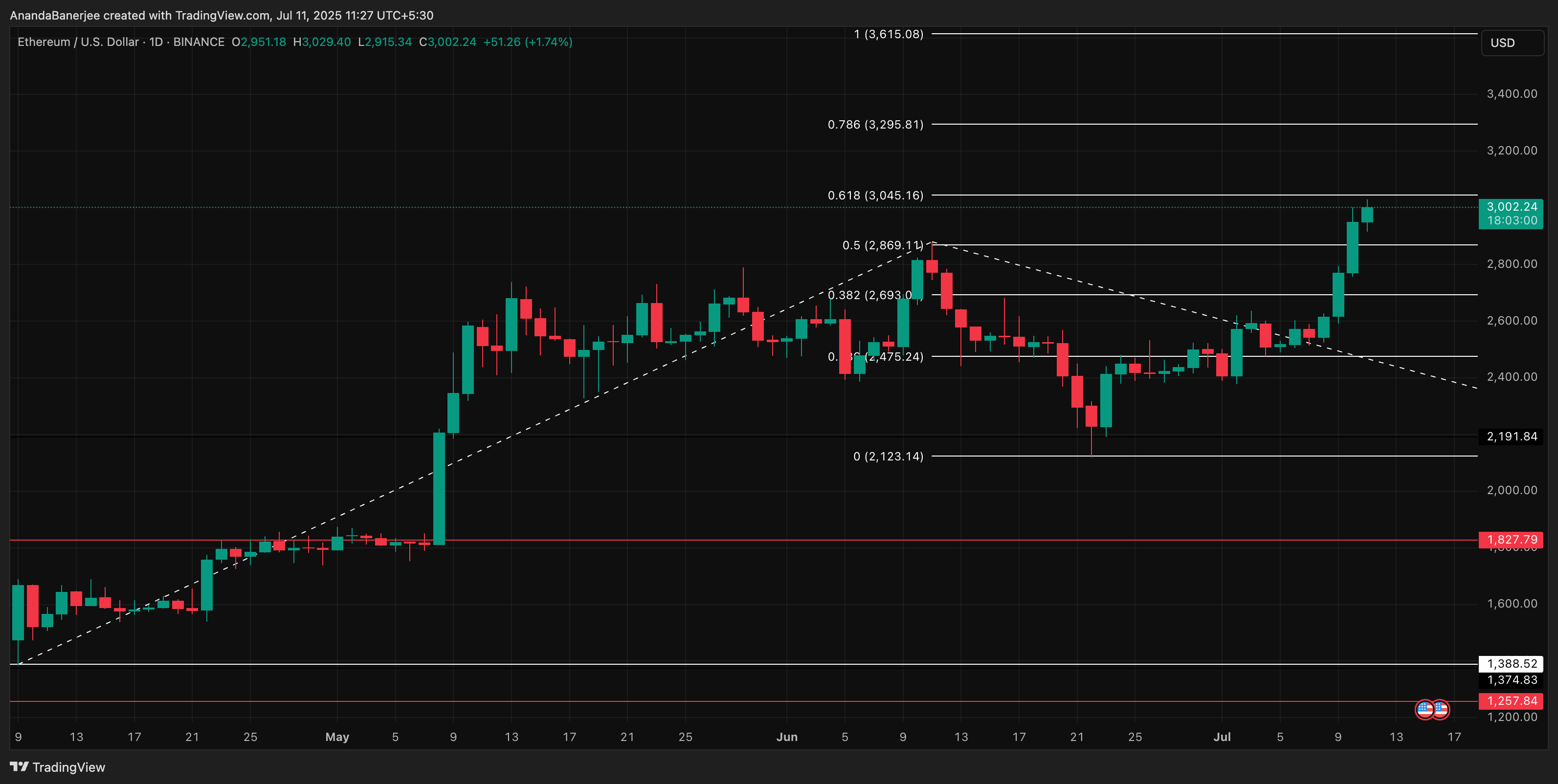

Price levels and impulse depend on fibonacci and OBV divergence

The recent Ethereum rise above $ 3,000 led him to the key area of resistance. It is located at $ 3 045. It is formed by the expansion of Fibonacci 0.618, built using a trend from a peak minimum of $ 1,388, a peak of $ 2,869 and a correctional minimum of $ 2,123. Next, $ 3,295 will enter the game (the fibonacci level 0.786).

These levels of Fibonacci are closely correlated with the resistance clusters in and out of the money between $ 2,968 and $ 3,230, where many ETH holders are at the level of break -in. This coincidence strengthens the idea of checking the impulse both from the technical side and from the point of view of the behavior of wallets. Above this range, the next goal will be the level of Fibonacci 1 by $ 3,615, but only if the pulse remains.

However, one important indicator is anxious. Despite the increase in the price of ETH, the On-Balance Volume (OBV) metric could not exceed the previous maximum from the last price peak of $ 2,890. Such divergence shows that the volume does not fully support the rally. If the price is growing, and OBV falls, this often indicates a weakening of demand or a decrease in the number of new buyers in the market. This can warn about the slowing of the impulse.

The breakthrough below $ 2,693 will confirm the importance of divergence at the level of Fibonacci 0.382. This can lead to a reduction in price to $ 2,475 or lower.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.