Technical indicators indicate that Ethereum bears are trying to take control of the market, and they may succeed. We analyze the beginning of October for ETH.

The tense situation in the Middle East led to a sharp drop in the cryptocurrency market on Tuesday. As a result, more than $500 million in positions were liquidated. Ethereum (ETH) was particularly hard hit, with traders with long positions suffering significant losses.

Ethereum traders count losses

On Monday, the price of Ethereum fell to $2,447, which was the lowest in the last ten days. The unexpected drop led to the liquidation of many long positions opened in the expectation that the price would continue to rise.

When the value of an asset moves against the trader’s position, the exchange is forced to close the position due to a lack of funds to support it. This leads to liquidation. Liquidations of long positions occur when traders are forced to sell an asset at a lower price to cover losses in a falling market.

This usually happens when the price of an asset falls below a certain level. This forces traders expecting the price to rise to leave the market. According to Coinglass, traders with long ETH positions suffered $96 million in losses on Monday. This was the largest single liquidation in 57 days.

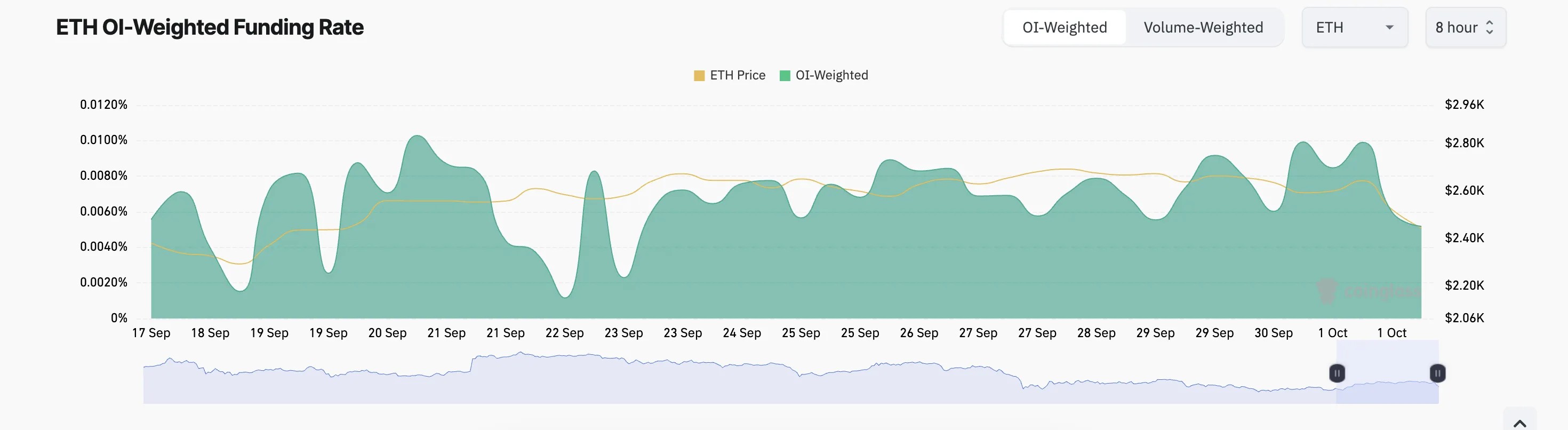

However, ETH futures traders continue to open more long positions. This is indicated by a positive financing rate. This mechanism provides a balance between long and short positions in the perpetual futures market. Positive rates indicate dominance of long contracts and that the contract price is above the spot price. This means that more traders are buying the coin with the expectation of selling at a higher price. The rate is now 0.0052%, reflecting the optimism of futures traders.

Ethereum funding rate. Source: Coinglass

Ethereum funding rate. Source: Coinglass

ETH Forecast: Spot Traders Are Scared

Technical analysis of Ethereum shows that the situation on the spot market is significantly different. According to the daily chart, the bears are once again in control of the market.

For example, index Elder-Raywhich measures the balance of power between buyers and sellers, turned negative for the first time since September 11. Negative values indicate that bears are the dominant force in the market.

Dynamics of the moving average convergence/divergence indicator (MACD) demonstrates that its MACD line (blue) crossed the signal line (orange) from top to bottom and is aimed at further decline. This indicates a possible change in momentum to bearish.

If selling pressure intensifies, the price could fall back to the August 5 low of $2,112, down 15% from current levels.

However, if the overall market trend improves, the bulls could retake the initiative and send the Ethereum price towards the $3,101 resistance.

Stay informed! Subscribe to World Stock Market in Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.