- EUR / GBP regains positive traction on Friday and recovers some of the previous day’s heavy losses

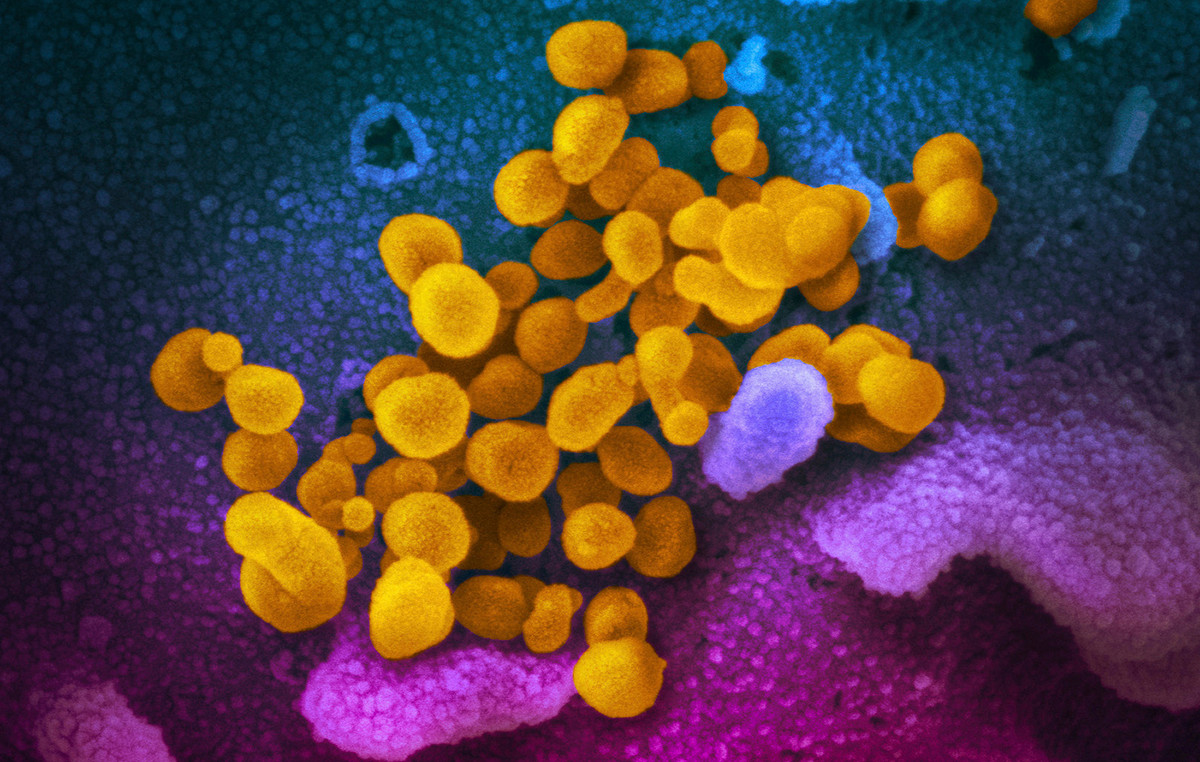

- Brexit woes, COVID-19 nervousness and mixed UK economic data weigh on the GBP and support the pair’s rise.

- Germany’s upbeat preliminary PMI benefits the euro and provides an additional boost to the pair.

Intraday selling bias around the British pound has gained traction after UK data, pushing the cross EUR/GBP upward. At the time of writing, the cross is listed around the 0.8565 level, still positive on the day and retreating slightly after reaching a daily high near 0.8585.

The cross has captured some aggressive buying on the last trading day of the week and has broken with two consecutive days of losses, halting this week’s sharp pullback from nearly two-month highs. The relative underperformance of the British pound occurs amid rising UK COVID-19 infections and stagnation over Northern Ireland Protocol of the Brexit agreement.

It is worth reporting that new cases in the UK have increased by more than 50,000 a day. Furthermore, the EU rejected the UK’s demand for a new approach to the Northern Ireland Protocol. The combination of factors has continued acting like a headwind for the pound sterling and it has helped the EUR / GBP cross to regain some positive traction on Friday.

On the economic data front, UK top retail sales posted slightly better than expected growth of 0.5% in June. The positive reading, however, was offset by softer underlying sales figures, which rose a modest 003% during the reported month and did little to provide any significant boost or impress the GBP bulls.

In addition, the purchasing managers index IHS Markit / CIPS Manufacturing PMI Seasonally Adjusted Drops to 60.4 Points in July versus 62.5 expected, while the preliminary services business activity index for July fell to 57.8 versus June’s final reading of 62.4.

Secondly, The common currency remained on the defensive after the ECB’s shift towards more pessimism on Thursday. The central bank reviewed its forward-looking guidance and noted that it is likely to maintain a highly accommodative policy for a long time. Having said that, better-than-expected preliminary Germany PMIs extended some support.

The latest IHS / Markit report has shown that the German manufacturing PMI rose to 65.6 in July and pointed to an extension. In addition, the indicator of the activity of the services sector stood at 62.2 in the reported month compared to the estimated 59.1. This marked a notable increase from $ 57.5 the previous month and the highest level since June 1997.

From now on, any news related to Brexit and the events surrounding the coronavirus saga will influence the British pound. This, in turn, should give the EUR / GBP cross some momentum and allow investors to seize some short-term opportunities.

EUR / GBP technical levels

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.