- EUR / GBP is witnessing some continuation selling for the third day in a row on Tuesday.

- Optimism about easing COVID-19 restrictions in the UK underpins the British pound.

- The disappointing results of the eurozone ZEW survey weigh on the euro and add to the selling bias.

The common currency has weakened across the board in reaction to the disappointing ZEW survey, dragging the cross EUR / GBP at one-and-a-half week lows, around the 0.8550-45 region in the last hour.

The cross has extended last week’s retracement drop from above the 0.8600 level and has witnessed some continuation sales for the third day in a row on Tuesday. The downside momentum has driven the EUR / GBP cross below the horizontal support at 0.8565-60 and is due to a combination of factors.

The British pound has been supported by British Prime Minister Boris Johnson’s announcement on Monday that all restrictive measures would be lifted on July 19. Aside from this, the sustained sell bias around the US dollar has provided additional boost to the British pound, which in turn has put pressure on the EUR / GBP cross.

On the other hand, the common currency has lost some ground following the disappointing release of the German ZEW economic sentiment index, which plummeted to 63.3 in July from a previous 79.8. In addition, the indicator for the eurozone fell to 61.2 for the current month, below the 84.4 expected.

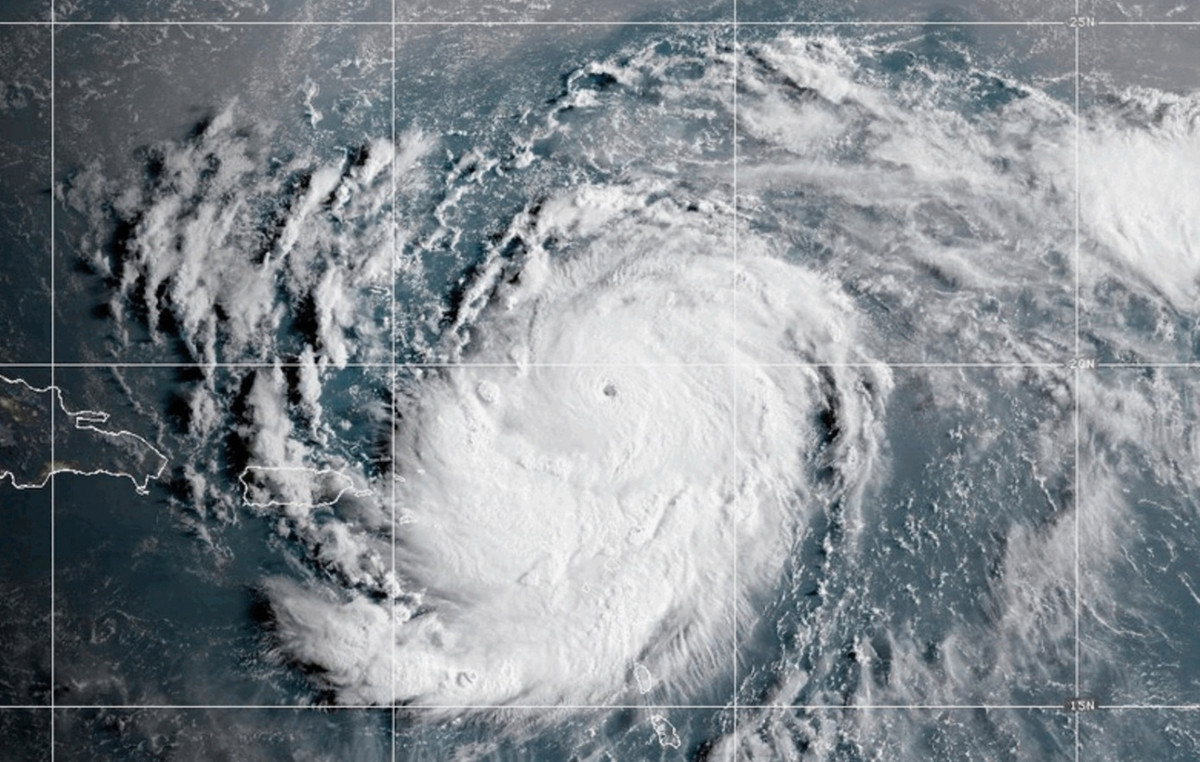

Incoming data suggests that the nascent eurozone economic recovery could be losing steam amid concerns about the spread of the highly contagious Delta variant of the coronavirus. This, in turn, supports the prospects for a broadening of the current bearish move for the EUR / GBP cross.

EUR / GBP technical levels

.

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.