- The EUR/JPY stabilizes while Japan and the EU prepare for growing tensions with the USA.

- The ECB rates decision acts as an additional catalyst for the EUR/JPY.

- The EUR/JPY is consolidated above the resistance of the mobile average about 172.00.

The euro (EUR) is being negotiated in a narrow range against Japanese Yen (JPY) on Tuesday, since commercial tensions between the United States and its key partners remain a central approach.

With the commercial conversations between the EU and the USA and between the US and Japan currently in progress, the EUR/JPY is negotiating about 172.00 at the time of writing.

Japan and the EU prepare for the impact as the deadline of US tariffs approaches.

Both Japan and the European Union are preparing for a significant increase in tariffs on exports to the US, which will enter into force on August 1, as negotiations enter a critical stage.

The risk of a broader commercial conflict continues to weigh on the feeling, particularly for exports dependent economies such as Japan and the Eurozone.

The main commercial negotiator of Japan, Ryosei Akazawa, is currently in Washington to discuss with the USA. This is the eighth round of commercial conversations, which aim to address existing commercial measures and prevent additional tariffs on exports.

At the same time, EU officials are conducting conversations from Brussels. Until now, meetings have not been confirmed in person among Senior Commercial Representatives of the EU and the USA.

The result of the meetings from July 22 to 23 will be significant. If the conversations collapse, the US is expected to advance with a proposed 30% tariff on EU assets.

In response, the European Union has prepared retaliation measures aimed at American products, including digital services and aerospace equipment.

The ECB rates decision acts as an additional catalyst for the EUR/JPY

The euro also faces an event risk due to the next decision of the European Central Bank (ECB) scheduled for Thursday.

Although an immediate policy change is not anticipated, the Monetary Policy Declaration and the Press Conference that accompany it will probably offer information on the evaluation of the Central Bank about the risks of inflation, the dynamics of growth and possible policy adjustments later in the year.

For the EUR/JPY, any change in the tone, particularly towards a more aggressive or dependent position, could influence the rates differentials and direct the short -term address.

EUR/JPY is consolidated above the resistance of the mobile average

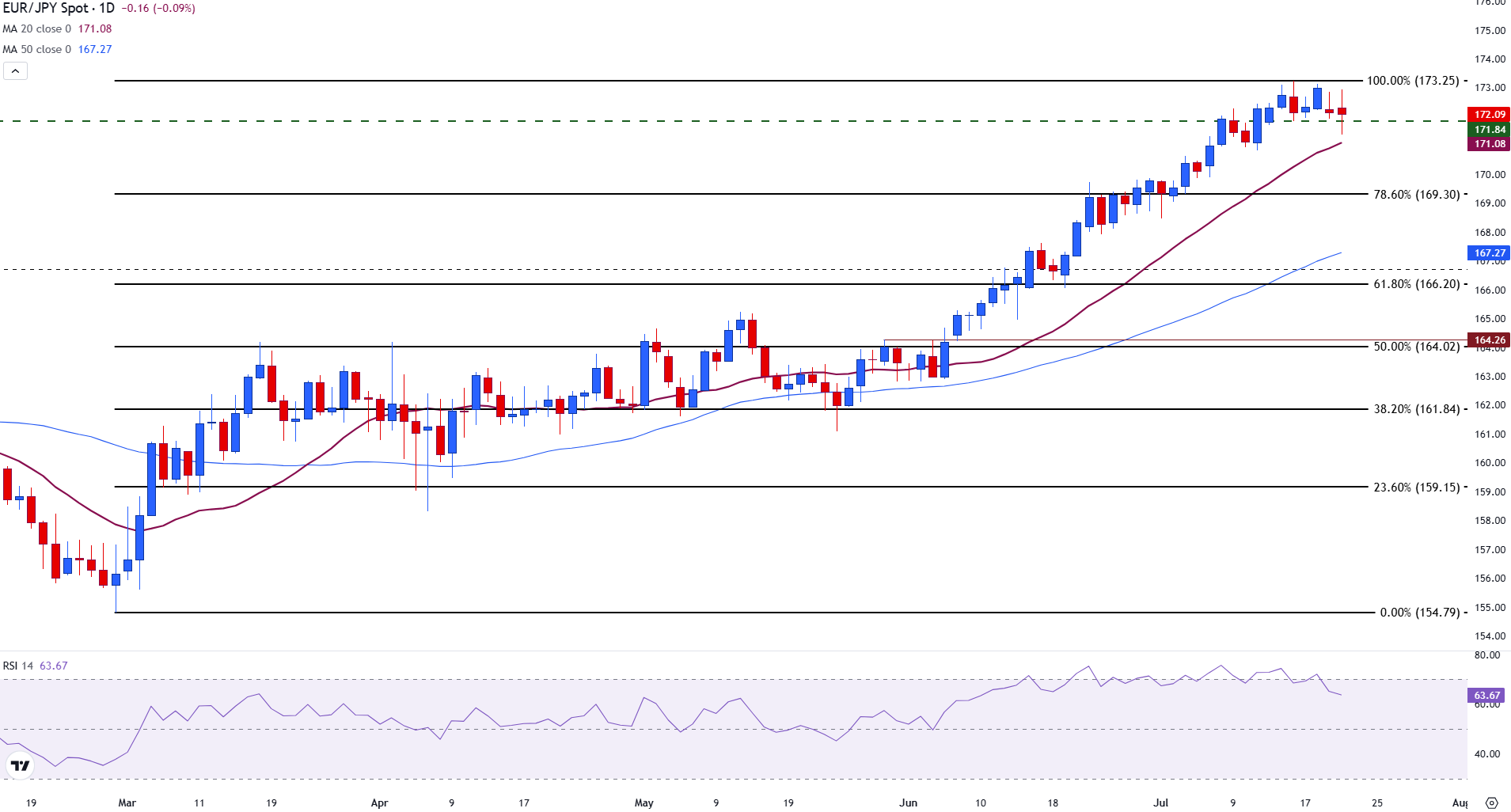

From a technical perspective, the EUR/JPY remains in a consolidation phase after a setback from the annual maximum of 173.25, tested last week. The torque is currently being negotiated above the 10 -day simple mobile average support, located about 170.90, with immediate resistance at the maximum intradic of 172.94, just below the psychological level of 173.00.

A rupture confirmed above this level would open the way for a possible movement towards 173.50, with more resistance near July 2024 in 175.43.

EUR/JPY DAILY GRAPH

At the bottom, the initial support is observed in 170.50. A deeper setback could find buyers in the area of 169.70–170.00, where the 20 -day SMA and the previous consolidation minimums converge.

The Relative Force Index (RSI) remains about 64 and points down after leaving the overcompra territory. This may be a sign that the bullish impulse will continue to fade.

Tariffs – Frequently Questions

Although tariffs and taxes generate government income to finance public goods and services, they have several distinctions. Tariffs are paid in advance in the entrance port, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and companies, while tariffs are paid by importers.

There are two schools of thought among economists regarding the use of tariffs. While some argue that tariffs are necessary to protect national industries and address commercial imbalances, others see them as a harmful tool that could potentially increase long -term prices and bring to a harmful commercial war by promoting reciprocal tariffs.

During the election campaign for the presidential elections of November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy. In 2024, Mexico, China and Canada represented 42% of the total US imports in this period, Mexico stood out as the main exporter with 466.6 billion dollars, according to the US Census Office, therefore, Trump wants to focus on these three nations by imposing tariffs. It also plans to use the income generated through tariffs to reduce personal income taxes.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.