- The EUR/JPY was seen around the 163.00 zone after going back during Monday’s session.

- The general trend remains bullish, with the decrease limited by averages in ascending tendency.

- The price is maintained above key supports, while the resistance is aligned with the short -term recovery objectives.

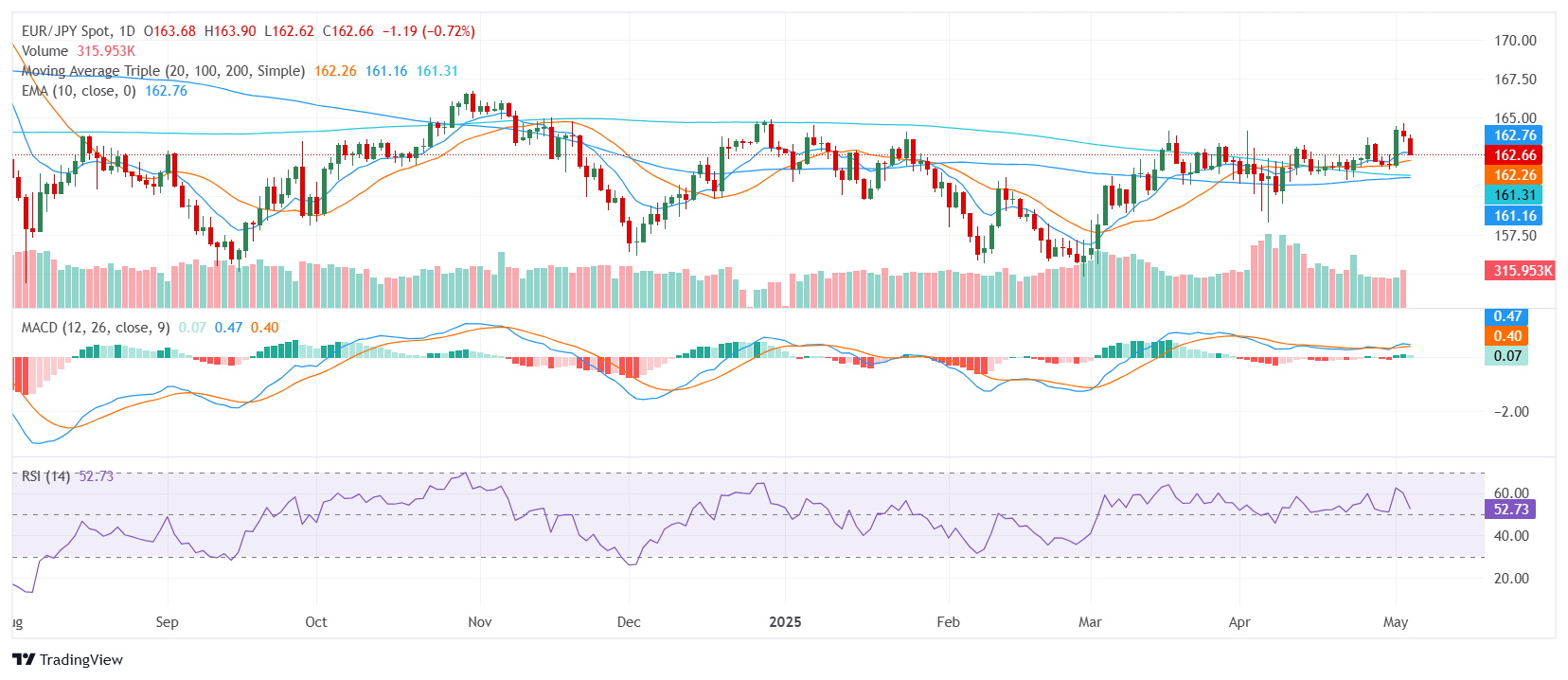

The Eur/JPY torque fell on Monday, approaching the 163.00 area as the session closed and before the Asian opening. Despite the fall of the day, the general configuration remains constructive, with the torque even staying above critical supports of the trend line. Impulse readings seem neutral, but the underlying structure is sustained by longest -long -term indicators.

Technically, the torque maintains its upward posture. The convergence and divergence indicator of mobile socks (MACD) indicates a continuous purchase interest, while the relative force index (RSI) remains neutral near the midline around 53. Other tools such as the amazing oscillator and the bullish/bassist power also show neutral readings, reflecting a short -term consolidation instead of a change in the directional impulse.

What reinforces the positive tone is the alignment of key mobile averages. Simple mobile socks (SMA) of 20 days, 100 days and 200 days are all on the rise and are below current prices, providing a strong technical soil. The exponential and simple mobile socks of 30 days offer additional dynamic support in the 162.10–162.15 area, helping to contain deeper setbacks.

Support levels are seen in 162.40, 162.26 and 162.14. The resistance is marked in 162.67, 162.76 and 163.60. A sustained rebound from the current levels could see the EUR/JPY to test the upper end of its recent range, while a break below the support would challenge the short -term upward case.

Daily graph

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.