- The EUR/JPY is negotiated around the 165.00 zone after a solid advance in Monday’s session.

- The broader bias remains bullish, supported by mobile socks in ascending trend and a strong impulse.

- Key support levels are maintained below, while resistance has not yet been firmly established.

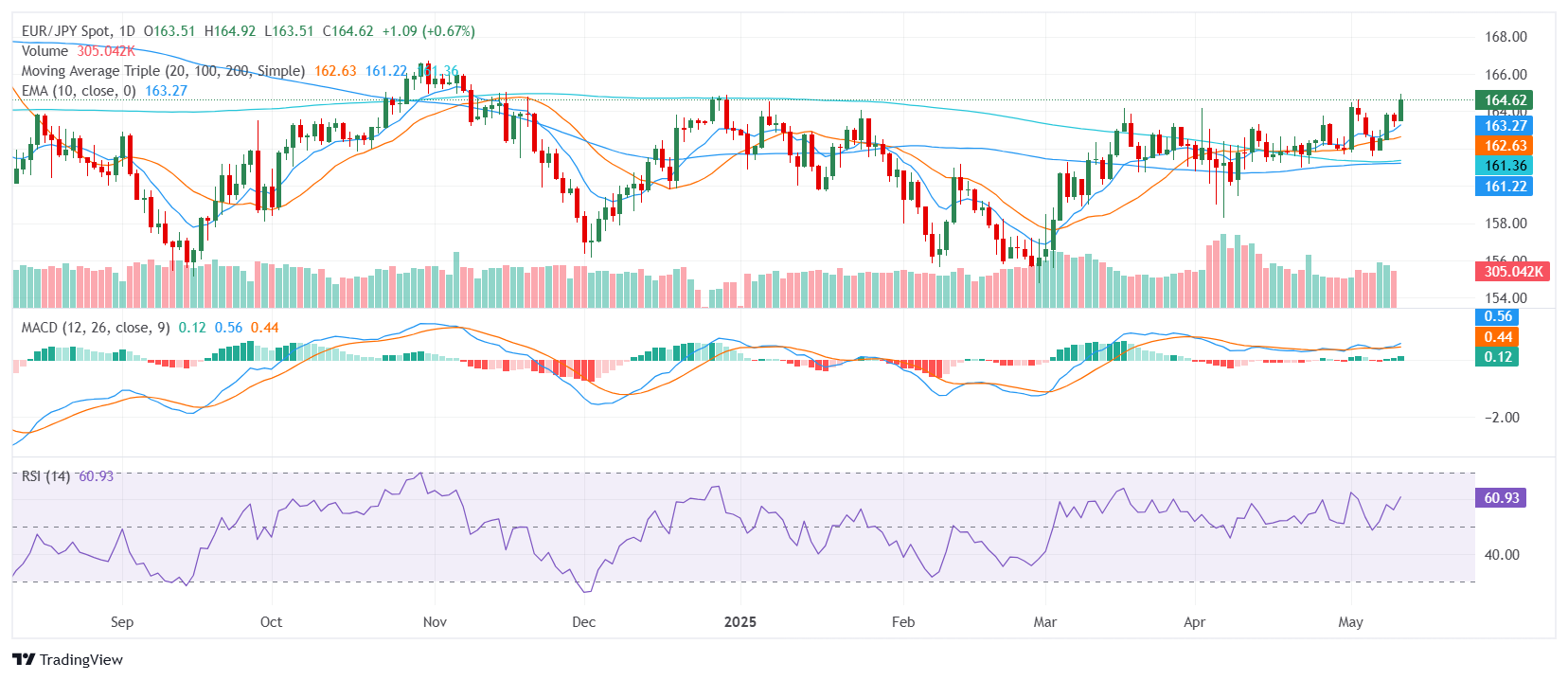

The EUR/JPY pair advanced on Monday, negotiating near the 165.00 zone after the European session, reflecting a strong bullish tone as the market is directed towards the Asian session. The pair remains positioned in the middle of its recent range, suggesting that buyers maintain control despite some mixed short -term signs. The broader technical structure remains favorable, backed by a group of firm mobile socks and firm impulse readings.

From a technical perspective, the torque is showing a clear bullish signal. The relative force index is in the 60s, reflecting a constant ascending impulse without immediate overcompra pressure. The convergence/divergence of mobile socks confirms this bias with a purchase signal, reinforcing the positive tone. Meanwhile, the raw material channel index is negotiated in the 170, indicating a stable impulse, while the amazing oscillator is maintained around 1, suggesting additional upward potential. However, the rapid stochastic RSI remains in neutral territory, hinting at a possible short term.

The upward structure is even more supported on mobile socks. Simple mobile socks (SMA) of 20 days, 100 days and 200 days have an ascending slope, providing a strong underlying support and confirming the broader upward trend. In addition, 10 -day exponential and simple mobile socks also around current price levels, reinforcing the immediate bullish perspective as the torque seeks to extend their profits.

Support levels are identified in 163.86, 163.26 and 163.12. While resistance has not yet been firmly established, a sustained thrust above the recent maximums could confirm a broader breakdown, potentially opening the door to more increases in the following sessions.

Daily graph

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.