- Risk aversion flows into European equities, coupled with falling eurozone yields, weighed heavily on EUR/JPY on Thursday.

- The pair last traded down 1.0% at the 154.50 area, a sharp reversal from intraday highs closer to 157.00.

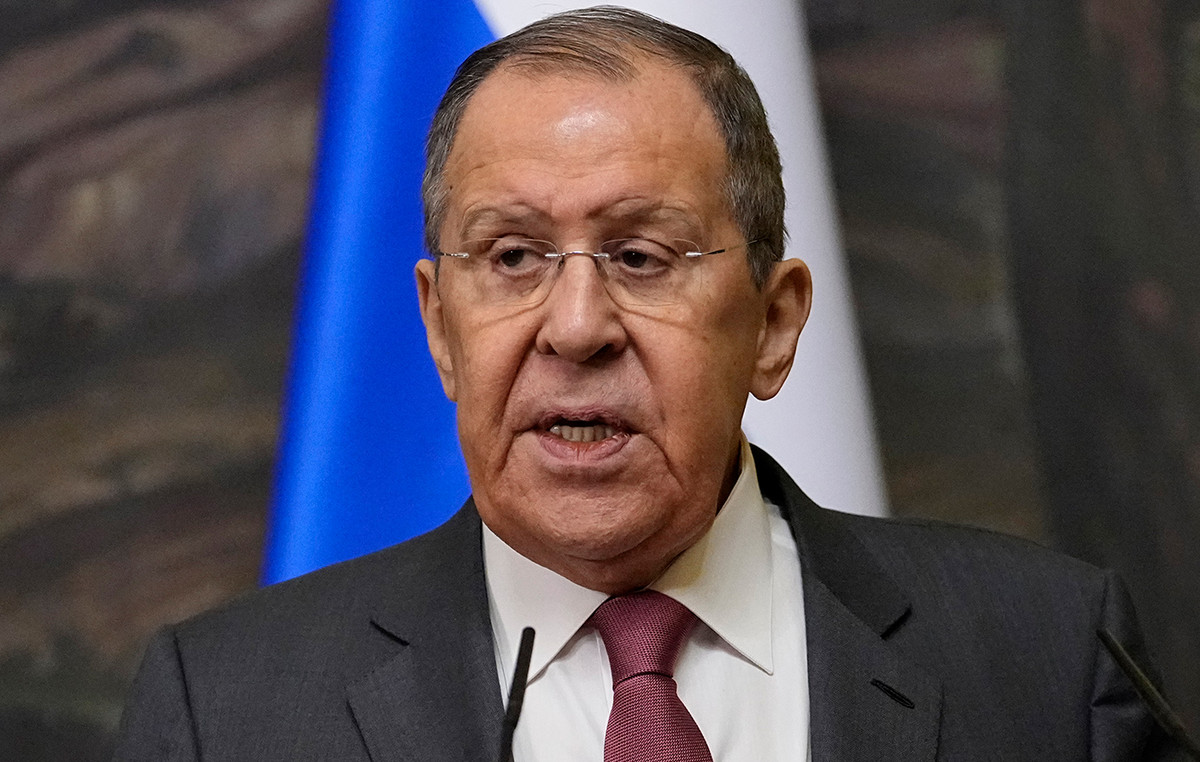

A sharp drop in euro zone yields, coupled with declines in major European stock markets amid rising energy-related tensions between the EU and Russia, dampened the euro’s appeal on Thursday, with the single currency among the worst performing currencies in the G10. While the euro’s losses against its majors were large, they were sharper against the spread-sensitive/safe-haven Japanese yen. As a result, EUR/JPY tumbled roughly 1.0% on Thursday, its worst one-day performance since March 4. That pushed the pair back from intraday highs at 156.50 to 154.50.

At current levels near 154.50, the pair is now trading just 0.3% above key support in the form of 2021 highs at 154.12. If economic/energy tensions between the EU and Russia continue to rise through the end of the week (could Russia start to block gas flows into the EU?), then the pair may well extend the recent bearish move that has already has seen retreat above 2.0% from previous weekly highs around 137.50. A break below the 154.12 support would open the door for a push lower towards support at the 153.50 and 153.00 areas.

Big upside surprises in Spain, France and Germany’s flash HICP inflation estimates for March over the past two days have done little to stop the euro’s downward reversal, with the pair instead following the example of the aforementioned movements in yields and risk appetite. As things stand, the current inflationary environment in the Eurozone suggests that the Euro is poised to maintain a sizeable policy divergence advantage over the Yen.

That was a key factor driving the pair of late, but with economic uncertainty in the eurozone continuing to grow as a result of the Russo-Ukrainian war, it’s hard to be sure the ECB will stick to its current policy stance (of QE ending in the third quarter and rate hikes in the fourth quarter). Unless the geopolitical uncertainty clears up a bit, this is likely to keep a check on any EUR/JPY bounce.

Technical levels

Source: Fx Street

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.