- The EUR/JPY quotes about 163.45, sliding after the rejection of the resistance level of 163.94.

- The caution before Schnabel del ECB’s speech limits the support of the euro, despite the divergence of policies between the ECB and the BOJ.

- The weak economic data of Japan underlines the weakness of YEN, but the demand for shelter assets maintains the profits under control.

- Commercial conversations between the US and China revive the appetite for risk, although Trump’s threat moderates optimism

The EUR/JPY torque is quoting downward on Friday, pressed by the renewed commercial tensions between the US and China, Japan Mixed Economic Data and a cautious positioning of investors before a scheduled speech of the member of the Executive Board of the European Central Bank (ECB), Isabel Schnabel.

At the time of writing, the EUR/JPY is lowering 0.20% to 163.45, while the markets emphasize expectations around the demand for shelter for the Japanese Yen (JPY) and the continuous resilience of the euro (EUR) derived from the divergence of policies between the ECB and the Bank of Japan (BOJ).

Commercial conversations between the US and China revive the mood, but the warning of Trump tariffs stops optimism

A key market engine this week has been the perspective of revived high -level commercial conversations between the United States and China. The initial optimism was supported by the confirmation that high -level commercial conversations between the United States and China will take place on Saturday in Switzerland, with US Treasury Secretary, Scott Besent, and the trade representative, Jamieson Greer, who is expected to meet senior Chinese officials.

However, the feeling of risk was moderated after the US president, Donald Trump, suggested an 80% tariff on China, pointing out a possible relief from the current rate of 145%, but still creating uncertainty. This ambiguity has limited profits in risk -sensitive currencies while supporting shelters such as JPY.

Attention focuses on Schnabel del ECB while the divergence of policies with the BOJ remains a key engine

The member of the ECB Executive Board, Isabel Schnabel, is talking at the Monda Conference of the Hoover Institution in the USA.

The markets expect a 25 basic points cut in June, but those responsible for policies continue to depend on the data. Meanwhile, the Bank of Japan maintains an ultra lax monetary posture, in contrast to the back of the ECB and supporting the strength of the EUR/JPY. Any indication of a long restriction by the ECB could further drive the euro.

The weak data of Japan highlight the moderate road of the BOJ, they limit the support of the YEN

Earlier on Friday, Japan published key economic indicators for March that offered a mixed snapshot of internal conditions. The preliminary coincident index fell to 116.0 from a revised 117.3, suggesting a deceleration in the current economic impulse. Meanwhile, the advanced economic index was 107.7, slightly above the forecasts (107.5) but below the previous 108.2, insinuating softer expectations for future growth.

These figures reinforce the opinion that the BOJ will maintain its position of accommodating monetary policy, particularly in the absence of inflation or growth pressures.

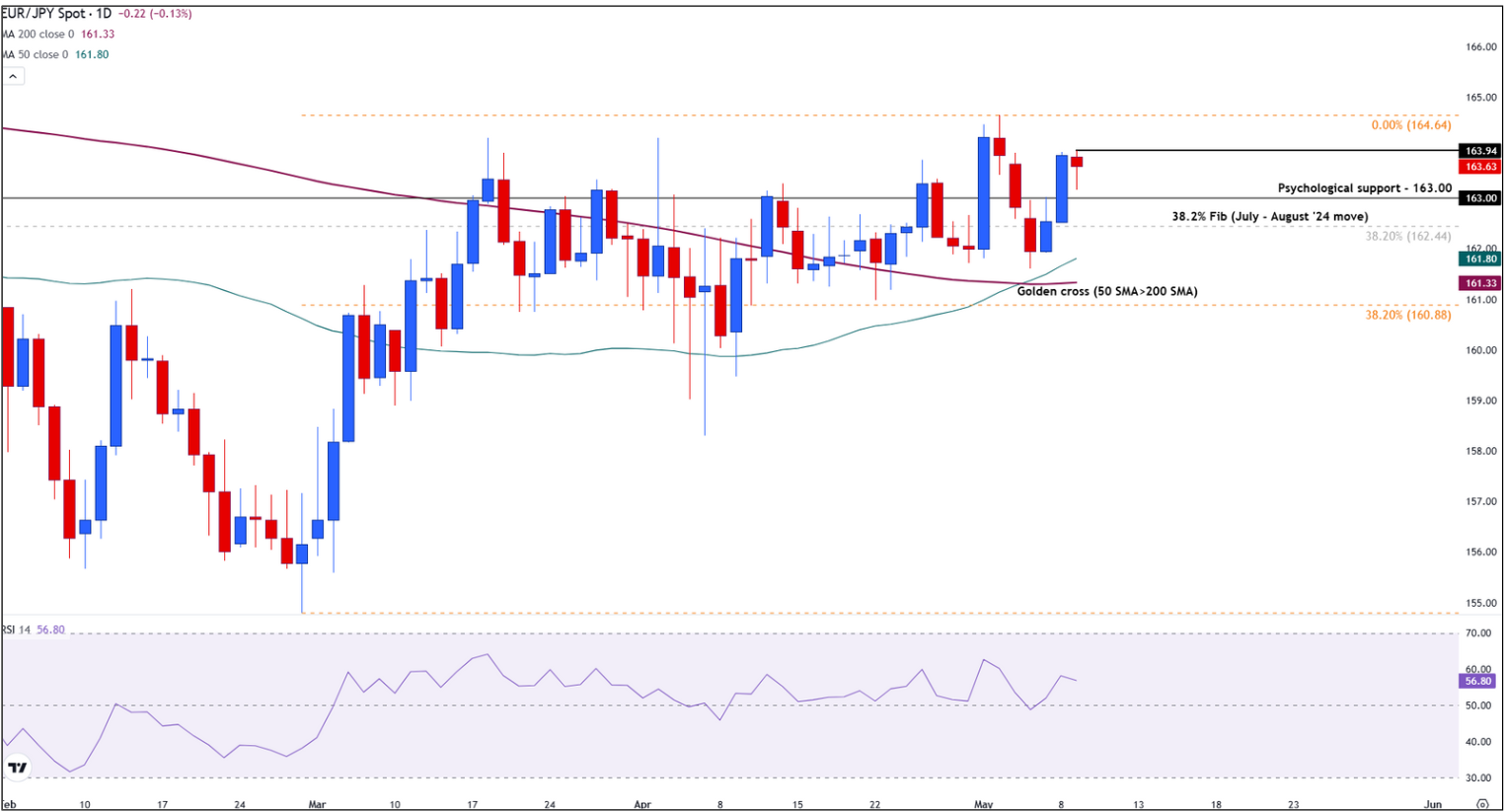

The EUR/JPY is stabilized after the rejection of the resistance level of 163.94

The EUR/JPY is consolidating around 163.45, having tried intradic resistance in 163.94 during Friday’s early trade. The pair continues to quote above its simple 50 -day mobile socks (161.80) and 200 days (161.32), which recently formed a golden crossing, reinforcing a medium -term bullish perspective.

The bullish impulse remains content below 163.94, a daily confirmed daily closure being necessary to expose the maximum of March in 164.64.

The support is observed at the psychological level of 163.00, followed by the fibonacci setback of 38.2% of July-August Rally of 2024 in 162.44. A rupture below that area would bring the approach to the group of mobile socks about 161.80–161.32.

The relative force index (RSI) is currently maintained around 55.78, suggesting a moderate bullish impulse without overcompra conditions.

EUR/JPY DAILY GRAPH

And in Japanese faqs

The Japanese Yen (JPY) is one of the most negotiated currencies in the world. Its value is determined in general by the march of the Japanese economy, but more specifically by the policy of the Bank of Japan, the differential between the yields of the Japanese and American bonds or the feeling of risk among the operators, among other factors.

One of the mandates of the Bank of Japan is the currency control, so its movements are key to the YEN. The BOJ has intervened directly in the currency markets sometimes, generally to lower the value of YEN, although it abstains often due to the political concerns of its main commercial partners. The current ultralaxy monetary policy of the BOJ, based on mass stimuli to the economy, has caused the depreciation of the Yen in front of its main monetary peers. This process has been more recently exacerbated due to a growing divergence of policies between the Bank of Japan and other main central banks, which have chosen to abruptly increase interest rates to fight against inflation levels of decades.

The position of the Bank of Japan to maintain an ultralaxa monetary policy has caused an increase in political divergence with other central banks, particularly with the US Federal Reserve. This favors the expansion of the differential between the American and Japanese bonds to 10 years, which favors the dollar against Yen.

The Japanese Yen is usually considered a safe shelter investment. This means that in times of tension in markets, investors are more likely to put their money in the Japanese currency due to their supposed reliability and stability. In turbulent times, the Yen is likely to be revalued in front of other currencies in which it is considered more risky to invest.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.