- EUR / JPY regains its smile above 129.00.

- US yields lose momentum and weigh on the dollar.

- Flash GDP for the fourth quarter of EMU stood at -0.7% quarter-on-quarter, -4.9% year-on-year.

The moderate downward correction in US yields sent the dollar jolted and triggered a rally in the risk space on Tuesday.

EUR / JPY on the rise due to the purchase of the EUR

The EUR/JPY it reverses two consecutive daily pullbacks and manages to regain some bullish traction in response to the moderate rebound in the single currency.

In fact, the better mood around the euro comes alongside the downward correction in US yields, which in turn triggers a downward movement in the dollar.

Additionally, yields on the US 10-year benchmark fell to the 1.52% area during early trading after surpassing the 1.60% level at the end of last week, the area last traded in February 2020.

On the Japanese agenda, GDP figures for the fourth quarter showed that the economy expanded 2.8% quarter-on-quarter during the October-December period and 11.7% when it comes to annualized figures. Both figures came disappointing estimates.

In the euro area, Germany’s trade surplus widened to € 22.2 billion in January, while advanced figures for overall euro area GDP indicated that the economy is now contracting 0.7% qoq and 4.9% relative to the last year.

Relevant levels

Right now, the cross is gaining 0.33% at 129.36 and is facing next resistance at 129.87 (February 24 high) followed by 130.00 (psychological level) and then 130.14 (November 7, 2018 monthly high). On the other hand, a drop below 128.18 (March 2 weekly / monthly high) would target 127.30 (February 17 low) and finally 127.11 (50-day SMA).

.

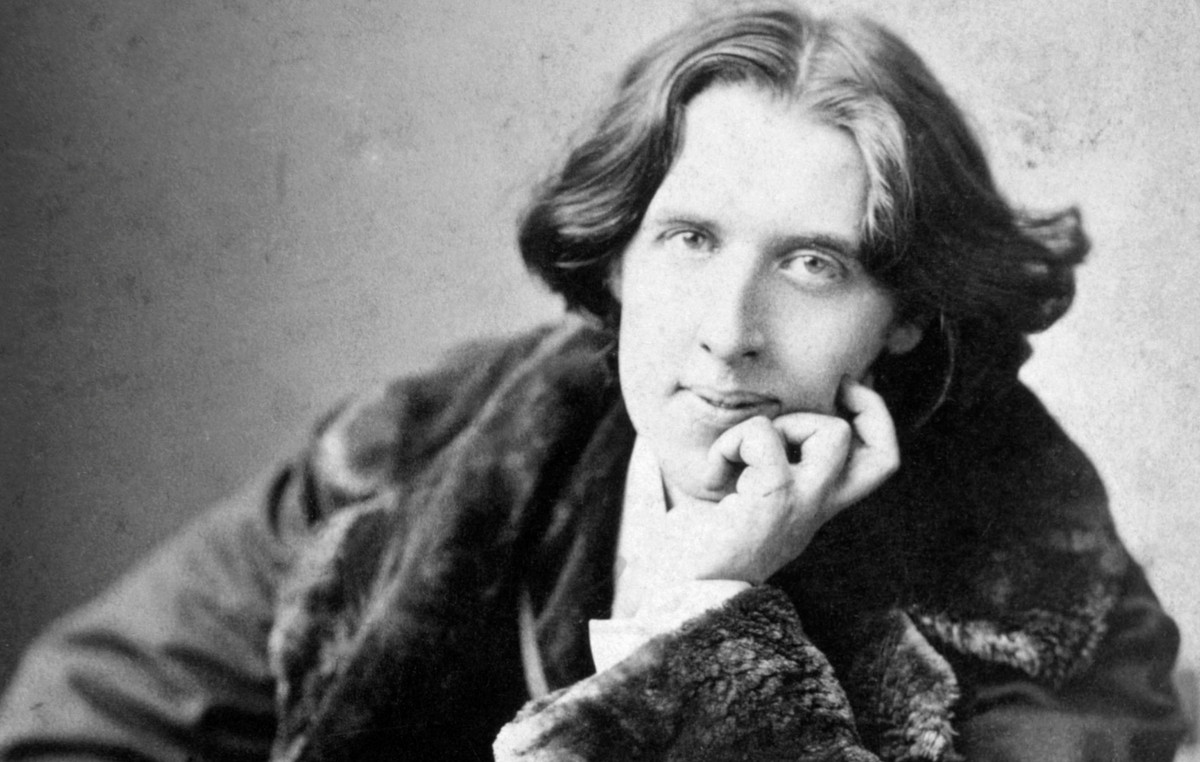

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.