- The EUR/JPY remains firm about 169.00, with the psychological level of 170.00 keeping the bulls at bay.

- The euro benefits from the return of the feeling of positive risk, but Momentum indicators suggest that the pair may still be overcompared.

- The Japanese Yen, as a safe refuge, fights against his counterparts of the G10, with the environment of low interest rates in Japan limiting his profits.

The euro (EUR) is experiencing a modest setback against Japanese Yen (JPY) on Thursday, after having uploaded more than 3% this month.

The EUR/JPY is quoted slightly below the 169.00 mark, with the minimum of Thursday of 168.56 providing imminent support at the time of writing.

With the bulls still anxious to re -test the next large level of resistance at the psychological level of 170.00, both technical and fundamental factors are playing a role in determining the next movement of the torque.

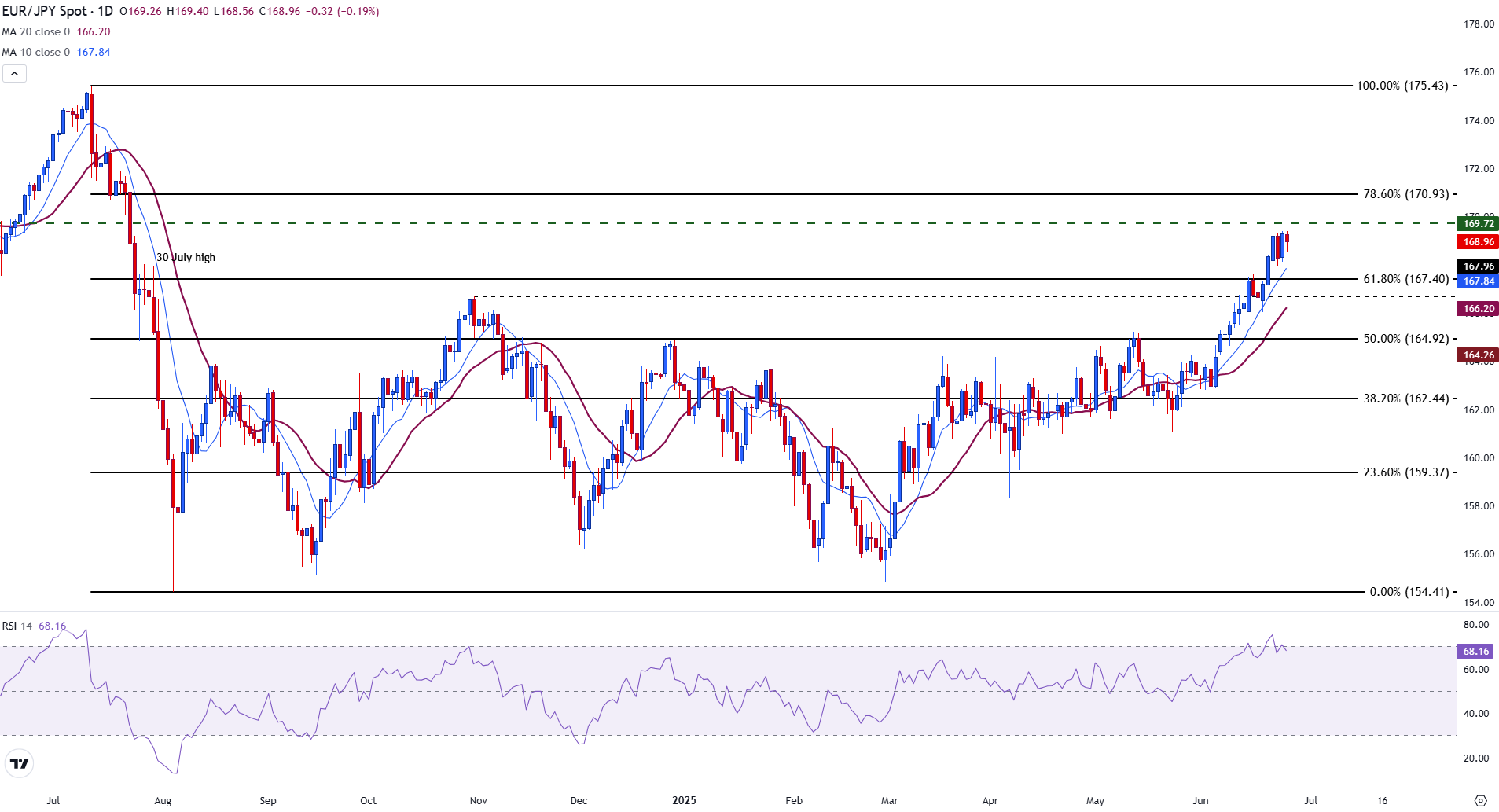

The recent increase in optimism that has pushed the euro to maximum of several years in front of a wide range of currencies is showing signs of deceleration. For the EUR/JPY, the Relative Force Index (RSI) in the daily chart is above 68, suggesting that the pair is still threatening to enter the territory of overcompra.

However, the bearish momentum would need to show positive signs of accumulation before the trend can be reversed.

Fundamentally, the feeling of risk has softened after the stop the fire between Israel and Iran that was confirmed on Tuesday. This has placed the Japanese Yen in an unfavorable position in front of his g10 counterparts.

With risk aversion fading and both Japan and the European Union (EU) pressing for a commercial agreement with the United States before the deadline of July 9, the differential of interest rates continue to favor the strength of the euro.

EUR/JPY DAILY GRAPH

If the EUR/JPY rises above 170.00 and geopolitical tensions continue to decrease, the Fibonacci recoil level of 78.60% of the July-August’s fall could again come into play at 170.93.

A rupture of this level and a resistant euro could potentially open the door to a movement towards the long -term resistance barrier in 175.43, aligning with the maximum of July 2024.

In contrast, a resurgence of tensions in the Middle East or an increase in the potential of the Bank of Japan to climb rates could exert bear pressure on the pair. A clear movement below 169.00 could see prices to test the simple mobile average (SMA) of 10 days in 167.84.

The following support layer is found in the fibonacci setback of 61.80% of the movement mentioned in 167.40, racing the way for a movement towards the 20 -day SMA in 166.20.

FAQS risk feeling

In the world of financial jargon, the two terms “appetite for risk (Risk-on)” and “risk aversion (risk-off)” refers to the level of risk that investors are willing to support during the reference period. In a “Risk-on” market, investors are optimistic about the future and are more willing to buy risk assets. In a “Risk-Off” market, investors begin to “go to the safe” because they are concerned about the future and, therefore, buy less risky assets that are more certain of providing profitability, even if it is relatively modest.

Normally, during periods of “appetite for risk”, stock markets rise, and most raw materials – except gold – are also revalued, since they benefit from positive growth prospects. The currencies of countries that are large exporters of raw materials are strengthened due to the increase in demand, and cryptocurrencies rise. In a market of “risk aversion”, the bonds go up -especially the main bonds of the state -, the gold shines and the refuge currencies such as the Japanese yen, the Swiss Franco and the US dollar benefit.

The Australian dollar (Aud), the Canadian dollar (CAD), the New Zealand dollar (NZD) and the minor currencies, such as the ruble (Rub) and the South African Rand (Tsar), tend to rise in the markets in which there is “appetite for risk.” This is because the economies of these currencies depend largely on exports of raw materials for their growth, and these tend to rise in price during periods of “appetite for risk.” This is because investors foresee a greater demand for raw materials in the future due to the increase in economic activity.

The main currencies that tend to rise during the periods of “risk aversion” are the US dollar (USD), the Japanese yen (JPY) and the Swiss Franco (CHF). The dollar, because it is the world reserve currency and because in times of crisis investors buy American public debt, which is considered safe because it is unlikely that the world’s largest economy between in suspension of payments. The Yen, for the increase in the demand for Japanese state bonds, since a great proportion is in the hands of national investors who probably do not get rid of them, not even in a crisis. The Swiss Franco, because the strict Swiss bank legislation offers investors greater protection of capital.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.