- EUR/USD technical break ahead of key US data release.

- FOMC Minutes support hawkish sentiment and the US dollar.

The EUR/USD pair fell around 0.25% on Wednesday, weighed down by weaker-than-expected Eurozone PMI and PPI, the risk-averse tone around China noise and Committee minutes. Federal Open Market which have cemented the current hawkish sentiment.

The dollar has rallied of late and was driven higher in late trading in New York ahead of the major US data release on Thursday and Friday. Firstly, fears that trade frictions between China and the US could escalate led the dollar higher this week. China announced Monday it would impose export controls on some gallium and germanium products from August 1, escalating the trade war with the US and could cause further disruption to global supply chains. Analysts have described Monday’s move as China’s second – and biggest – countermeasure in the long-running technology fight between the United States and China, after it in May banned some key domestic industries from buying US memory chipmaker Micron ( MU.O),” Reuters wrote about it.

Drop in inflation in the Eurozone

Nationally, Eurozone data disappointed and follows a mixed inflation report that came out in late June, in which the headline data beat expectations, but while the data accelerated 5.5% in June, it was lower. to the increase of 6.1% in May. Core HICP inflation rose to 5.4% year-on-year in June, from 5.3% in May. But markets had expected 5.5%. On Wednesday, the eurozone reported weak Composite and Services PMIs:

Both the headline Services PMI and the Composite PMI were down four points from the preliminary figures, to 52.0 and 49.9. “This is the first time the composite index has been below 50 since December and confirms our view that the Eurozone is entering a recession,” Brown Brothers Harriman analysts explained.

As for the data made up of countries, Germany fell two points compared to the preliminaries, to 50.6, and France fell one point, to 47.2. Italy and Spain reported for the first time and their composite data stood at 49.7 and 52.6, respectively. Italy has joined France below the key line of 50 and it is only a matter of time before other countries do as well,” added the analysts, who explained that inflation expectations in the Eurozone continue to fall:

The ECB’s monthly survey showed that inflation expectations for the next 12 months fell to 3.9% in May, from 4.1% in April and 5% in March. For the next three years, inflation expectations remained stable at 2.5%, compared to 2.9% in March. The ECB will welcome this fall, which should allow the optimists to keep control of the situation at the meeting on July 27.”

Markets expect the ECB to raise 25 basis points twice more and the World Interest Rate Probability (WIRP) suggests that the odds of a 25 basis point hike are approaching 90% this month.

Aggressively, FOMC minutes support the US dollar

Meanwhile, in the United States, the Federal Open Market Committee (FOMC) released the minutes of its June meeting, sending the dollar higher. According to the document, some officials were in favor of a rate hike at the meeting, but were in favor of a pause. The minutes showed a division among FOMC members: “Most participants noted that uncertainty about the outlook for the economy and inflation remained high and that additional information would be valuable in considering the appropriate stance of monetary policy.” , the minutes pointed out.

Attention now turns to US jobs data, where the nation will report layoffs on Thursday, jobless claims, ISM services and JOLTS ahead of Friday’s Nonfarm Payrolls report. This series of new data is expected to overshadow today’s FOMC minutes and offer clues to the next move by the Fed, where there is a possibility of two more hikes this year.

US payrolls likely remained above trend in June, but still represent a slowdown after ~300K increases in April-May. We also expect the EU rate to fall 0.1 pp to 3.6% and wage growth to 0.3% m/m,” analysts at TD Securities noted.

Aside from this week’s events, traders will be watching next Wednesday’s Consumer Price Index.

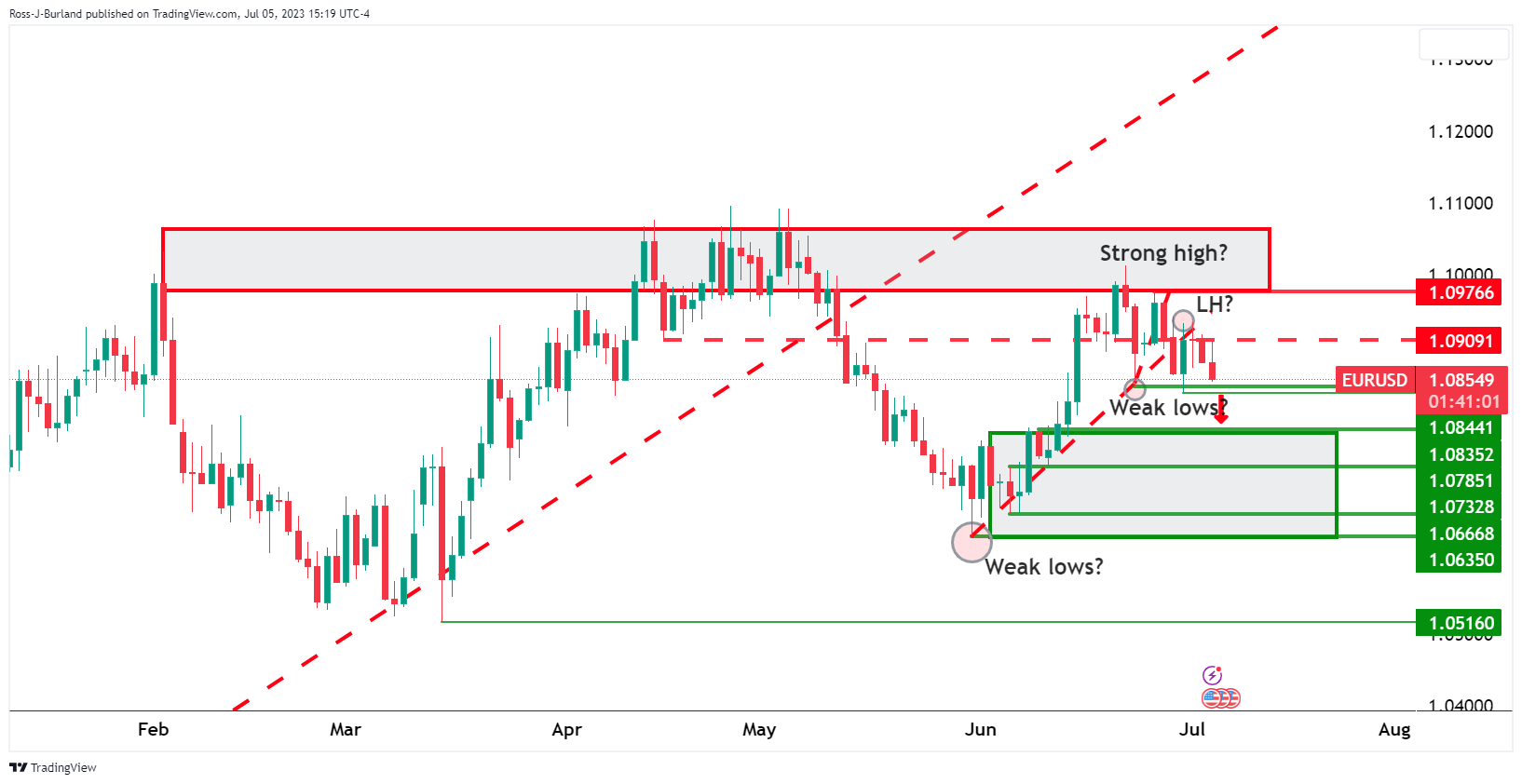

EUR/USD and US Dollar charts

The DXY, as illustrated above, has seen a move higher following the FOMC minutes towards a zone of potential resistance. Euro bulls will want to see the 103.30 support and trend lines break down in the coming sessions, which could help prop up the single currency around US data:

On the other hand, EUR/USD is heading to the brink around what could be weak daily lows that protect a move below 1.0850 in a breakout market that leaves the 1.07 zone vulnerable for the next few days.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.