- The dollar loses strength in the market and cuts gains.

- The euro marks maximums on all fronts.

- EUR/USD tries to avoid the fourth drop in a row.

EUR/USD rebounded sharply and rose from more than ten-day lows at 1.0943, up to 1.0998, marking a new daily high. It then pulled back and is trading a small daily loss at 1.0980.

The dollar, as measured by DXY, is rising on Monday, although it trimmed some of the gains. The index trades at 99.15, up 0.35%, after reaching as high as 99.30 hours ago, the highest since March 8. The advance of the DXY is mainly supported by the rally in USD/JPY and the rise in Treasury yields.

The 10-year US bond rate soared to 2.55%, level not seen since April 2019. Analysts also point out that the 5-year and 30-year Treasury bond yield curve inverted for the first time since 2006, which would reflect fears about the impact of monetary policy on the economy.

The euro gained momentum in the last hours. EUR/GBP rose to 0.8367 and EUR/CHF to 1.0300 (high since last Wednesday). Among the major European currencies, the euro is the best performer, while the pound is among the weakest.

Looking ahead to the next few hours, the economic calendar on Monday is light. In the US, the publication of the index of leading indicators for February and the manufacturing index of the Dallas Fed stand out. The White House will release the budget for fiscal year 2023.

EUR/USD remains weak, with non-negative signals

EUR/USD maintains a dominant bearish tone technically. The current bounce can be seen as a positive factor and bearish fatigue is possible. For it to gain more strength, the euro should exceed and be clearly stated over 1.1000which is where the 20-day moving average is passing through and offers resistance.

In the very short term, a return below 1.0965 would expose the day’s low. The next support can be seen at 1.0925/30.

Technical levels

Source: Fx Street

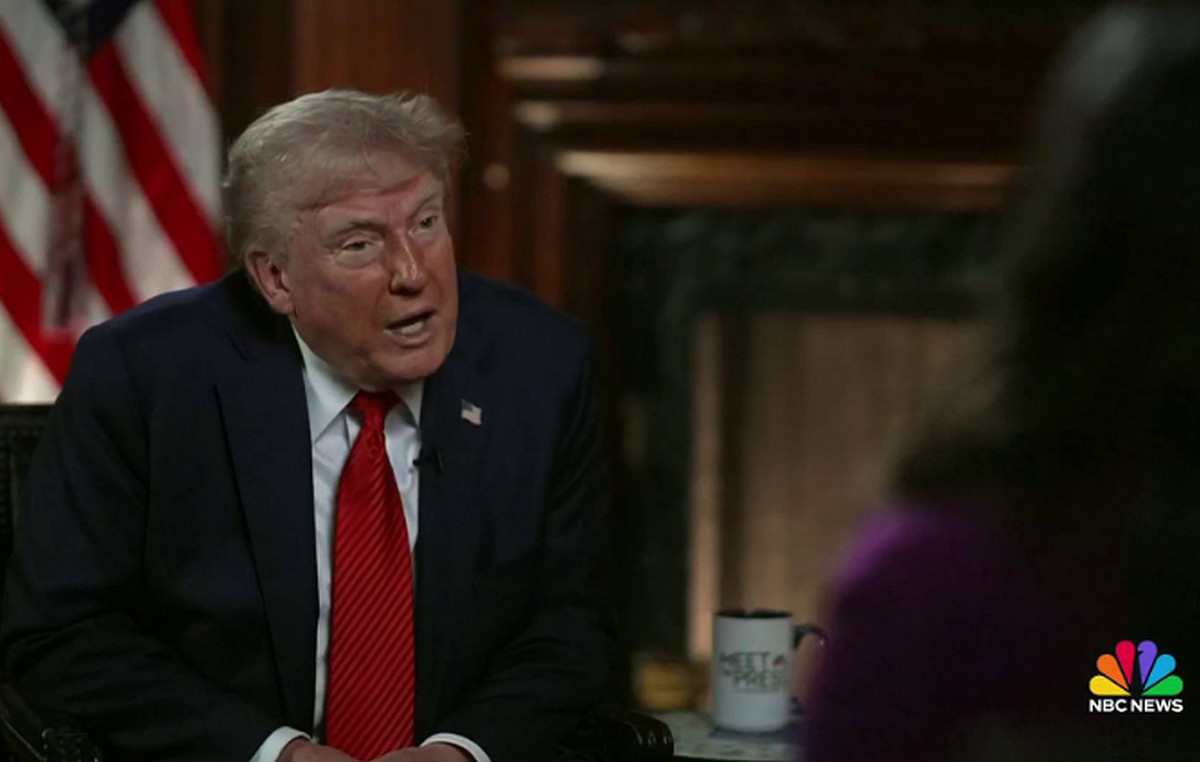

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.