- EUR/USD looks offered in the 1.0425/30 zone after NFPs.

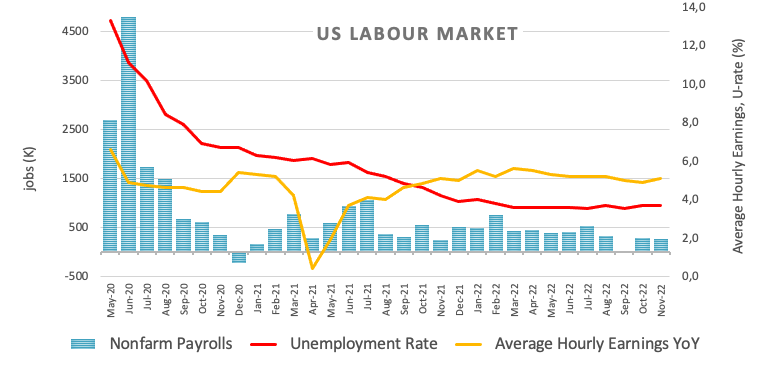

- US Nonfarm Payrolls surprised to the upside in November.

- The unemployment rate remained at 3.7%.

The EUR/USD is coming under further downward pressure and is currently trading at the 1.0425/30 area following Friday’s US jobs report.

The EUR/USD pair is picking up selling pressure after the Non-Farm Payrolls release showed the US economy added 263,000 jobs during November, beating earlier estimates of a gain of 200,000 jobs. Furthermore, the October reading was also revised up to 284,000 (from 261,000).

The unemployment rate stood at 3.7% and average hourly earnings, a proxy for inflation through wages, rose 0.6% month-on-month and 5.1% from a year earlier. Also, the Participation Rate dropped a bit to 62.1% (from 62.2).

What to keep in mind around the euro

EUR/USD bullish momentum faltered at 1.0550, or multi-month highs, amid lingering optimism in the risk space and sharp dollar weakness ahead of US payrolls.

Meanwhile, the European currency is expected to closely follow the dynamics of the dollar, the impact of the energy crisis in the region and the divergence between the Fed and the ECB. In addition, the revaluation by the markets of a possible pivot in the Fed’s policy continues to be, for the moment, the exclusive driver of the pair’s price.

Returning to the euro area, growing speculation about a possible recession in the bloc emerges as a major domestic headwind facing the euro on the near term horizon.

technical levels

For now, the pair is trading at 1.0425/30 and a break of 1.0365 (200-day SMA) would target 1.0330 (weekly low Nov 28) on the way to 1.0222 (weekly low Nov 21). To the upside, there is a first hurdle at 1.0548 (Dec 2 monthly high) before 1.0614 (June 27 weekly high) and finally 1.0773 (June 27 monthly high).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.