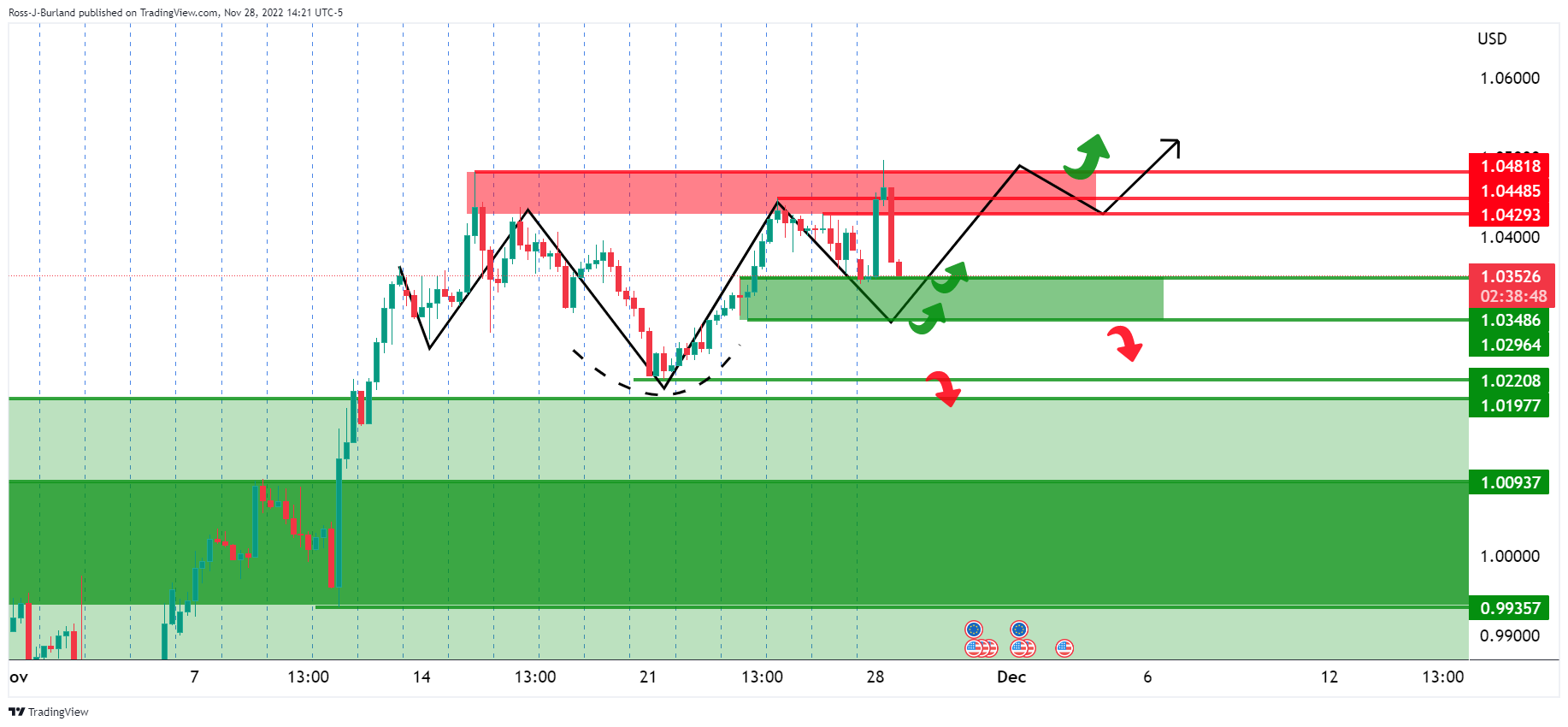

- EUR/USD fell into key support on risk aversion issues.

- A reverse head and shoulders pattern could be forming.

At the time of writing, EUR/USD has lost 0.29%, falling to a low of 1.0354 from a high of 1.0496. Risk currencies such as the euro are under pressure as protests against COVID restrictions in China weigh on market sentiment.

Violent protests in major Chinese cities over the weekend against the country’s strict COVID restrictions have lowered growth expectations in the world’s second-largest economy. This is creating a flight to safety in support of the yen, US dollar and Swiss franc.

Meanwhile, the economic challenges facing the euro area are not the same as those in the US, weighing on the euro: “Supply-side shocks set the stage for a period “Prolonged high inflation coupled with lackluster growth. A recession seems difficult to avoid and we expect Gross Domestic Product to decline by 0.9% in 2023, followed by stagnation in 2024,” Danske Bank analysts argue.

Key points:

”Elevated inflation pressures, coupled with the risk of de-anchoring inflation expectations, will keep the ECB firmly in tightening mode. Rate cuts could be in the offing in 2024, but uncertainty remains high.”

”The greatest fragility in Europe comes from the (geo)political front, as well as from a new worsening of the energy crisis or new outbreaks of Covid-19 next winter. Upside risks to the growth outlook come from pandemic-related private savings buffers, fiscal measures and accelerating investment spending.”

“Stagflation” need not be the new normal, but structural reforms to address low productivity and adverse demographic trends, as well as secure a leading position in the race for ecological transition, remain key.

Fed members at stake

Speakers from the Federal Reserve will be important this week. On Monday, Federal Reserve Bank of New York President John Williams said he believes the Fed will have to raise rates tight enough to push inflation down, and keep them there for the rest of the year. next year:

“I think we’re going to need to keep policy tight for a while; I would expect that to continue at least into next year,” Williams said at a virtual event held by the Economic Club of New York, adding that he did not expect a recession.

James “Jim” Bullard, president and CEO of the Federal Reserve Bank of St. Louis, has said that rates must rise to reduce inflation. He also said that the Fed “will have to keep rates at a high enough level through 2023 and into 2024.”

Bullard also said that a “tight labor market gives us license to pursue a disinflationary strategy now.”

In this sense, for the week, investors will closely monitor the non-farm payrolls for November, as well as the second estimate of the third quarter gross domestic product and consumer confidence for this month.

EUR/USD Technical Analysis

Despite the risks of a continuation to the downside, an inverse head and shoulders pattern could be in the offing at this juncture. Bullish commitments around 1.0300/50 would be forming the right shoulder of the bullish pattern.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.