- The EUR/USD pair falls after the optimism of the US manufacturing PMI and paid prices indices, which suggest that the Fed could refrain from easing its policy.

- The rise in the US Dollar Index and Treasury yields reflects growing confidence in the US economic outlook.

- The upcoming Eurozone Manufacturing PMIs could push EUR/USD further lower as estimates are expected to contract further.

The Euro extends its losses against the US Dollar, with most European markets closed for Easter Monday. Data from the United States supported a downward trend in EUR/USD, which fell more than 0.40% and was trading at 1.0742.

Strong US ISM Manufacturing PMI and rising prices paid will keep Fed on hold

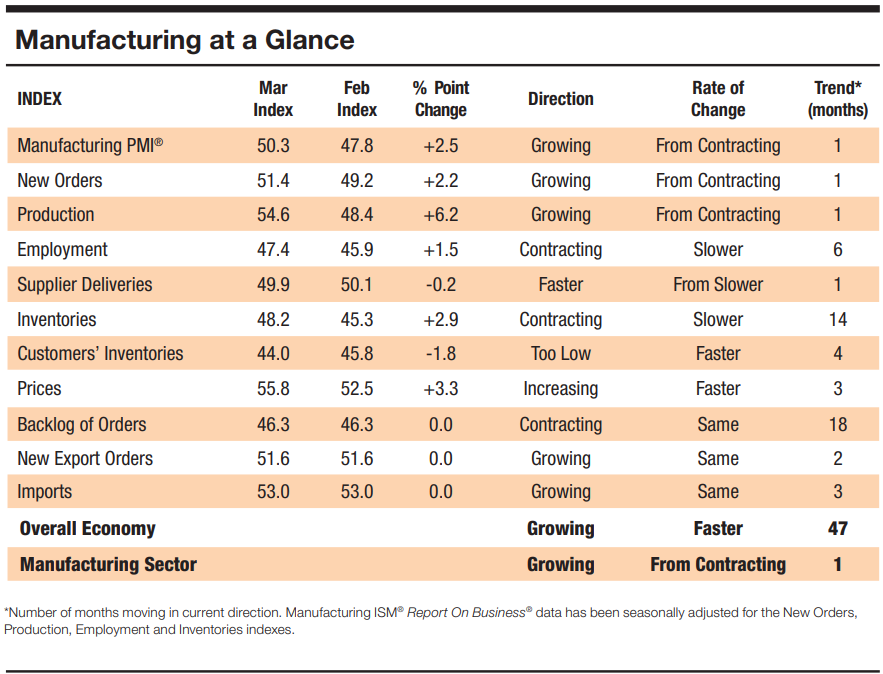

The Institute for Supply Management (ISM) revealed that business activity expanded in March for the first time since September 2022, an indication that the economy remains strong. The manufacturing PMI stood at 50.3 points, beating estimates of 48.4 and crushing February's reading of 47.8. The same report revealed that the prices paid index grew to 55.8, its highest level since August 2022, when it reached 52.5 points. This could discourage the Federal Reserve from easing policy as the economy performs better than expected.

Around 13:45 GMT, S&P Global revealed the latest revision to the March US manufacturing PMI, which stood at 51.9, down from the previous reading of 52.2.

Following this data, the EUR/USD has extended its losses beyond the psychological figure of 1.0750, which could exacerbate a test of the February 14 swing low at 1.0694.

Meanwhile, the US Dollar Index (DXY), which measures the performance of the Dollar against a basket of currencies, rose 0.36% to 105.93, while US Treasury yields rose. The yield on 10-year Treasury bonds stands at 4.305%, rising almost 10 points more.

Following the data release, money market traders see a 61% chance that the Fed will cut rates by 25 basis points, according to CME's FedWatch tool.

On the other side of the pond, the economic agenda of the Eurozone (EU) will include the publication of the HCOB manufacturing PMI for Spain, Italy, France, Germany and the bloc as a whole. Most readings, except those in Spain, are expected to continue to deteriorate and remain in recessionary territory.

EUR/USD Price Analysis: Technical Outlook

The EUR/USD daily chart shows the pair heading towards the 1.0700 area, before challenging 1.0694, the February 14 low. Breaking this last level would expose the November 10 intermediate support at 1.0656, followed by the main support at 1.0516, the November 1 low. On the other hand, if buyers recapture 1.0750, an upward correction towards 1.0800 is expected.

EUR/USD

| Overview | |

|---|---|

| Latest price today | 1.0744 |

| Today's daily change | -0.0048 |

| Today's daily variation | -0.44 |

| Today's daily opening | 1.0792 |

| Trends | |

|---|---|

| daily SMA20 | 1.0874 |

| 50 daily SMA | 1.0835 |

| SMA100 daily | 1.0876 |

| SMA200 Journal | 1.0836 |

| Levels | |

|---|---|

| Previous daily high | 1.0806 |

| Previous daily low | 1.0768 |

| Previous weekly high | 1.0864 |

| Previous weekly low | 1.0768 |

| Previous Monthly High | 1.0981 |

| Previous monthly low | 1.0768 |

| Daily Fibonacci 38.2 | 1.0791 |

| Fibonacci 61.8% daily | 1.0783 |

| Daily Pivot Point S1 | 1.0771 |

| Daily Pivot Point S2 | 1.0751 |

| Daily Pivot Point S3 | 1.0733 |

| Daily Pivot Point R1 | 1.0809 |

| Daily Pivot Point R2 | 1.0826 |

| Daily Pivot Point R3 | 1.0847 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.