- EUR/USD falls as robust US Treasury yields bolster the dollar, despite Fed signals of possible rate cuts in September.

- Mixed US data: Jobless claims rise and PMI results show growth in services but worsening manufacturing contraction.

- ECB’s Kazaks suggests possible rate cuts with cautious, restrictive approach to policy.

EUR/USD is set to end Thursday’s session with losses of over 0.30% after the Dollar was bolstered by high US Treasury yields, despite Fed officials supporting a rate cut at the upcoming September meeting. At the time of writing, the pair is hovering around the 1.1100 figure for the third consecutive day.

EUR/USD holds around 1.1100 for the third consecutive day, pressured by high US Treasury yields.

Wall Street ended the session with losses ahead of Fed Chair Jerome Powell’s speech at Jackson Hole, scheduled for tomorrow around 14:00 GMT. Boston and Philadelphia Fed Presidents Susan Collins and Patrick Harker are ready to ease policy, with the former adding that the labor market remains healthy. At the same time, the latter said the Fed should lower rates in a “methodical” manner.

On the data front, the US Initial Jobless Claims for the week ending August 17 came in higher than expected, rising to 232K and beating the previous reading. On the business activity front, the S&P Global PMIs for August were mixed, with Services expanding above estimates, while the Manufacturing PMI contracted more sharply, hinting at a deeper economic slowdown.

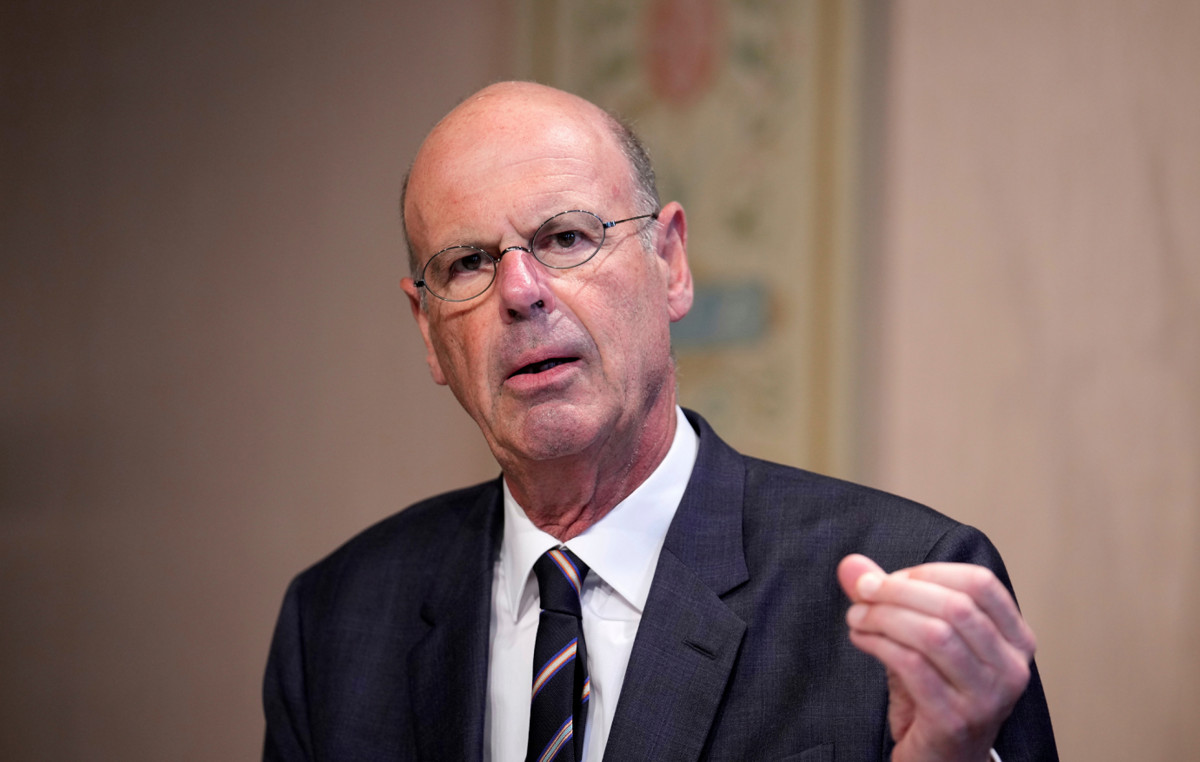

Across the Atlantic, preliminary Eurozone PMIs were mixed, but the focus was on the European Central Bank’s (ECB) Martins Kazaks, who crossed the lines on Bloomberg. He said he is open to discussing a rate cut in September but suggests a gradual approach. He added that policy would remain tight despite lowering rates twice and suggested that if inflation remains stable, they could still cut rates.

Looking ahead to the day, EUR/USD traders will be looking out for the release of French Business Confidence data. On the US front, Fed Chair Jerome Powell’s speech and housing data.

EUR/USD Price Forecast: Technical Outlook

From a technical perspective, the EUR/USD formed a bearish two-candlestick ‘quasi harami’ chart pattern, but sellers failed to push the exchange rate below 1.1100, which would have paved the way for a further decline.

Momentum remains bullish, but with the Relative Strength Index (RSI) exiting overbought conditions, a drop in EUR/USD below 1.1100 is possible.

In that case, the first support would be the August 14 high at 1.1047, followed by a test of the 1.1000 mark. On the other hand, if the pair holds above 1.1100, look for a retest of the yearly high of 1.1174, before challenging 1.1200.

Euro FAQs

The Euro is the currency of the 20 European Union countries that belong to the Eurozone. It is the second most traded currency in the world, behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily volume of over $2.2 trillion per day. EUR/USD is the most traded currency pair in the world, accounting for an estimated 30% of all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB), based in Frankfurt, Germany, is the reserve bank of the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s main mandate is to maintain price stability, which means controlling inflation or stimulating growth. Its main instrument is to raise or lower interest rates. Relatively high interest rates – or the expectation of higher rates – generally benefit the Euro and vice versa. The Governing Council of the ECB takes monetary policy decisions at meetings held eight times a year. Decisions are taken by the heads of the national banks of the Eurozone and six permanent members, including ECB President Christine Lagarde.

Eurozone inflation data, as measured by the Harmonised Index of Consumer Prices (HICP), is an important econometric data point for the euro. If inflation rises more than expected, especially if it exceeds the ECB’s 2% target, the ECB is forced to raise interest rates to bring inflation back under control. Relatively high interest rates compared to their peers usually benefit the euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases measure the health of the economy and can influence the Euro. Indicators such as GDP, manufacturing and services PMIs, employment and consumer sentiment surveys can influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment, but it can encourage the ECB to raise interest rates, which will directly strengthen the Euro. Conversely, if economic data is weak, the Euro is likely to fall. Economic data from the four largest Eurozone economies (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone economy.

Another important output for the euro is the trade balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports during a given period. If a country produces highly sought-after export products, its currency will appreciate due to the additional demand created by foreign buyers who wish to purchase these goods. Therefore, a positive net trade balance strengthens a currency and vice versa for a negative balance.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.