- The dollar falls moderately in the market ahead of US data.

- Inflation in the Eurozone slows down in November.

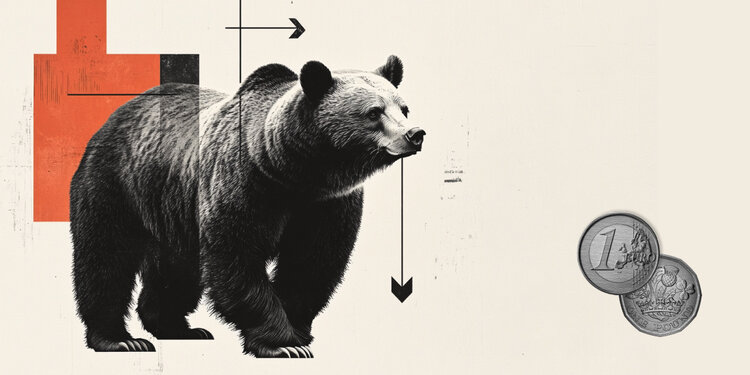

- EUR/USD still with bullish signs, but without strength.

EUR/USD is rising on Wednesday, albeit without much conviction. It marked a high for the day at 1.0380 and then returned to the 1.0350 area where it is trading. Eurozone inflation data showed a slowdown, now coming from the US.

The modest weakness of the dollar is being the support factor for the advance of the EUR/USD, which tries to recover after having marked low in a week in the Asian session at 1.0317.

After data from the EZ comes those from the US.

The inflation rate in the Eurozone fell more than expected in November, going from 10.6% to 10%, below the 10.4% expected. The core inflation rate remained at 5%. “It is not clear if this means that the inflation rate has passed its peak in view of the extreme fluctuations in energy prices. Core price inflation remains high,” said Commerzbank analysts, who see the data raising the odds that the European Central Bank (ECB) will raise interest rates by just 50 basis points in December.

The data did not have a great impact on the market since after Tuesday’s inflation figures in Germany and Spain, a surprise was expected with data below expectations. EUR/GBP, after rising to 0.8645 and falling to 0.8620, is trading unchanged for the day around 0.8640.

Later on Wednesday it will be published in US ADP private employment data. Then it will be the turn of reading GDP growth of the third trimester followed by the PMI of Chicago and in the American afternoon the Federal Reserve will publish the Beige Book on the state of the economy. Fed Chairman Jerome Powell will give a speech.

technical overview

The EUR/USD maintains a bottom bullish tone but shows difficulties in extending the bullish run, facing resistance at the 200-day average, which passes through 1.0380; and also with problems in holding on to 1.0400. A consolidation above this last level would enable more rises and new monthly highs.

Between 1.0320 and 1.0300 there is a significant support band which, if it gives way, would leave the Euro battered, with room for more losses with a possible destination at the 20-day moving average at 1.0245.

In shorter charts the bias is bearish (with the euro marking higher and lower lows), although losses are limited by the support of 1.0320.

technical levels

EUR/USD

| Panorama | |

|---|---|

| Last Price Today | 1.0363 |

| Today’s Daily Change | 0.0037 |

| Today’s Daily Change % | 0.36 |

| Today’s Daily Open | 1.0326 |

| Trends | |

|---|---|

| 20 Daily SMA | 1.0219 |

| SMA of 50 Daily | 0.9977 |

| SMA of 100 Daily | 1.0037 |

| SMA of 200 Daily | 1.0379 |

| levels | |

|---|---|

| Previous Daily High | 1.0394 |

| Minimum Previous Daily | 1,032 |

| Previous Weekly High | 1.0449 |

| Previous Weekly Minimum | 1.0223 |

| Maximum Prior Monthly | 1.0094 |

| Minimum Prior Monthly | 0.9632 |

| Daily Fibonacci 38.2% | 1.0349 |

| Daily Fibonacci 61.8% | 1.0366 |

| Daily Pivot Point S1 | 1.0299 |

| Daily Pivot Point S2 | 1.0272 |

| Daily Pivot Point S3 | 1.0224 |

| Daily Pivot Point R1 | 1.0373 |

| Daily Pivot Point R2 | 1.0421 |

| Daily Pivot Point R3 | 1.0448 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.