- EUR/USD is now focused on the key events ahead for the rest of the week, including the Fed and ECXB, as well as the NFPs.

- For now, the 78.6% Fibonacci support and the 50% mean reversion zone between 1.0800 and 1.0850 keep the bulls in play.

The pair EUR/USD is at a crossroads and is trading around 1.0863, up slightly 0.015% on the day, after swinging between a low of 1.0802 and 1.0867 in what has been a day of back and forth trading before meetings of the central banks.

The Federal Reserve meeting on Wednesday is the first big risk for EUR/USD, with the European Central Bank on Thursday, but the icing on the cake could be US Non-Farm Payrolls on Friday, especially if there are surprises. As for central banks, the Federal Reserve is expected to raise rates by no more than 25 basis points and the European Central Bank by 50 basis points.

The communication prior to these interest rate decisions has pretty much sealed the deal in this regard and markets are also expecting hawkish rhetoric from central bank governors Jermoe Powell and Christine Lagarde respectively. However, his tone around growth and inflation, as well as guidance on possible further hikes, could be determinative for the market. In fact, the Federal Open Market Committee will want to stress the fact that we are going to see higher rates for a little while longer, but it all depends on whether or not the market believes that narrative.

Regarding the US dollar, analysts at TD Securities argued that it is not as sensitive to STIR prices, “so a longer stance higher might not resonate as much.” The USD is stretched, although the catalyst for a Fed reversal seems like a very high bar. However, some parts of the foreign exchange market are showing signs of recovery fatigue.”

EUR/USD Technical Analysis

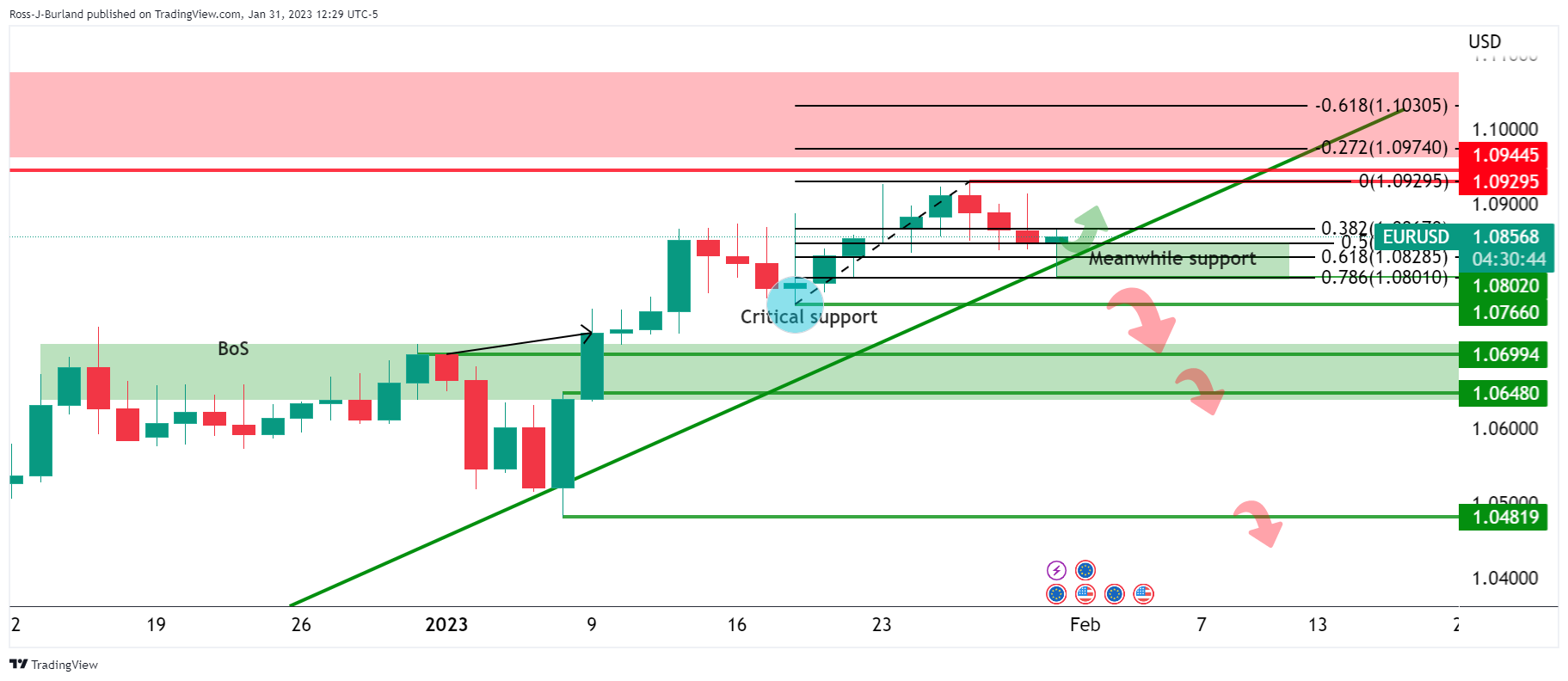

EUR/USD is at a critical juncture on the charts ahead of the Federal Reserve event. The bulls are still in play, but there are prospects for a significant correction if the market gets the Fed wrong. If the bull cycle trend line support breaks and the Fed gets hawkish, the price would plunge with time up to 1.0650/00.

EUR/USD daily chart

Extended…

For now, the price remains in the front of the trend line, so the trend remains bullish with an eye on 1.0930/50 and then the area of the upper quarter of 1.09 and 1, 10 after that.

2x magnification…

As we can see, critical horizontal support is at 1.0765, just below the quarter level that guards a run at 1.0700 and at 1.0650 and even 1.0600 as a 100% measured move of the consolidation range. current:

.

For now, meanwhile 78.6% Fibonacci support and 50% mean reversion zones between 1.0800 and 1.0850 keep bulls in play at the front of the uptrend line. So again, the bias is still bullish at this point.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.