- EUR/USD reverses recent weakness and targets 1.0200.

- German 10-year Bund yields offer support to the pair’s ongoing recovery.

- The German construction PMI fell to 43.7 in July.

The common currency manages to regain some traction to the upside and pushes EUR/USD back to the 1.0180 area Thursday.

EUR/USD strengthens on dollar selling

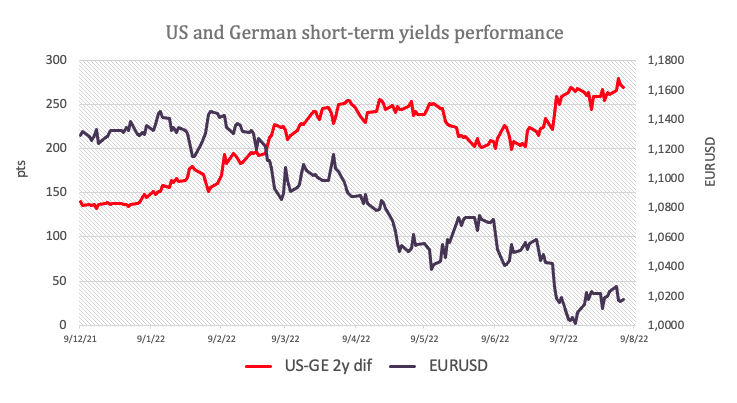

The now dovish stance around the dollar allows for the current rebound in risk sentiment and prompts EUR/USD to attempt another move towards the key barrier in the 1.0200 region.

The dollar, meanwhile, appears to be in retreat despite the rise in yields and the recent aggressive rhetoric from several Fed speakers, who generally reinforced the current tightening process and advocated further rate hikes in the coming months, always in the current context of inflation high and persistent.

The pair’s bounce so far comes along with a further improvement in 10-year German Bund yieldsthis time flirting with the 0.90% zone.

In Germany, the Construction PMI worsened to 43.7 in July and factory orders contracted 0.4% monthly in June.

Across the Atlantic, initial jobless claims and trade balance data will be released.

What can we expect around the EUR?

EUR/USD appears to be regaining composure and is initially heading towards the 1.0200 zone before to point to recent highs near 1.0300, always due to renewed selling pressure around the dollar.

Meanwhile, price action around the common currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation fears, and the divergence between Fed and ECB monetary policy.

Among the negative aspects for the pair is the growing speculation about a possible recession in the region, which seems to be underpinned by the decline in investor sentiment and the renewed downward trend of some fundamental indicators.

EUR/USD levels

At time of writing, the EUR/USD pair is advancing 0.17% on the day, trading at 1.0180. A break of 1.0293 (2nd Aug high) would target 1.0409 (55-day SMA) on the way to 1.0615 (27th Jun high). On the other hand, the next support on the downside is 1.0096 (26 Jul low), followed by 1.0000 (psychological level) and 0.9952 (14 Jul low).

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.