- EUR/USD falls 0.23% on Thursday, trading near 1.0270 after losing momentum following a brief rally.

- The MACD histogram shows ascending green bars, hinting at modest buying interest despite broad headwinds.

- The RSI sits at 43 in negative territory, suggesting only a slight rebound within a predominant bearish environment.

The EUR/USD found some support on Thursday but still retreated 0.23% to settle around 1.0270. Although buyers attempted to push prices higher in early trade, their efforts were undermined by the inability to sustain a breakout above the 20-day simple moving average (SMA). This inability to overcome key technical barriers highlights the pair’s fragile recovery prospects.

On the technical side, the Moving Average Convergence/Divergence (MACD) indicator continues to show ascending green bars, indicating that the buying pressure has not completely disappeared. However, the Relative Strength Index (RSI), currently at 43, remains in negative territory despite its recent rise, emphasizing the cautious tone around the euro. Unless the pair can overcome persistent resistance around the 20-day SMA, bullish enthusiasm is likely to remain subdued.

Looking towards possible turning points, initial support appears near 1.0250, with a drop below that threshold opening the door to the 1.0220 region. Conversely, a decisive push above the 1.0300 zone would be required for buyers to gain significant momentum, potentially setting the stage for a challenge of the 1.0350 barrier if sentiment improves further.

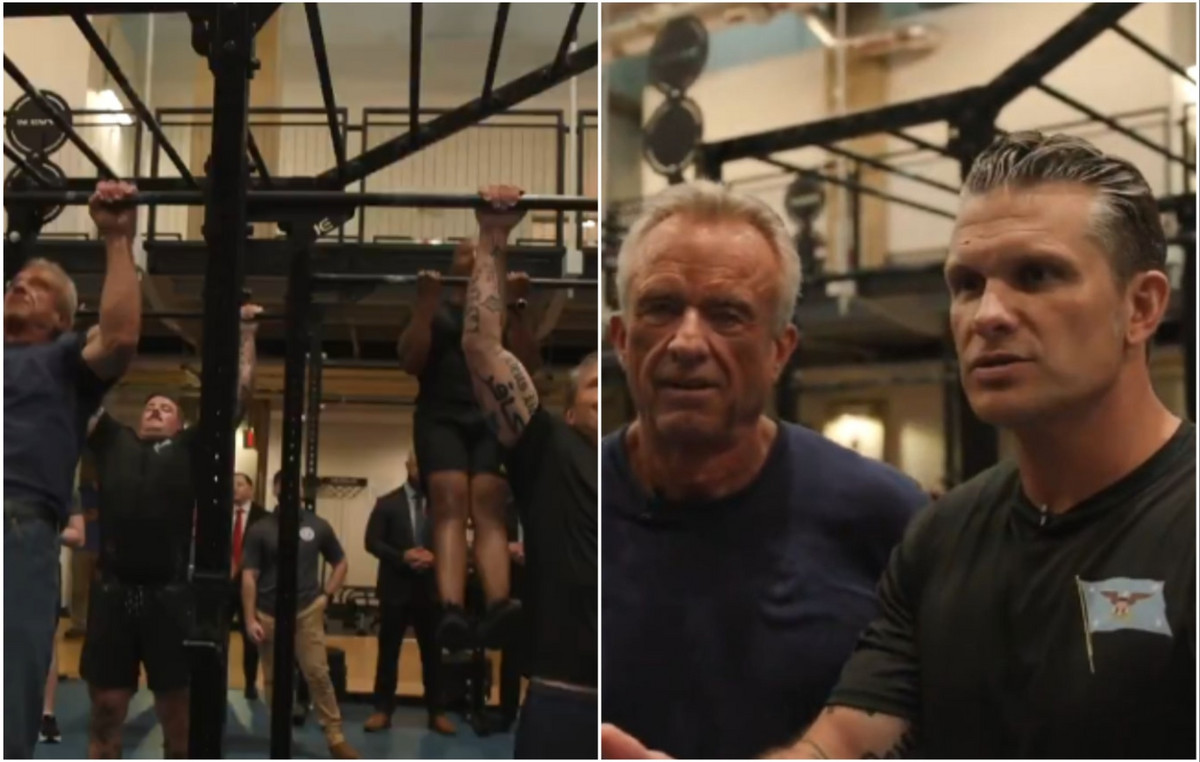

EUR/USD: Daily Chart

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.