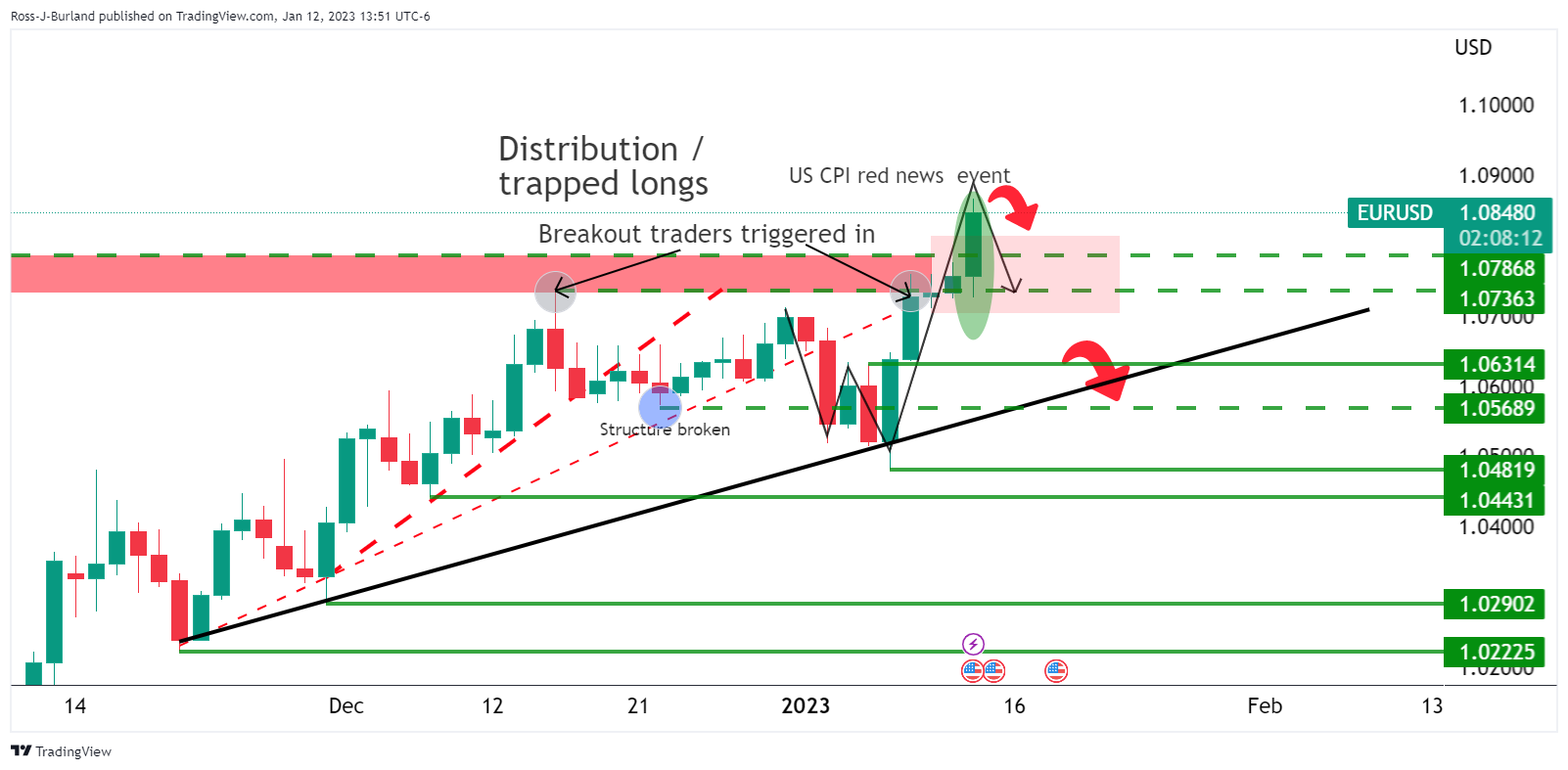

- EUR/USD bears are in control and watch the 38.2% fibonacci retracement which aligns with previous resistance near 1.0720.

- EUR/USD bears need to break below 1.0770 first.

The bulls have seen limited and eyes are on 1.0720 declines continue throughout the week, with price picking up on Tuesday’s supply, helped by ECB policymakers beginning to consider a slower pace of interest rate hikes.

EUR/USD analysis at the start of the week

The bearish thesis was in play as the bulls fell into a trap with breakout traders excited by the US Consumer Price Index and a move through 1.0800 towards 1.0850. However, there has been no follow-up:

Since then, the price has stalled and is on track to retest 1.0780 and move down towards 1.0700. However, the bears needed to break the trend line support on the lower time frames, such as the 4-hour chart below:

EUR/USD Update

We finally got it and today’s bearish momentum probably seals the deal for a deeper correction with a bearish head and shoulders in play:

We have a broken structure at 1.0801, but bears need to break below 1.0780/70 to really nail the coffin.

However, the bears are in the way of daily bearish targets as follows:

The 38.2% Fibonacci retracement that lines up with previous resistance structures could be targeted near 1.0720. This structure protects a deeper move on the Fib scale and a 50% mean reversal within the scale near 1.0680 cannot be ruled out.

However, bears need to get below 1.0770 first.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.