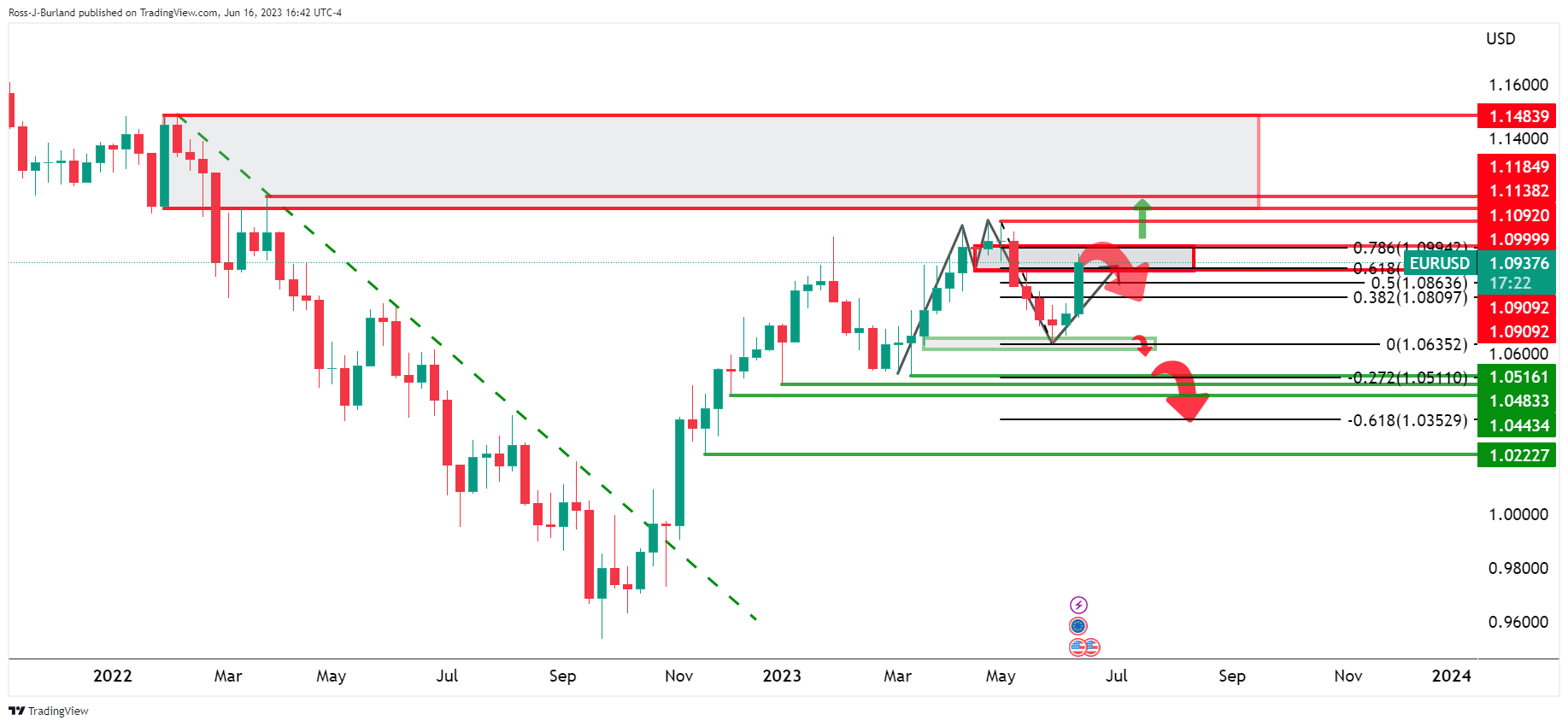

- EUR/USD bears are taking over and keeping an eye on trend line support.

- Bulls will need to stay engaged above the daily 78.6% Fibonacci retracement.

Bears eye trend line support, EUR/USD is turning lower as below:

EUR/USD Prior Analysis

The market was seen to have run into the weekly neckline of the M formation.

On the daily chart, it was noted that we had possible stops above the swing highs that had remained intact, until now. Before a move higher towards them, it was argued that a push to the downside might be in order first. This highlighted the Fibonacci 38.2% bullish momentum on the daily chart, as well as trend line support.

EUR/USD Update

The price is moving lower towards the support of the daily trend line and from the neckline of the weekly M formation.

From an hourly perspective, the price has broken out of the structure, (BoS) and has formed a new bullish turn. Therefore, we can anticipate another bearish push towards trend line support at a 50% mean reversal or 61.8% Fibonacci retracement of the previous hourly bullish push as follows:

A break of the trend line will dilute the bullish thesis, but as long as the 78.6% Fibonacci retracement on the daily chart holds, near 1.0780, a bullish case can still be made.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.