- EUR/USD bulls are in the market and aim to break above the 1.08 resistance.

- Bulls should keep their commitment between 1.0700/50.

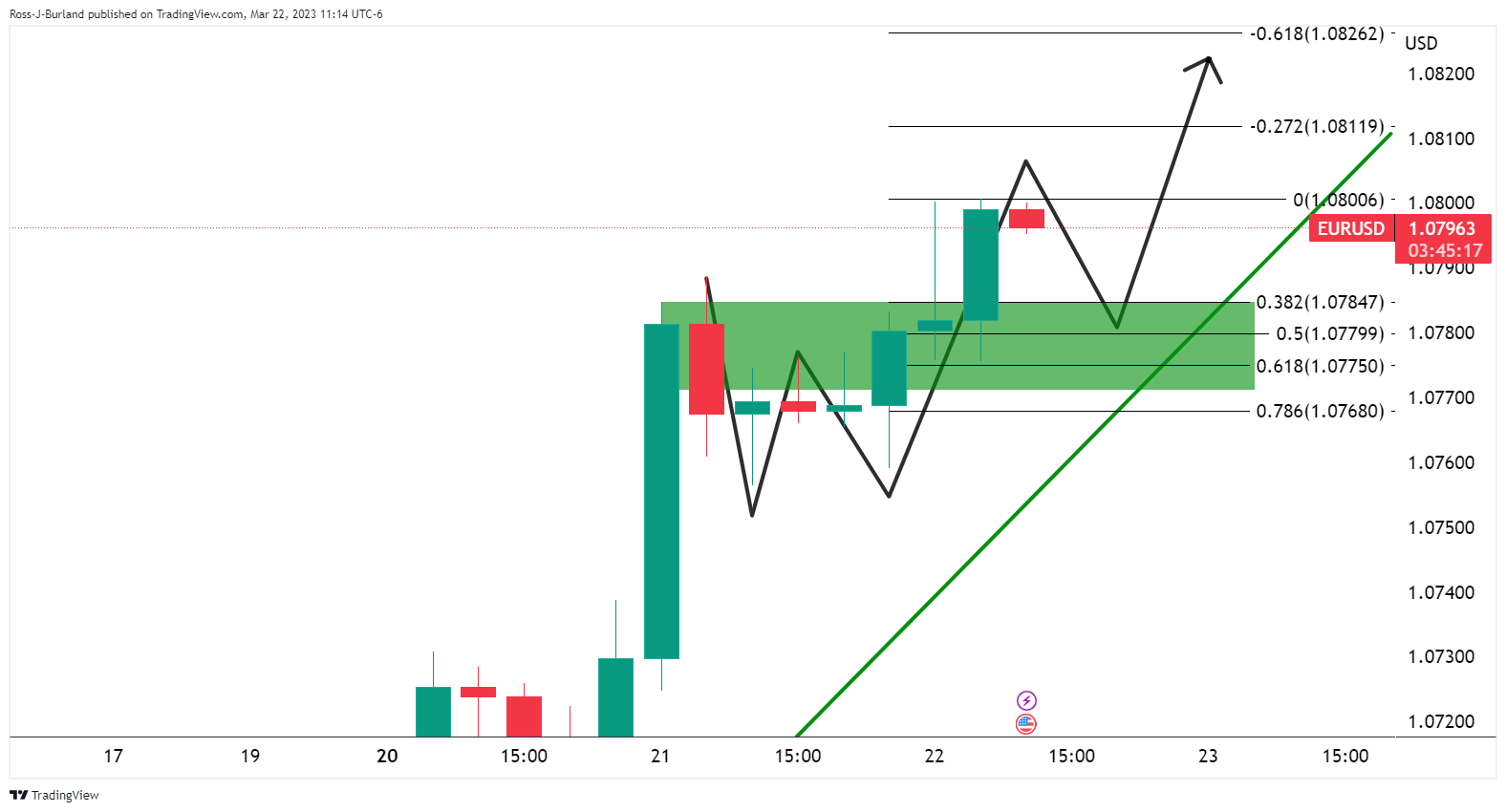

- The first key support is near 1.0770/85.

The EUR/USD pair is at the 1.08 resistance pending the Federal Reserve’s interest rate decision at 1400ET/18:00 GMT. Fed implied futures favor a 25 basis point rate hike.

The Fed will release new economic projections and the market will focus on whether the dot charts call for an easing of monetary policy. In our view, there is a risk that the market will not see the moderate rise that has been forecast for today. This should provide support for the dollar and reinforce the strength of the resistance at 1.08”, argued Rabobank analysts.

EUR/USD Technical Analysis

On the 4-hour charts, the price is at the back of the uptrend, which is a bearish factor. However, the falling wedge and triple bottom are bullish:

As long as the support structure holds between 1.0700 and 1.0750/60, there will be prospects for a bullish continuation for the foreseeable future.

In the meantime, we have a W formation in play. This is a reversal pattern and the bears are already moving.

Price remains in front of the bullish dynamic trend line support, so if there are pullbacks, the bulls will be keen to see a slowdown above the 78.6% Fibonacci retracement and in line with the support of the 78.6% Fibonacci retracement. neck line and trend line.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.