- EUR/USD falls for the fourth consecutive session before a modest rebound to 1.0310 on Friday.

- The RSI sits at 33, approaching oversold territory amid persistent bearish pressure.

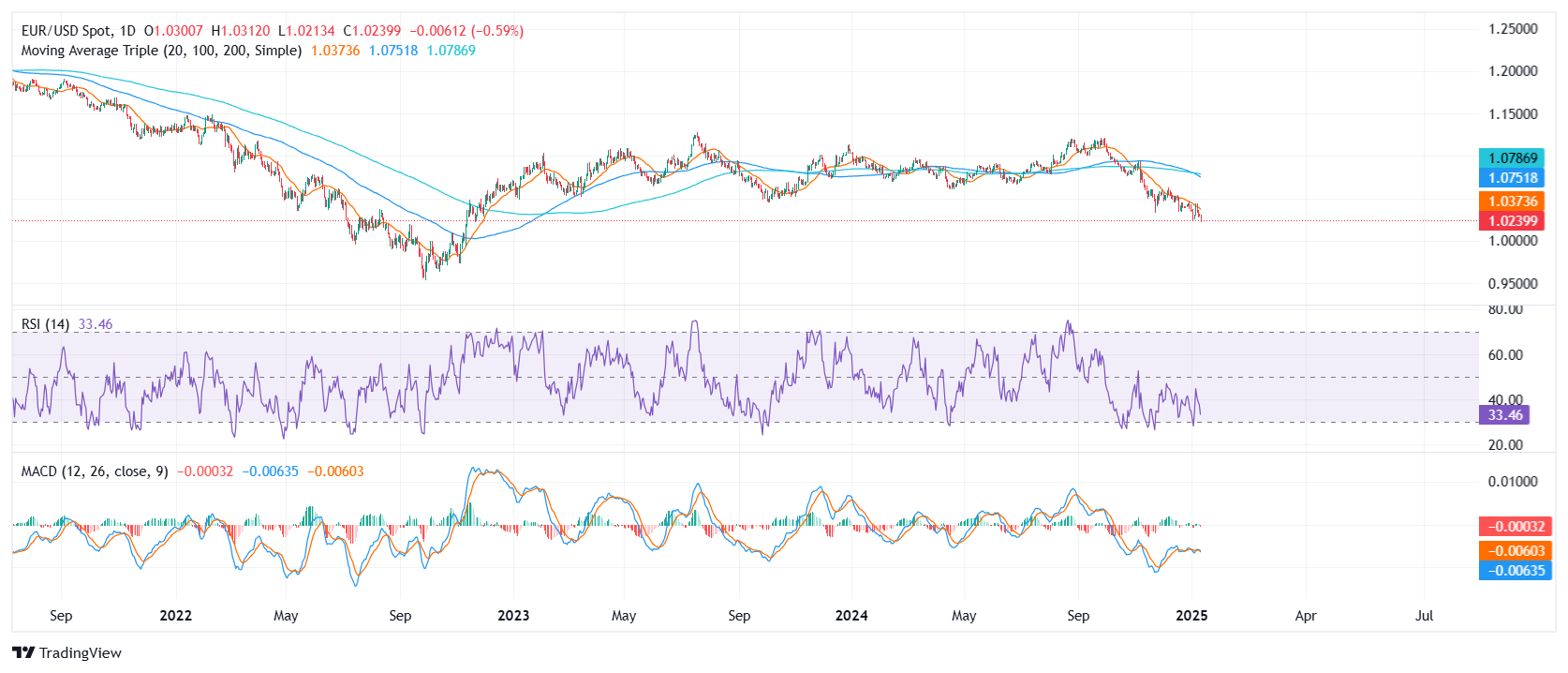

EUR/USD deepened its decline to new lows not seen since November 2022, briefly falling below 1.0250 on Friday and the pair racked up a four-day losing streak, reflecting an overall negative tone in recent sessions. Sellers appear to be firmly in control, with any bullish attempts so far failing to generate a significant change in direction.

Technical indicators underline the predominant downside risk. While the Relative Strength Index (RSI) at 33 is approaching oversold territory, its downward trajectory suggests that buyers lack conviction. Meanwhile, the MACD histogram has turned more bearish, printing rising red bars and pointing to an acceleration in negative momentum.

In terms of key levels, immediate support emerges near the 1.0250 level, and a break below that floor would expose the 1.0220 region or potentially lower. On the other hand, if EUR/USD manages to rally above 1.0350, it could relieve some of the selling pressure and open the door towards the 1.0380 resistance zone, where a more sustained recovery attempt could gain traction.

EUR/USD Daily Chart

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.