- EUR/USD is consolidating in a range above a two-and-a-half-week low touched on Monday.

- Bets on a Fed rate cut in September keep USD bulls on the defensive and act as a tailwind.

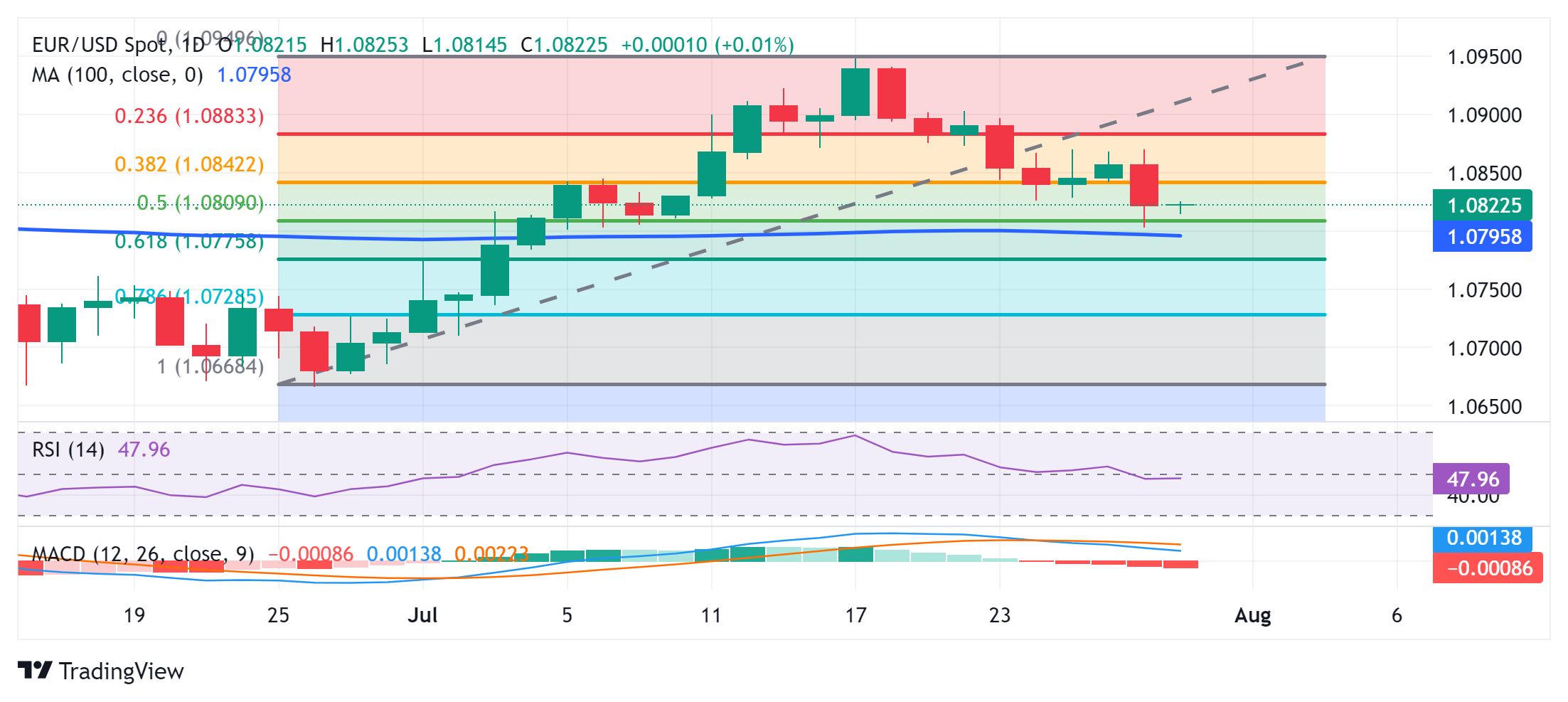

- A sustained break below the 100-day SMA is needed to support prospects for further losses.

The EUR/USD pair is struggling to consolidate the overnight bounce from the 1.0800 vicinity, or a two-and-a-half-week low, and is hovering in a tight range during the Asian session on Tuesday. Spot prices are currently trading around the 1.0820-1.0825 region, almost unchanged on the day as traders opted to wait for the release of Germany’s preliminary consumer inflation figures before positioning for a firm intraday direction.

The market focus will then shift to the preliminary Eurozone CPI report on Wednesday, which will be followed by the outcome of a two-day FOMC monetary policy meeting. In addition to this, key US macroeconomic data scheduled for the start of a new month, including the Non-Farm Payrolls (NFP) report on Friday, will be watched for further clues on the Federal Reserve’s (Fed) rate cut path. This, in turn, will play a key role in influencing the near-term USD price dynamics and determining the next directional move of the EUR/USD pair.

From a technical perspective, spot prices showed resilience below the 50% Fibonacci retracement level of the June-July rally on Monday, although the lack of significant buying warrants caution for the bulls. Moreover, oscillators on the daily chart have started gaining negative traction, suggesting that the path of least resistance for the EUR/USD pair is to the downside. That said, acceptance below the 100-day SMA is needed to support prospects for an extension of the recent pullback from a four-month peak, around the mid-1.0900 zone touched on July 17.

Spot prices could then weaken further below the 61.8% Fibo level near the 1.0775 region and test the next relevant support near the 1.0745 horizontal zone. This is closely followed by the 78.6% Fibo level near the 1.0730 area, below which the EUR/USD pair is likely to challenge the June monthly low, around the 1.0660 region, with some intermediate support near the 1.0700 round mark.

On the other hand, any subsequent upside move is likely to face resistance near the 1.0840-1.0845 region or the 38.2% Fibo level. Sustained strength beyond the latter could lift the EUR/USD pair above the 1.0865 horizontal barrier, towards the 1.0885-1.0890 region. Some follow-through buying beyond the 1.0900 mark should allow the bulls to once again target the multi-month peak, around the mid-1.0900 zone.

Economic indicator

Consumer Price Index (YoY)

The German CPI is published by the German Federal Statistical Office, Destatisand measures the average change in prices of a basket of goods and services purchased by households for consumption purposes. The CPI is the main indicator for measuring inflation and changes in purchasing trends. A reading higher than expectations is bullish for the euro, while a reading lower than expectations is bearish.

Next post:

Tue Jul 30, 2024 12:00 (Preliminary)

Frequency:

Monthly

Dear:

2.2%

Previous:

2.2%

Fountain:

Federal Statistics Office of Germany

Why is it important for operators?

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.