- President Donald Trump said he needs two weeks to decide whether to attack Iran, and the markets sigh from relief.

- A decrease in risk aversion is providing some support to the euro as the demand for sure refuge is relieved.

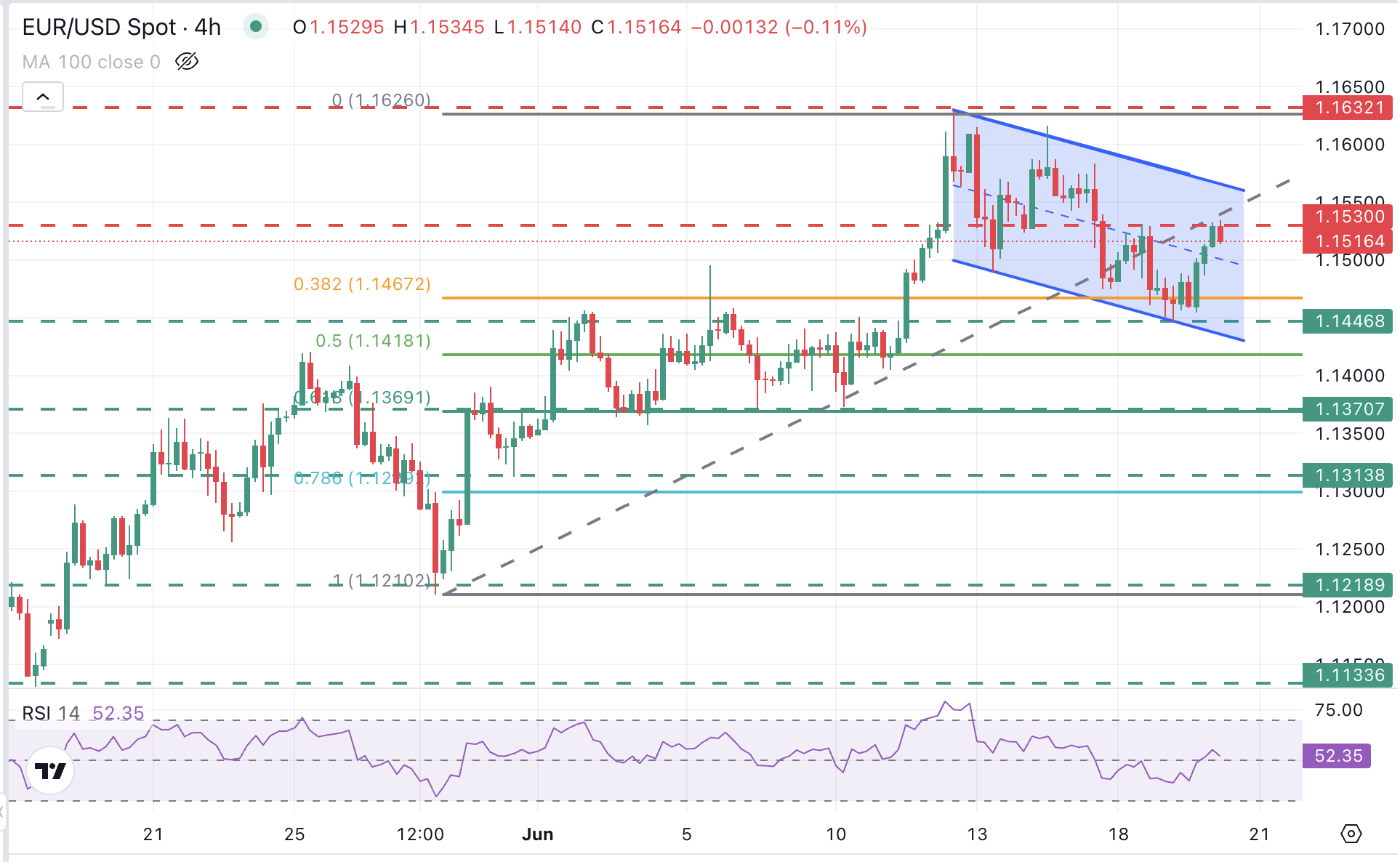

- EUR/USD continues in a bassist correction from the maximum of 1,1630.

The Eur/USD He is negotiating up for the third consecutive day on Friday and has returned above the level of 1,1500, negotiating at 1,1520 at the time of writing. The comments of the US President Donald Trump, saying that he needs two weeks to decide on entering the conflict of the Middle East, have relieved investors’ fears on an imminent attack and have provided some support to the euro.

However, the PAR is on its way to a moderate weekly loss, since investors’ concerns that war between Iran and Israel could become a broader regional conflict have maintained The appetite for risk content, increasing demand for the US dollar and other traditional shelters.

Beyond that, the strong increase in oil prices raises another challenge for a weak euro economy, while the commercial relationship with the US remains highly uncertain. Negotiations between US and European authorities remain stagnant just two weeks after the deadline of Trump’s July 9 to reach an agreement or face high tariffs.

Earlier this week, the Federal Reserve (FED) maintained interest rates without changes and maintained its projection of two cuts in 2025, but President Jerome Powell He adopted a hard line tone, minimizing the points chart and warning about greater inflationary pressures derived from Trump tariffs. Powell’s press release made the decision a “hard line maintenance”, which gave additional support to the US dollar.

Euro price today

The lower table shows the percentage of euro change (EUR) compared to the main currencies today. The euro was the strongest currency against the US dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.19% | -0.09% | -0.10% | -0.11% | -0.22% | -0.06% | -0.04% | |

| EUR | 0.19% | 0.07% | 0.07% | 0.09% | 0.14% | 0.15% | 0.15% | |

| GBP | 0.09% | -0.07% | 0.10% | 0.02% | 0.07% | 0.08% | 0.08% | |

| JPY | 0.10% | -0.07% | -0.10% | 0.05% | -0.13% | -0.10% | -0.00% | |

| CAD | 0.11% | -0.09% | -0.02% | -0.05% | -0.08% | -0.18% | 0.06% | |

| Aud | 0.22% | -0.14% | -0.07% | 0.13% | 0.08% | 0.29% | 0.02% | |

| NZD | 0.06% | -0.15% | -0.08% | 0.10% | 0.18% | -0.29% | 0.00% | |

| CHF | 0.04% | -0.15% | -0.08% | 0.00% | -0.06% | -0.02% | -0.00% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the euro of the left column and move along the horizontal line to the US dollar, the percentage change shown in the box will represent the EUR (base)/USD (quotation).

What moves the market today: the euro extends its recovery as risk aversion relieves

- The feeling of the market improved something on Friday after Trump relieved the fears of an imminent attack on Iran, and news reports suggest that US and Iranian officials are maintaining various lines of direct and indirect negotiations. There are also news that Iranian diplomats will meet with Eurozone officials to hold nuclear conversations on Friday, which opens the possibility of a peace agreement.

- Meanwhile, the conflict in the Middle East enters its eighth day with Tehran and Tel Aviv exchanging missiles and threats. Israel attacked several military and nuclear objectives during the night in an attempt to paralyze the objective of the Islamic Republic of obtaining a nuclear weapon and overthrowing its government.

- Petroleum prices remain stable at high levels, approximately 12% above the May range, which raises an additional challenge for the eurozone economy and acts as an obstacle to the recovery of the euro.

- France’s data revealed that the business climate remained quite stable at the level of 96.1 in June, rising slightly from 96.0, but the feeling among manufacturers has deteriorated to 96.0 since 97.0 in May, in the face of expectations of an improvement to 97.8.

- Earlier this week, the Federal Reserve maintained interest rates in the range of 4.25% -4.50% as expected, as well as projections of two interest cuts cuts by the end of the year, but the expectations of economic growth by 2025 were reduced to 1.4% from the previous 1.7%, and inflation expectations increased to 3% from the previous 2.7%. A weaker growth context and greater inflation raises a dilemma for the Central Bank.

- On Thursday, the president of the European Central Bank (ECB), Christine Lagarde, advocated greater regional trade between the European Union and neighboring economies to compensate for losses for global fragmentation during an event in Kyiv.

- The macroeconomic calendar is scarce on Friday. In the US, the culminating point will be the manufacturing survey of the Fed of Philadelphia, which is expected to show a slight improvement, although the index is maintained in negative territory for the third consecutive month.

- Something later, it is expected that the preliminary consumer confidence index published by the European Commission has improved at -14.5 in June from -15.2 in the previous month, even at levels consisting of weak economic growth.

EUR/USD continues in a bassist correction from 1,1630

EUR/USD He is negotiating within a descending channel since he reached a maximum of 1,1630 on June 12. The torque has reduced some losses in the last three days, but is still on its way to a moderate weekly loss. From a technical perspective, the bassist correction since the maximum of last week remains at stake.

The upward attempts are being limited around the maximum of June 18 in 1,530 on Friday. The torque should confirm above that level and break the upper part of the descending channel, now in 1,1570, to break the immediate bearish structure and re -focus attention on the aforementioned maximum of 1,1630.

At the bottom, the immediate support is in 1,1445 (minimum of June 19) and the support of the trend line of the descending channel, in 1,1440. A bearish reaction below that level would increase the pressure towards 1,1370, the minimum of June 6 and 10, and the 61.8% fibonacci retreat level drawn from the minimum of 1,1210 of May 29 to the maximum of 1,1630 of June 12.

Fed Faqs

The monetary policy of the United States is directed by the Federal Reserve (FED). The Fed has two mandates: to achieve prices stability and promote full employment. Its main tool to achieve these objectives is to adjust interest rates. When prices rise too quickly and inflation exceeds the objective of 2% set by the Federal Reserve, it rises interest rates, increasing the costs of loans throughout the economy. This translates into a strengthening of the US dollar (USD), since it makes the United States a more attractive place for international investors to place their money. When inflation falls below 2% or the unemployment rate is too high, the Federal Reserve can lower interest rates to foster indebtedness, which weighs on the green ticket.

The Federal Reserve (FED) celebrates eight meetings per year, in which the Federal Open Market Committee (FOMC) evaluates the economic situation and makes monetary policy decisions. The FOMC is made up of twelve officials of the Federal Reserve: the seven members of the Council of Governors, the president of the Bank of the Federal Reserve of New York and four of the eleven presidents of the regional banks of the Reserve, who exercise their positions for a year in a rotary form.

In extreme situations, the Federal Reserve can resort to a policy called Quantitative Easing (QE). The QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non -standard policy measure used during crises or when inflation is extremely low. It was the weapon chosen by the Fed during the great financial crisis of 2008. It is that the Fed prints more dollars and uses them to buy high quality bonds of financial institutions. The one usually weakens the US dollar.

The quantitative hardening (QT) is the inverse process to the QE, for which the Federal Reserve stops buying bonds from financial institutions and does not reinvote the capital of the bonds that it has in portfolio that they expire, to buy new bonds. It is usually positive for the value of the US dollar.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.