- EUR/USD moves back into neutral territory as markets prepare for the Fed.

- Traders are watching for a shift in the tone of the presidency.

The EUR/USD remains firm in more investors await the outcome of the Federal Reserve this week, while investors worry about a possible slowdown in the pace of interest rate hikes from December.

Analysts at TD Securities expect the FOMC to make another 75 basis point rate hike and say the decision will bring policy to a level where the Committee might feel more comfortable shifting to a more stable rate hike. . The exact timing, however, will largely depend on CPI data ahead of the December meeting. Powell might offer some clues at the post-meeting press conference.”

Looking ahead, the fed funds futures market has priced in a 57% chance of a 50 basis point hike, amid suggestions from Fed officials to slow the pace of tightening. However, the probability is lower than last Friday, which was 70%. Any moderate tone in Powell’s testimony could cause the curve to steepen. The bull market is decently priced for a dovish Fed, but it may still extend. The absence of leads from Powell poses the risk of a pain trade. However, this could be limited given the dollar’s closer correlation with curve easing vs. terminal.”

The dollar index is up more than 15% this year as the Fed has hiked rates sharply, crushing other currencies and putting pressure on the global economy. Investors have therefore welcomed speeches and interviews by some Fed officials who have suggested the central bank could make smaller hikes after Wednesday’s meeting.

Meanwhile, the Purchasing Managers’ Index (PMI) from the Institute of Supply Management (ISM) lost 0.7 points to 50.2, remaining in narrow expansion territory. The drop in new orders was smaller and employment was unchanged. Markets were also reminded that global inflation remains stubbornly high on Monday, when data showed euro zone prices posted the biggest increase on record for the year to October.

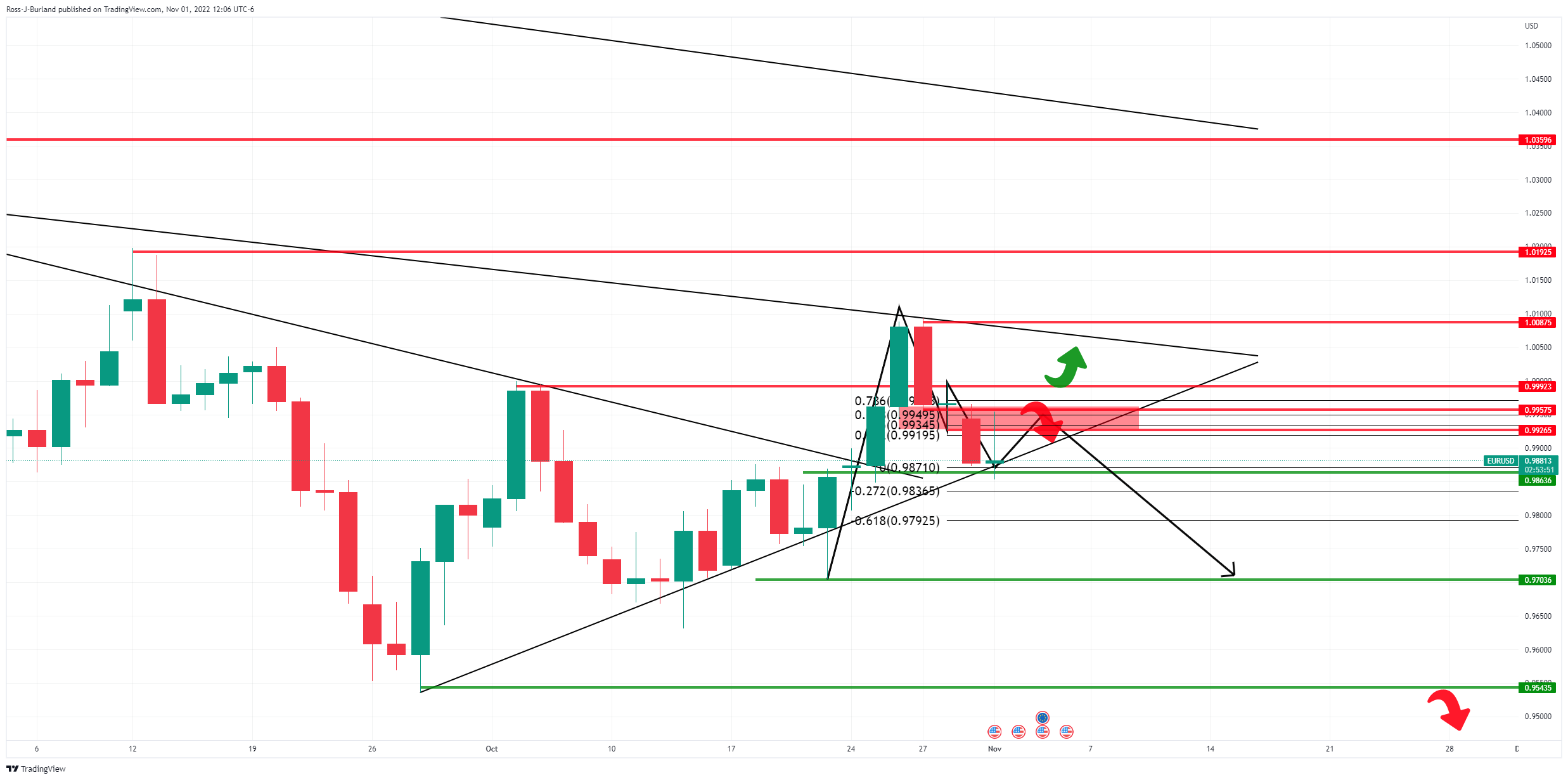

EUR/USD technical analysis

The price has carved an M formation within the symmetrical triangle that leaves the bias to the downside as long as the neckline of the M formation holds for the next few sessions:

EUR/USD

| Overview | |

|---|---|

| last price today | 0.9882 |

| daily change today | -0.0004 |

| Today’s daily variation in % | -0.04 |

| Daily opening today | 0.9886 |

| Trends | |

|---|---|

| daily SMA20 | 0.9843 |

| daily SMA50 | 0.9888 |

| daily SMA100 | 1.0078 |

| daily SMA200 | 1.0497 |

| levels | |

|---|---|

| Previous daily high | 0.9966 |

| Previous Daily Low | 0.9873 |

| Previous Weekly High | 1.0094 |

| Previous Weekly Low | 0.9807 |

| Previous Monthly High | 1.0094 |

| Previous Monthly Low | 0.9632 |

| Daily Fibonacci of 38.2% | 0.9908 |

| Daily Fibonacci of 61.8% | 0.993 |

| Daily Pivot Point S1 | 0.9851 |

| Daily Pivot Point S2 | 0.9815 |

| Daily Pivot Point S3 | 0.9758 |

| Daily Pivot Point R1 | 0.9944 |

| Daily Pivot Point R2 | 1.0001 |

| Daily Pivot Point R3 | 1.0036 |

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.