- EUR/USD pares part of the initial bullish move to 1.0670.

- The final Inflation Rate of the EMU rose 8.5% year-on-year in February.

- Advanced US Consumer Sentiment worsens to 63.4 in March.

He EUR/USD pair maintains the bullish trend around the 1.0640 zone at the end of the week. Despite the rebound of the last two sessions, the pair’s weekly performance falls into negative territory.

EUR/USD: Weekly gains seem capped around 1.0760

The recovery of risk space, mainly due to the easing of concerns about the banking system on both sides of the ocean, keeps the buying pressure around EUR/USD unchanged, adding to Thursday’s advance above 1.0600 , the figure for the end of the week.

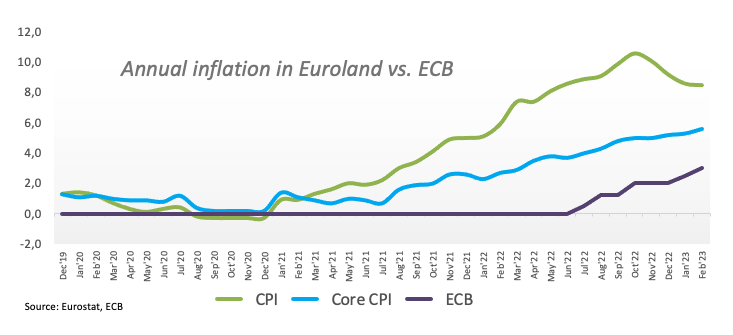

On the US side of the equation, the turnaround in the dollar comes amid the resumption of the downward trend in yields in the US and Germany, all on the back of the 50 basis point rate hike by from the ECB on Thursday and the conviction of a 25 basis point rate hike at the Fed meeting on March 22.

As for the data from the Eurozone, the final inflation figures showed an 8.5% increase in the CPI through February and 5.6% in the case of core inflation.

In the United States, Industrial Production did not register a monthly variation in February and contracted by 0.2% compared to the same month in 2022. In addition, Manufacturing Production grew by 0.1% month-on-month and was close to 1.0% in the last twelve months. Finally, the CB Leading Index fell 0.3% MoM over the past month and the Advanced University of Michigan Sentiment Index is expected to have deflated to 63.4 in March.

What to watch out for around the EUR

EUR/USD manages to put some of the recent weakness behind it and re-reaches the 1.0600 barrier and higher by the end of the week. The bounce seen so far in the second half of the week faltered near 1.0670.

Meanwhile, the evolution of the prices of the European currency should closely follow the dynamics of the dollar, as well as the possible next movements of the ECB in a context still dominated by high inflation, although in the midst of diminishing recession risks .

technical levels

For now, the pair is up 0.20% at 1.0629 and a break of 1.0759 (March 15 monthly high) would target 1.0804 (Feb. 14 weekly high) en route to 1.1032 (Feb. 2 high). On the other hand, the next support lies at 1.0516 (March 15 monthly low), followed by 1.0481 (Jan 6 low) and finally 1.0324 (200-day SMA).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.