- As investors unwind from the problems of the banking crisis, the EUR/USD pair gained ground above 1.0700.

- PPI in Germany was mixed, with a year-over-year reading above 15%, while month-on-month data contracted.

- EUR/USD: Bullish in the short term, but needs to break above 1.0760 to extend gains.

EUR/USD breaks the 1.0700 barrier and rises 0.50% after hitting a daily low of 1.0631. Improved market sentiment and intervention by the European Central Bank (ECB) help the euro (EUR), while the US dollar (USD) continues to weaken overall. At the time of writing, the EUR/USD pair is trading at 1.0720.

The German PPI and the intervention of the ECB, among the factors that drive the euro

Market sentiment improved after UBS’s purchase of its Swiss rival Crédito Suisse. The turmoil in financial markets has fueled speculation that central banks around the world may slow down the pace of monetary policy tightening. However, traders expect a 25 basis point rate hike from the Federal Reserve (Fed) on Wednesday. CME’s FedWatch tool odds for a quarter percentage point rise stand at 73.10%.

The EUR/USD has been boosted by ECB statements. ECB President Christine Lagarde said inflation is expected to remain excessively high for a longer period. She added that there is no compromise between inflation and financial stability, and that without tensions, the ECB would have indicated that further rate hikes were necessary.

Around the same time, the ECB’s Stoumaras commented that the ECB would not give any further forward guidance and said that meetings would be data dependent.

Earlier, Germany’s inflation on the producer side, known as the Producer Price Index (PPI), contracted -0.3% MoM, disappointing estimates of -0.5%. On an annual basis, the PPI rose 15.45, above forecasts of 14.5%.

Apart from this, the US economic data last Friday revealed that Industrial Production experienced a year-on-year decline of -0.2%, which is the first contraction of last year. The monthly reading was 0%, below the 0.2% estimate. In addition, US Consumer Sentiment, as measured by the University of Michigan (UM), decreased from 67 in February to 63.4 in March, the first drop in four months.

The US Dollar Index, which measures the value of the dollar, extended its losses to 0.44% at 103.417, a tailwind for the EUR/USD pair. US Treasury yields recover but fail to support the dollar.

EUR/USD Technical Analysis

EUR/USD has printed three consecutive bullish candlesticks, although it is still far from testing last week’s high at 1.0759. The daily chart suggests the existence of a triple bottom, although it would need to recover the latter to confirm its validity. This would pave the way for a rally towards the yearly high of 1.1032, but firstly, traders need to break through Feb 14 at 1.0804 before targeting 1.1000. Conversely, a break below the 100 and 200 day EMAs around 1.0545/1.0569 would turn the trend of EUR/USD down.

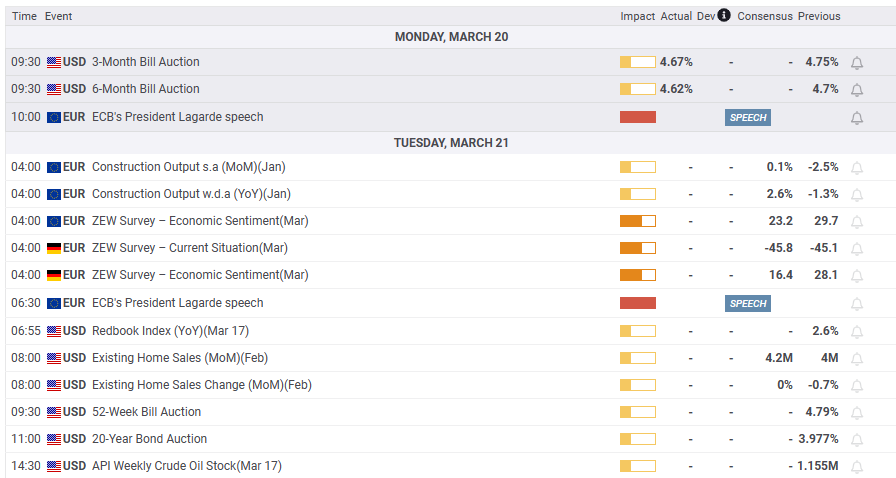

What is there to watch out for?

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.