- The EUR/USD pair advances in the Friday session and approaches 1.0900.

- Markets are tilting toward risk as investors once again bet that the Fed is done with rate hikes.

- The minutes of the Fed meeting will be published next Tuesday.

The pair EUR/USD it reached the 1.0900 area late on Friday, closing a week of recovery in the 1.0880 area after receiving a boost from the week’s opening bids near 1.0680.

US inflation numbers softened noticeably this week, taking market sentiment back to the top and sending the US Dollar (USD) lower across the board, while bets risk piled up in the Euro (EUR). The EUR/USD pair has been at the top of the market as investors take a breather from concerns about the Federal Reserve (Fed) rate hike.

Markets rally as investors announce end to Fed rate hikes

Given the moderation of growth and inflation figures in the US, the Money Markets value the possibility of the Fed maintaining rates in December at 100%. As the Fed has moved from an aggressive “hike for longer” stance to a more dovish “wait and see” stance, investors are seizing any opportunity for risk appetite as US data continues to show moderation. inflation.

The finalized Harmonized Index of Consumer Prices (HICP) in Europe was published early on Friday as expected, with a month-on-month increase of 0.1% in October and an annualized figure of 2.9%.

European inflation is slowly approaching the 2% band set by the European Central Bank (ECB) again, and the euro’s upside potential could be limited now that the ECB appears determined to raise rates.

US real estate data helps reinforce risk sentiment heading into Friday

US building permits in October increased from 1.471 million (revised downward from 1.475 million) to 1.487 million, beating the forecast decline to 1.45 million. Housing starts in October also exceeded forecasts, as 1.372 million residential units were added compared to 1.346 million in September (also revised downward from 1.458 million), exceeding the 1.35 million expected.

EUR/USD Technical Outlook

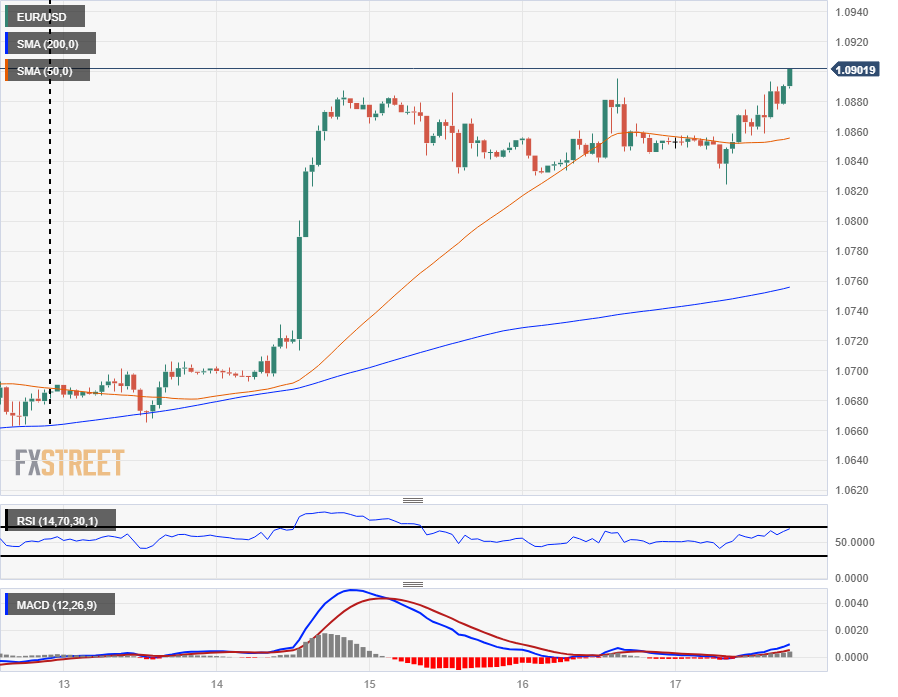

The recovery of the EUR/USD pair on Friday, with risk appetite, leads the pair to test chart territory in the 1.0900 area, reaching all-time highs for the week before the close.

The Euro is up 2.2% against the Dollar from the week’s lows at 1.0665.

The EUR/USD pair bounced off the 200 hourly moving average (SMA) last week, and the pair is testing its highest bids since late August.

This week’s recovery above the 1.0800 zone sees EUR/USD break the 200-day SMA and tilt bullish for Friday, with the 50-day SMA turning higher just above 1.0600 as the moving average struggles to follow the upward push of the Euro.

EUR/USD Hourly Chart

EUR/USD Daily Chart

EUR/USD technical levels

EUR/USD

| Overview | |

|---|---|

| Latest price today | 1.0903 |

| Today I change daily | 0.0057 |

| Today’s daily variation | 0.53 |

| Today’s daily opening | 1.0846 |

| Trends | |

|---|---|

| daily SMA20 | 1,067 |

| daily SMA50 | 1.0629 |

| SMA100 daily | 1.0792 |

| SMA200 daily | 1.0804 |

| Levels | |

|---|---|

| Previous daily high | 1.0896 |

| Previous daily low | 1,083 |

| Previous weekly high | 1.0756 |

| Previous weekly low | 1.0656 |

| Previous Monthly High | 1.0695 |

| Previous monthly low | 1.0448 |

| Daily Fibonacci 38.2 | 1.0871 |

| Fibonacci 61.8% daily | 1.0855 |

| Daily Pivot Point S1 | 1.0819 |

| Daily Pivot Point S2 | 1.0792 |

| Daily Pivot Point S3 | 1.0754 |

| Daily Pivot Point R1 | 1.0885 |

| Daily Pivot Point R2 | 1.0923 |

| Daily Pivot Point R3 | 1,095 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.