- EUR/USD retraces some of the recent strong rally and returns below 1.0650.

- Preliminary eurozone inflation figures surprised to the upside in February.

- Focus shifts to initial jobless claims and Waller’s speech from the Fed across the Atlantic.

The European currency halts its recent bullish momentum and forces the EUR/USD to retrace towards the 1.0620/15 region during the European session on Thursday.

EUR/USD continues to fall after eurozone data

The EUR/USD pair falls back to 1.0615 area as buying interest resumes around the US dollarespecially after the hitherto uninterrupted recovery in US yields and hawkish messages from Fed spokesmen (Kashkari on Wednesday).

Despite the weekly erratic behavior, the pair manages to stay in the positive territory after bottoming out at the 1.0535/30 area last week.

There has been no major reaction after the president Lagarde reiterated this morning that a 50 basis point rate hike is still on the table at the March meeting, while adding that decisions on the future path of rates will depend on the data, although it remains uncertain how far interest rates could rise. He has also pointed out that inflation is still too high and he does not see a recession in the region.

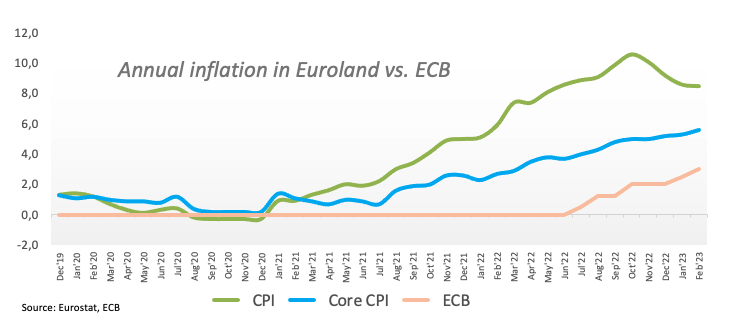

Regarding the economic data of the region, advanced eurozone inflation figures now show a headline CPI increase of 8.5% yoy in February and a core CPI of 5.6%. Later in the session, the ECB will publish the minutes of its February meeting.

In the US, they will be published initial weekly claims for unemployment benefits before the speech of C. Waller, of the FOMC.

What can we expect from the Euro?

EUR/USD is facing some selling pressure and retraces some of Wednesday’s advance to near 1.0700.

Meanwhile, the evolution of the prices of the common currency should closely follow the dynamics of the dollar, as well as the possible next movements of the ECB after the central bank already anticipated another 50 basis point rate hike at the March meeting.

Returning to the euro zone, it seems that the concern about a recession has dissipated, although it remains an important factor in sustaining the recovery of the common currency, as well as the hawkish discourse of the ECB.

EUR/USD levels

At time of writing, the pair is down 0.34% on the day, trading at 1.0630. Immediate support is found at 1.0532 (Feb 27 low), followed by 1.0481 (Jan 6 low) and 1.0327 (200-day SMA). To the upside, the break of 1.0714 (55-day SMA) would target 1.0804 (Feb 14 high) en route to 1.1032 (Feb 2 high).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.