- EUR/USD comes under bearish pressure and approaches 1.0660 again.

- German factory orders surprise to the upside in January.

- Chairman Powell testifies before Congress later in session.

The renewed selling pressure forces the EUR/USD to give up part of the previous bullish move to the 1.0700 region in a turnaround on Tuesday.

EUR/USD still capped at 1.0700…for now

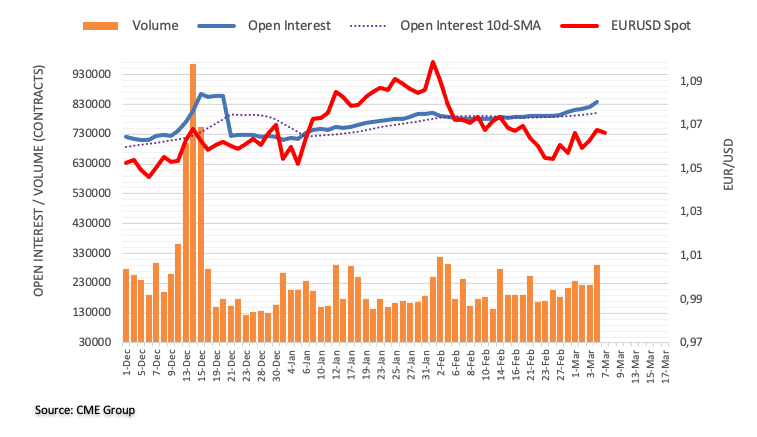

After two consecutive daily advances, the EUR/USD seems to have found stiff resistance just before the key 1.0700 barrier, amid a tepid rebound in the US dollar. However, further gains should not be ruled out in the near term as Monday’s rally was supported by rising open interest and volume in the futures markets.

Meanwhile, caution continues to prevail among market participants In light of the upcoming semi-annual testimony from the Fed Chairman, Jerome Powellbefore Congress on Tuesday.

No reaction has been seen in the Euro after the ECB published its Consumer Expectations Survey, where it forecasts 12-month consumer inflation expectations slightly lower, at 4.9% (from 5.0% above), and 2.5% (from 3.0%) in the three-year time horizon. Regarding economic growth, the survey continues to point to a contraction of 1.2% in the next 12 months.

Earlier in the session, German factory orders data showed they grew 1.0% m/m in January.

In the United States, wholesale inventories, the IBD/TIPP index of economic optimism and the change in consumer credit will be published later.

What can we expect from the Euro?

The EUR/USD pair appears to have found solid resistance near the 1.0700 area, against the fundamental background of continued dovishness ahead of Powell’s remarks later in the day.

Meanwhile, the evolution of the prices of the common currency should closely follow the dynamics of the dollar, as well as the possible next movements of the ECB after the central bank already anticipated another 50 basis point rate hike at the March meeting.

Returning to the euro zone, it seems that the concern about a recession has dissipated, although it continues to be an important factor in sustaining the recovery of the common currency, as well as the hawkish discourse of the ECB.

EUR/USD levels

At time of writing, EUR/USD is down 0.15% on the day, trading at 1.0657. Next support lies at 1.0532 (Feb 27 low), followed by 1.0481 (Jan 6 low) and 1.0326 (200-day SMA). On the other hand, a break of 1.0716 (55-day SMA) would target 1.0804 (Feb 14 high) en route to 1.1032 (Feb 2 high).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.