- The Euro seeks to consolidate its advance above 1.0900 against the US Dollar.

- Stock markets in Europe extend the positive start to the week.

- EUR/USD briefly reaches 4-day highs around 1.0930.

- The US Dollar Index (DXY) tests the 103.00 zone.

- The eurozone current account surplus increases in June.

- Fed speeches and housing data stand out on the US economic calendar.

The Euro (EUR) extends Monday’s good bounce against the US Dollar (USD) and lifts EUR/USD to the multi-day high zone around 1.0930, a region that also coincides with the 100-day SMA on Tuesday .

The further recovery in the pair is accompanied by a further loss of momentum in the Dollar, leading the DXY Dollar Index to give up more ground and opening the door for a possible visit to the 103.00 area sooner rather than later.

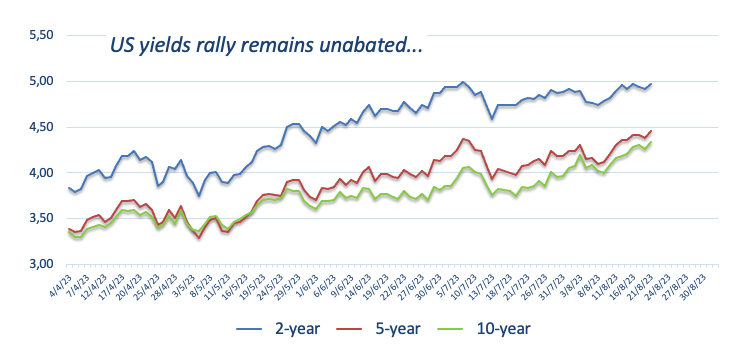

The dollar’s decline occurs amid a small correction in US yields at different maturities. In this sense, the short end of the curve continues to flirt with the 5.0% threshold, while the 10-year reference is around levels seen for the last time in November 2007, beyond 4.30%.

From a broader monetary policy perspective, the debate has resurfaced around the Federal Reserve’s commitment to tighten policy for an extended period. This renewed interest responds to the resilience of the US economy, even in the face of a slight easing in the labor market and lower inflation readings in recent months.

Within the European Central Bank (ECB) internal disagreements have arisen among the members of its Council on the continuation of the tightening measures after the summer period. These disagreements are contributing to renewed weakness that is weighing on the Euro.

Looking ahead, market participants are expected to take a cautious stance in light of the upcoming Jackson Hole Symposium and Chairman Jerome Powell’s speech in the second half of the week.

On the national calendar, the current account surplus in the euro zone in general widened in June to 35.84 billion euros, seasonally adjusted.

On the US agenda, existing home sales data for July will be released alongside the Richmond Fed’s regional manufacturing indicator and speeches from Thomas Barkin (2024 voter, centrist), Michelle Bowman ( permanent voter, centrist), FOMC Governor, and Austan Goolsbee (voter, centrist), of the Chicago Fed.

Market Drivers: Euro breaks above 1.0900 level and hits new weekly highs

- The Euro gains strength against the Dollar and breaks above the 1.0900 level.

- The improvement in risk appetite weighs on the dollar.

- US 10-year yields reach multi-year highs above 4.30%.

- The markets’ attention is still focused on the Jackson Hole meeting.

- The Fed’s talk of tightening rates for longer continues to haunt investors.

- The Fed is likely to keep rates unchanged through the first quarter of 2024.

Technical Analysis: Euro is now looking at 1.0960

EUR/USD extends Monday’s good run and hits fresh multi-day highs around 1.0930.

Should the recovery rally further, EUR/USD is expected to run into a tentative barrier at the 55-day SMA at 1.0961 ahead of the psychological 1.1000 level and August high at 1.1064 (August 10). . Once the latter is broken, the pair could challenge the weekly high at 1.1149 (July 27). If the pair breaks above this zone, it could relieve some of the bearish pressure and potentially visit the 2023 high at 1.1275 (July 18). Further up is the 2022 high at 1.1495 (Feb 10), closely followed by the round 1.1500 level.

Should the bears regain control, the pair could retest the August low at 1.0844 (August 18) ahead of the July low at 1.0833 (July 6). The break of this last level exposes the significant 200-day SMA at 1.0795 ahead of the May low at 1.0635 (May 31). Further down, there are additional support levels at the March low of 1.0516 (March 15) and the 2023 low at 1.0481 (Jan 6).

Furthermore, the positive outlook for the EUR/USD remains valid as long as it holds above the important 200-day SMA.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.