- The Euro is trading on the defensive against the US Dollar.

- Stock markets in Europe are now giving up initial gains.

- EUR/USD finds daily support around 1.0530.

- The US Dollar Index DXY is holding on to gains around the 106.50 area.

- The Economic Sentiment of the Eurozone and Germany surprised on the rise.

- Focus is on US retail sales and industrial production data.

The Euro (EUR) moves with moderate losses against the US Dollar (USD), leading the EUR/USD pair to trade around the 1.0550 level during the European session on Tuesday.

The DXY Dollar Index sees a slight advance towards the 106.30-106.40 region, putting aside Monday’s negative performance, as selling pressure persists in the US bond market.

Focusing attention on monetary policy, investors anticipate that the Federal Reserve (Fed) will maintain its stance of not applying any interest rate adjustments for the remainder of the year. Meanwhile, financial market participants are contemplating the possibility that the European Central Bank (ECB) may also pause its interest rate policy, despite inflation levels exceeding the bank’s target and growing concerns about a economic recession or stagflation in the European region.

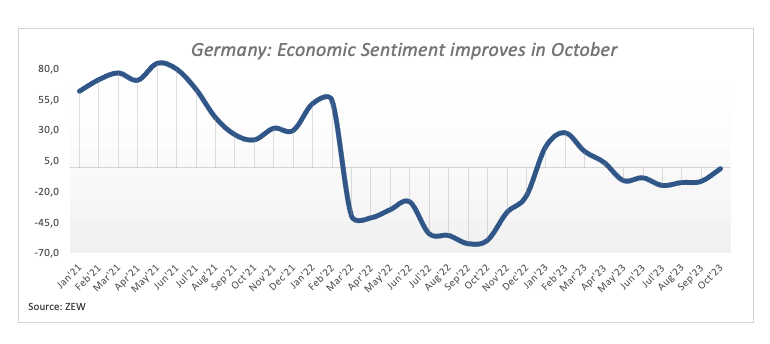

On the Euro economic agenda, economic sentiment in Germany and the eurozone, according to the ZEW Institute, was above expectations at -1.1 and 2.3 for the month of October.

In the United States, the focus will be on retail sales data, along with industrial production, the NAHB Housing Market Index, business inventories and speeches from FOMC Governor Michelle Bowman, the chairman of the New York Fed, John Williams, and the president of the Richmond Fed, Thomas Barkin.

Daily Market Summary: Euro struggles to regain 1.0600 zone

- The Euro faces some selling pressure against the Dollar.

- Yields in the US and Germany maintain the upward trend.

- Investors expect the Fed to keep interest rates steady in the coming months.

- Investors expect the ECB to pause its rate-hiking cycle.

- Those responsible for the ZEW institute suggest that the worst is over.

- Geopolitical tensions in the Middle East remain high.

- BoE’s Swati Dhingra sees some relaxation in the labor market.

- The RBA minutes showed a hardline stance from policymakers.

Technical Analysis: Euro faces key support around 1.0450

EUR/USD is under slight downward pressure and returns to the 1.0550 area on Tuesday.

If the current uptrend persists, EUR/USD could revisit the October 12 high at 1.0639, ahead of the September 20 high at 1.0736 and the notable 200-day SMA at 1.0821. A break above this level could lead to an attempt to break through the August 30 high at 1.0945 and approach the psychological level of 1.1000. Further up, if the August 10 high of 1.1064 is broken, the pair could approach the July 27 high of 1.1149 and even reach the 2023 high of 1.1275 seen on July 18.

On the other hand, should selling pressure resume, there is a chance to revisit the 2023 low at 1.0448 seen on October 3 and possibly test the important support at 1.0400. If this level is broken, it could open the door to retest the lows of 1.0290 (November 30, 2022) and 1.0222 (November 21, 2022).

As long as EUR/USD remains below the 200-day SMA, the possibility of sustained bearish pressure remains.

Frequently asked questions about the Euro

What is the Euro?

The Euro is the currency of the 20 countries of the European Union that belong to the euro zone. It is the second most traded currency in the world, behind the US dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily volume of more than $2.2 trillion per day.

EUR/USD is the most traded currency pair in the world, accounting for an estimated 30% of all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2% ).

What is the ECB and how does it influence the Euro?

The European Central Bank (ECB), headquartered in Frankfurt, Germany, is the reserve bank of the euro zone. The ECB sets interest rates and manages monetary policy

The ECB’s main mandate is to maintain price stability, which means controlling inflation or stimulating growth. Its main instrument is to raise or lower interest rates. Relatively high interest rates – or the expectation of higher rates – tend to benefit the Euro and vice versa.

The Governing Council of the ECB takes monetary policy decisions at meetings held eight times a year. Decisions are made by the heads of the eurozone’s national banks and six permanent members, including ECB President Christine Lagarde.

How do inflation data influence the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), are important econometric data for the euro. If inflation rises more than expected, especially if it exceeds the 2% target set by the ECB, it is forced to raise interest rates to bring it back under control.

Relatively high interest rates compared to their peers tend to benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How do economic data influence the value of the Euro?

Data releases measure the health of the economy and can influence the Euro. Indicators such as GDP, manufacturing and services PMIs, employment and consumer sentiment surveys can influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment, but it may encourage the ECB to raise interest rates, which will directly strengthen the Euro. Conversely, if economic data is weak, the Euro is likely to fall.

The economic data for the four largest economies in the eurozone (Germany, France, Italy and Spain) are especially significant, as they represent 75% of the eurozone economy.

How does the trade balance affect the Euro?

Another important release for the euro is the trade balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports during a given period.

If a country produces highly sought-after export products, its currency will appreciate due to the additional demand created by foreign buyers wishing to purchase these goods. Therefore, a positive net trade balance strengthens a currency and vice versa for a negative balance.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.