Major automakers such as Volkswagen, Daimler and Stellantis are keen to provide their European factories with a stable supply of batteries for electric vehicles, but they face a more serious problem in the form of a shortage of raw materials for these batteries.

Lack of sufficient amounts of lithium, nickel, manganese or cobalt could slow down the transition to electric vehicles, making them more expensive and unprofitable for automakers.

Until recently, it was believed that Europe lost the battery race to dominant Asian manufacturers such as China’s CATL, South Korea’s LG Chem and Japan’s Panasonic. This was not seen as a problem, hoping to import off-the-shelf batteries.

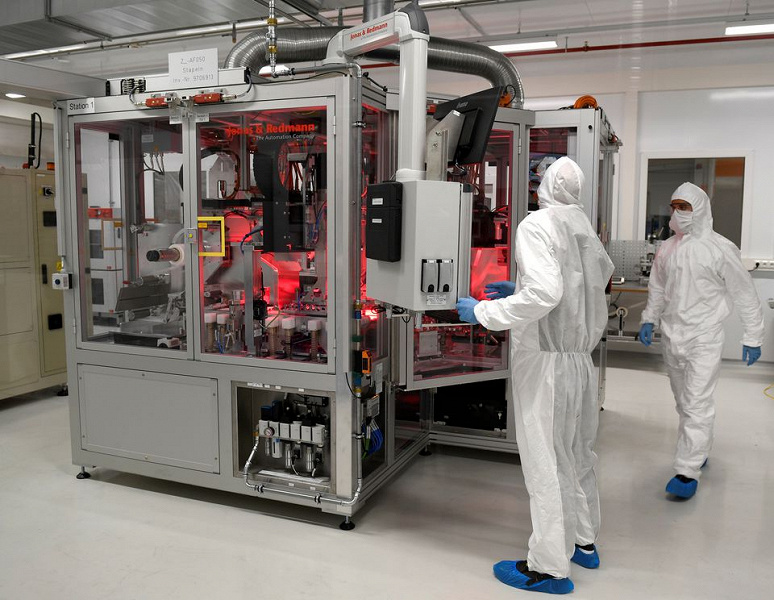

But predictions by major banks that electric vehicle sales will skyrocket over the next decade have shaken the political establishment and automakers and forced a rethink of battery manufacturing. The result is billion-euro EU funding programs and ambitious plans to build large battery factories by car manufacturers. Volkswagen alone is planning six battery factories in Europe, while Daimler and its partners are planning four. In total, the number of projects planned in the EU is approaching fifty.

If all these plans become a reality, local production can meet the demand for batteries by about 2030. Then, as many batteries will be produced annually as needed for 13 million electric vehicles.

The problem lies in materials such as lithium, nickel, manganese and cobalt. Investment in the extraction of raw materials lags behind investment in the production of battery cells, so raw material prices are already rising, and soon enough the lack of materials may become a limiting factor, since Europe is not the only region that is switching to electric vehicles.

One of the possible solutions is called the refusal of the more expensive imports in favor of its own development and production. According to EIT InnoEnergy estimates, by 2030 Europe will be able to obtain a quarter of the raw materials it needs locally, provided that investments begin to flow in this direction now. Another option is recycling, but quality problems do not allow us to hope that more than 10-20% of demand will be satisfied with secondary raw materials.

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.

.jpeg)

.jpg)