MEPs today approved a proposal from the European Commission to implement the recent international agreement on a global minimum corporate tax rate of 15%.

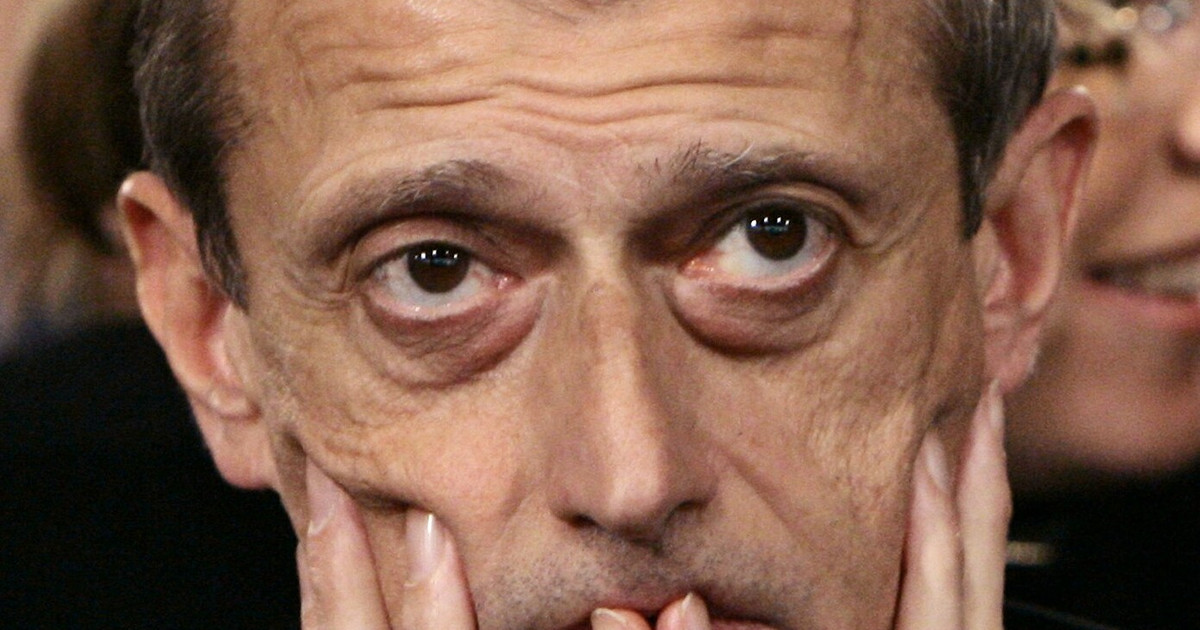

The report, drafted by Aurore Lalucq (Socialists, France), was adopted by 503 votes to 46, with 48 abstentions.

The text retains the key elements of the Commission proposal, in particular the proposed timetable and implementation deadline of 31 December 2022, with a view to the rapid implementation of legislation.

However, MEPs changed the Commission proposal on key points. In particular, they introduced a clause which provides for the revision of the annual revenue threshold under which a multinational will be subject to the minimum tax rate. They also want to assess the impact of legislation in developing countries.

MEPs are also seeking to reduce some of the exceptions proposed by the Commission and to reduce the possibility of abuse of the rules, in particular by introducing a specific article containing rules to combat tax avoidance schemes.

Statements

After the vote, the rapporteur said: “This agreement is not perfect. For example, we would like to have a higher tax rate. However, it is the result of the compromise reached. Today, there is an urgent need for an agreement between EU ministers and “rapid implementation of the legislation. That was the basic guiding principle of today’s vote.”

Next steps

The report, which is Parliament ‘s opinion, is now being forwarded to the Council, which must adopt a final text unanimously.

Source: Capital

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.