Protesters are repressed with gas when trying to enter Buenos Aires

“Hunger doesn’t wait, it’s enough to adjust.” With messages like this, flags and drums, hundreds of members of social movements

“The Acolyte”: new series from the Star Wars franchise gets a premiere date

“The Acolyte” new series from the universe of “Star Wars” , got a release date

Protesters are repressed with gas when trying to enter Buenos Aires

“Hunger doesn’t wait, it’s enough to adjust.” With messages like this, flags and drums, hundreds of members of social movements

“The Acolyte”: new series from the Star Wars franchise gets a premiere date

“The Acolyte” new series from the universe of “Star Wars” , got a release date

“The Acolyte”: new series from the Star Wars franchise gets a premiere date

“The Acolyte” new series from the universe of “Star Wars” , got a release date

Finance

US Chamber of Digital Commerce: “The arrest of Binance executives in Nigeria is a kidnapping”

The US Chamber of Digital Commerce has called on the administration of President Joe Biden to provide diplomatic assistance for

CoinMarketCap: Ethereum Balances on the Brink of a Psychologically Important Level

The second-largest cryptocurrency by capitalization faced significant downward pressure and a sharp price pullback, close to the levels of early

What’s hot

Standard Chartered: Bitcoin price will rise to $150,000 by the end of the year

Standard Chartered bank experts believe that the price of Bitcoin will rise to $150,000 by the end of 2024 and

Lost screen real estate, Citi’s new ‘world headquarters’

A man cleans up on the trading floor, following traders testing positive for Coronavirus disease (COVID-19), at the New York

What’s hot

Standard Chartered: Bitcoin price will rise to $150,000 by the end of the year

Standard Chartered bank experts believe that the price of Bitcoin will rise to $150,000 by the end of 2024 and

Lost screen real estate, Citi’s new ‘world headquarters’

A man cleans up on the trading floor, following traders testing positive for Coronavirus disease (COVID-19), at the New York

Markets

EUR/JPY trades little changed as BoJ hike priced in and Eurozone data upbeat

The EUR/JPY cross is trading flat at the start of the week as the BoJ's telegraphed price hike

MOST POPULAR

EUR/JPY trades little changed as BoJ hike priced in and Eurozone data upbeat

The EUR/JPY cross is trading flat at the start of the week as the BoJ's telegraphed price hike

MOST POPULAR

EUR/JPY trades little changed as BoJ hike priced in and Eurozone data upbeat

The EUR/JPY cross is trading flat at the start of the week as the BoJ's telegraphed price hike

Top News

Risks of hearing loss in old age are different for men and women

A hearing loss It's something common in old age. This condition is called

The head of Crypto.com commented on the Bitcoin correction

The CEO of the cryptocurrency exchange Crypto.com, Kris Marzsalek, believes that the crypto

What can I do to avoid crying when cutting onions? Experts give tips

Do you need to cry? Time to chop an onion. Onions are tasty

NFT with Dogwifhat symbol sold for $4.3 million

Possible owner of a dog named Achi, which is the symbol of the

Animal or vegetable protein: study suggests which is best for sleep

Have a good sleep quality It is essential for overall health. Studies have

Binance CEO predicts BTC will rise above $80,000

Binance cryptocurrency exchange CEO Richard Teng expects Bitcoin to continue to grow. This

Author's Choice

“The Acolyte”: new series from the Star Wars franchise gets a premiere date

“The Acolyte” new series from the universe of “Star Wars” , got a release date

Protesters are repressed with gas when trying to enter Buenos Aires

“Hunger doesn’t wait, it’s enough to adjust.” With messages like this, flags and drums, hundreds of members of social movements

“The Acolyte”: new series from the Star Wars franchise gets a premiere date

“The Acolyte” new series from the universe of “Star Wars” , got a release date

“The Acolyte”: new series from the Star Wars franchise gets a premiere date

“The Acolyte” new series from the universe of “Star Wars” , got a release date

MOST POPULAR

EUR/JPY trades little changed as BoJ hike priced in and Eurozone data upbeat

The EUR/JPY cross is trading flat at the start of the week as the BoJ's telegraphed price hike

MOST POPULAR

EUR/JPY trades little changed as BoJ hike priced in and Eurozone data upbeat

The EUR/JPY cross is trading flat at the start of the week as the BoJ's telegraphed price hike

best of

the month

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

MOST POPULAR

EUR/JPY trades little changed as BoJ hike priced in and Eurozone data upbeat

The EUR/JPY cross is trading flat at the start of the week as the BoJ's telegraphed price hike

best of

the month

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

lastest news

Suffocating heat and storms: Inmet issues warning for almost all of Brazil

The National Institute of Meteorology (Inmet) issued a warning of intense rain and storms for

“The Acolyte”: new series from the Star Wars franchise gets a premiere date

“The Acolyte” new series from the universe of “Star Wars” , got a release date

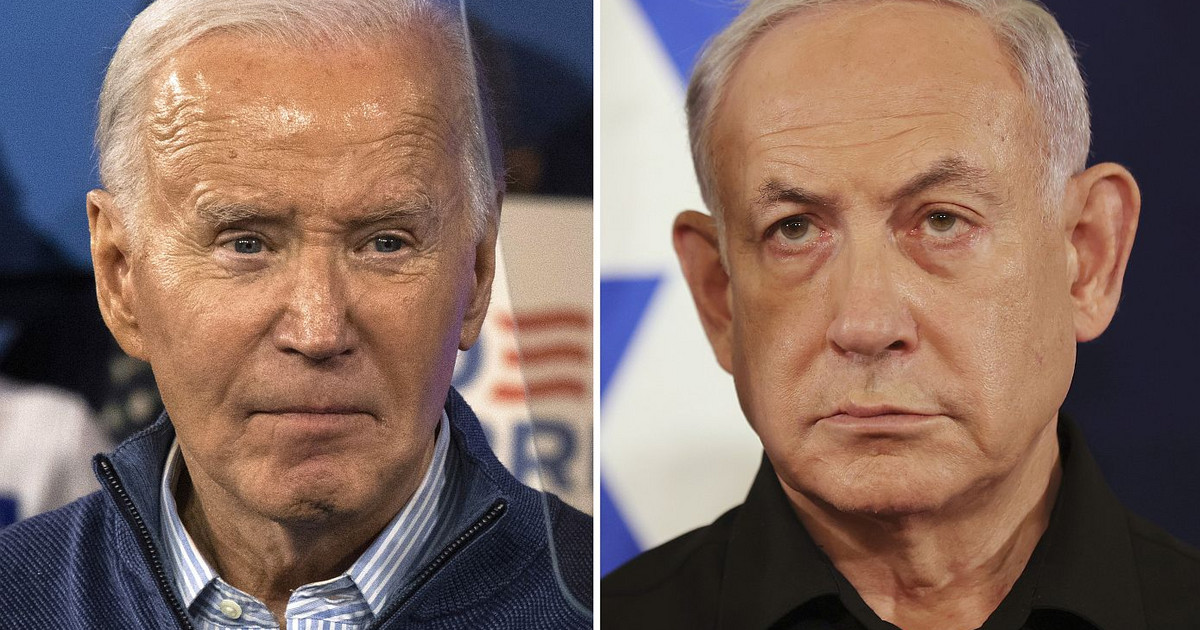

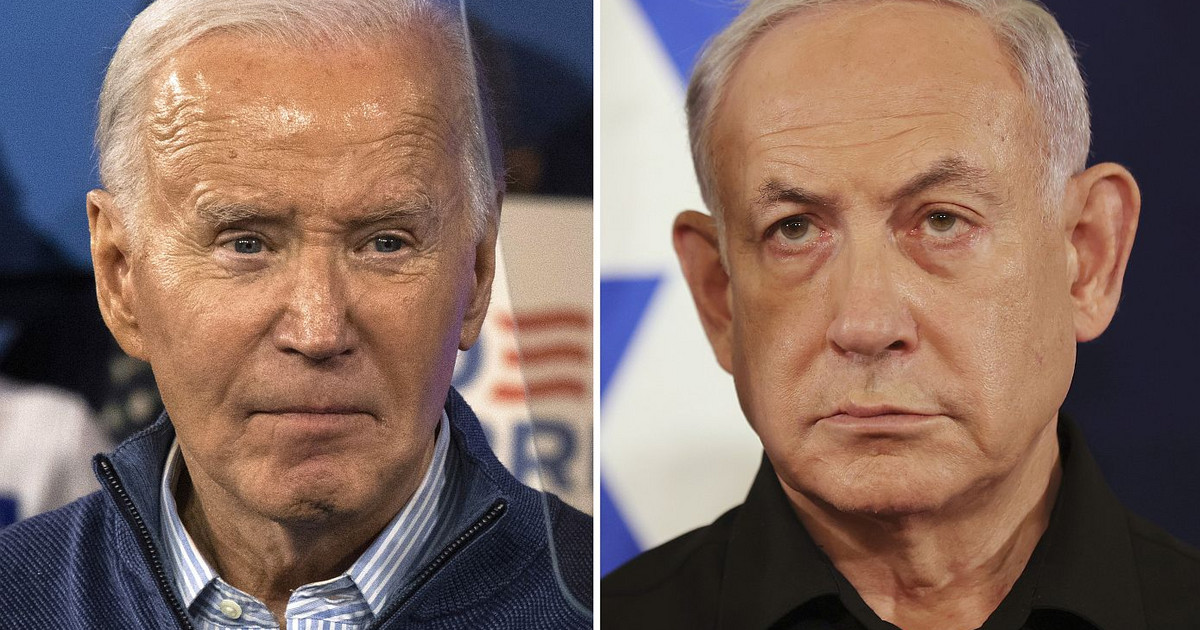

Netanyahu tells Biden 'Israel is determined to achieve all war objectives' in Gaza

Israeli Prime Minister Benjamin Netanyahu told US President Joe Biden that Israel is determined to

Waiting list for Prouni is now open; find out how to sign up

This Monday (18), the Ministry of Education opened the waiting list for the first semester

RBA Forecast: Three Scenarios and Their Implications for AUD/USD – TDS

TD Securities economists analyze the Reserve Bank of Australia's (RBA) interest rate decision and its

The European Union approved providing an additional 5 billion to Ukraine

The member states of the European Union approved providing an additional 5 billion to Ukraine,

lastest news

Suffocating heat and storms: Inmet issues warning for almost all of Brazil

The National Institute of Meteorology (Inmet) issued a warning of intense rain and storms for

“The Acolyte”: new series from the Star Wars franchise gets a premiere date

“The Acolyte” new series from the universe of “Star Wars” , got a release date

Netanyahu tells Biden 'Israel is determined to achieve all war objectives' in Gaza

Israeli Prime Minister Benjamin Netanyahu told US President Joe Biden that Israel is determined to

Waiting list for Prouni is now open; find out how to sign up

This Monday (18), the Ministry of Education opened the waiting list for the first semester

RBA Forecast: Three Scenarios and Their Implications for AUD/USD – TDS

TD Securities economists analyze the Reserve Bank of Australia's (RBA) interest rate decision and its

The European Union approved providing an additional 5 billion to Ukraine

The member states of the European Union approved providing an additional 5 billion to Ukraine,