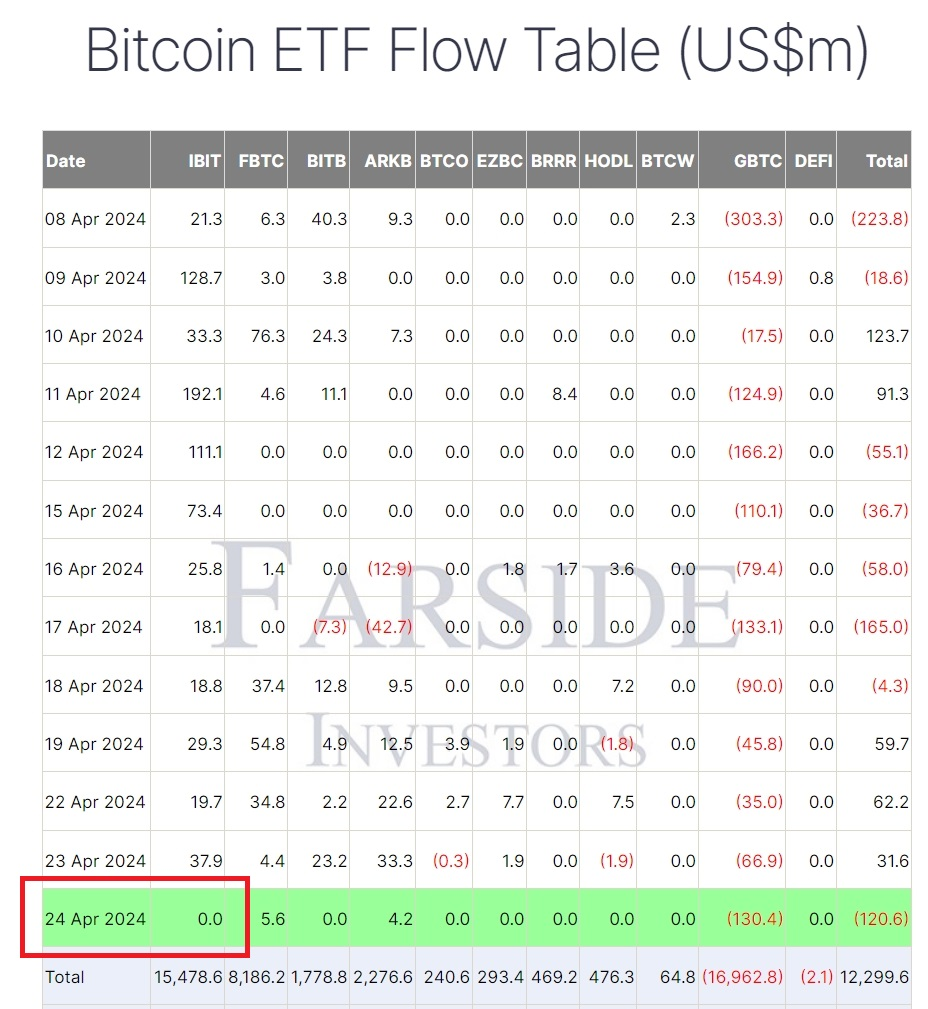

Since its launch on January 11, IBIT has attracted millions of dollars in investment daily and has managed to raise nearly $15.5 billion in just 71 days. However, on April 24, the inflow of liquidity into the fund remained at zero.

Farside commented that a similar phenomenon is not uncommon for other market participants. For example, Fidelity's FBTC fund recorded three days of zero inflows over the past two weeks. However, the first lack of liquidity in one of the most popular IBIT funds may signal the beginning of a slowdown in the Bitcoin ETF market.

According to Farside, demand for spot Bitcoin ETFs slowed in the days leading up to the halving, with total net outflows amounting to more than $300 million. The largest liquidity outflows were recorded in the Grayscale Bitcoin Trust (GBTC) – approximately $116 million – and Ark 21Shares (ARKB). – about $43 million.

Earlier, experts from the analytical group The Block Research published data that in early April, the total volume of transactions in the market for spot exchange-traded funds for Bitcoin reached a record level of $201.7 billion.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.