Bitcoin

Bitcoin over the past week decreased by 4.5 %. The largest cryptocurrency is still trading about $ 100,000, then rising, then lowering. Most of the week passed under the sign of the bears: five of the seven trading sessions ended in the minus.

Source: TradingView.com

The main catalyst for the fall was the concerns of the consequences of trade wars. They appeared on the news about Trump introducing trade duties 25 % for imports from Canada and Mexico, as well as 10 % for China. A little later, the effect of new restrictions is slightly weakened. Explained simply – Trump

put down The introduction of new tariffs for Canada and Mexico for a month after response from the neighboring countries. With China – the question is still suspended.

Another reason for the BTC fall was the surviving liquidation by traders of long positions. In particular, this concerned two trading sessions, on February 2 and 3, when the trading positions were closed by more than $ 2 billion. In general, throughout the Long liquidation week, they exceeded the liquidation of shorts in monetary terms.

Source: Coinglass.com

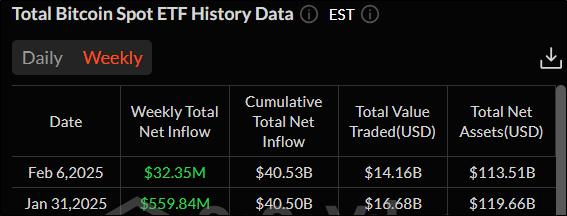

There was no support for bitcoin and from institutional investors. In the week, the influx of funds in the spotal ETF amounted to only $ 32.35 million from January 31, which is 17 times less than in the previous seven days.

Source: sosovalue.com

From the point of view of technical analysis, the initiative now has sellers. This is confirmed by an excess of a 50-day sliding average (indicated in blue) price. The trend of BTC is still weak, which is proved by the low value (23.2) of the ADX indicator. Support and resistance levels have remained unchanged since last week: $ 89 164 and $ 109,356, respectively.

Source: TradingView.com

Index

Fear and greed Compared to last week, I fell by 32 points. The current value is 44. This indicates a predominance of fear of greed in the moods of crypto -investors.

Ethereum

Air in seven days, from January 31 to February 7, decreased by more than 17%in price. In the course of the week on Monday, February 3, the cost of the second in capitalization of the coin also fell to minimums from August 2024 – $ 2,118.

Source: TradingView.com

The main reason for the negative dynamics of ETH in the week was a decrease in open interest. If at the end of January he confidently kept above $ 30 billion, then with the advent of February at once collapsed to $ 23.38 billion.

Source: Coinglass.com

But other metric for the broadcast is quite positive. From February 1, there is exclusively an outflow of broadcast from exchanges. In seven days, ETH was withdrawn in the amount of over $ 1 billion. This suggests that investors are ready to accumulate cryptocurrency, not selling.

Source: Coinglass.com

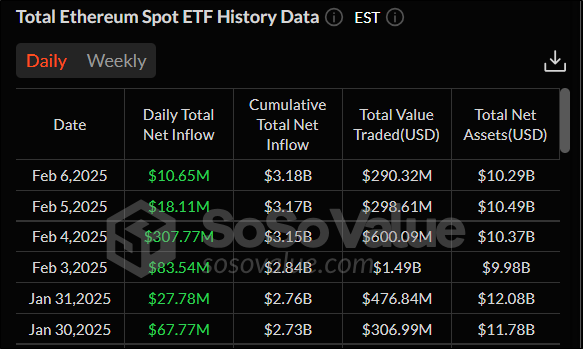

This is confirmed by statistics on spoty ETF on air. There are already six trading sessions in a row, cash tributaries have been observed. This indicates the interest from institutional investors in investments in the second in capitalization of cryptocurrency.

Source: sosovalue.com

In terms of technical analysis, the broadcast has a bear trend. True, indicators give multidirectional signals. The price is below 50-day sliding average (indicated in blue), which indicates in favor of sellers. But Stochastik came out of the resale zone, and also gave a bovine divergence signal (multidirectional movement of the indicator with a price marked with lilac lines). It usually testifies in favor of bulls. Nevertheless, talk about changing the trend prematurely. First you need to overcome the resistance level – $ 2,820.5. The support level is $ 2,112.

Source: TradingView.com

SOLANA

SOLANA from January 31 to February 7, 2025 sank by 17.7 %. Cryptocurrency is again trading below $ 200. Most of the week passed under the sign of a decrease: five of the seven trading sessions turned out to be minus.

Source: TradingView.com

Despite the negative price dynamics, in general, the news background is positive for Solana. The US Securities and Exchange Commission (SEC) has finally made some progress in relation to the spotov ETF for this cryptocurrency. No applications have been approved yet. But the regulator

agreed Consider the proposal of Grayscale about the conversion of its Trust (Grayscale Solana Trust) to the Sports on SOLANA. The former head of the SEC Gary Gensler rejected such initiatives. It is worth noting that this is the first time when the regulator

agreed Consider applications for spotes ETF for cryptocurrencies, which he himself had previously recognized unregistered securities.

On February 6, the event was significant for Solana – for a year, the work of the blockchain was not overshadowed by malfunctions. This has become a record term for SOL cryptocurrency. Despite the fact that consensus problems have not arisen for twelve months, 30 % of transactions in Solana are still unsuccessful. The main reason is the delay of transfers with centralized crypto -rhms (CEX) due to lack of reserves. There were days in the past when 70 % of transactions in Solana

turned out to be unsuccessful.

But the economic cost of cryptocurrency, which consists of the maximum extracted value (MEV) and collected commissions, increased by the third more than 300 %in the fourth quarter of 2024. The main reasons

steel The growth of activity on the network and the yield of validators.

According to technical analysis, SOLANA has a bear’s general trend. The price is below the 50-day sliding average (indicated by blue colors). RSI also continues to fall, dropping below 50 mark, which speaks in favor of continuing the trend. Current levels of support and resistance: $ 175 and $ 202, respectively.

Source: TradingView.com

Conclusion

February began for large cryptocurrencies in the red zone. Bitcoin, ether and Solana for a week decreased in price. At the same time, there are a number of positive signals that can serve as a turn in the near future.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.