The Member of the Board of Governors of the Federal Reserve (FED), Dr. Lisa Cook, said Friday during an event organized at the University of New York that, although the economic factors of the US were strong during the first quarter, those responsible for the FED policy are beginning to see signs of stress in key industries, namely the housing and the commercial real estate sector.

Dr. Cook also stressed that treasure bond markets were ordered and functional during commerce -related volatility in April, but stopped before saying that bond market functionality could begin to suffer due to inconsistent policies management by the White House.

Cook key outstanding aspects

According to Dr. Cook, a “sufficiently large income shock could increase breaches and lead to losses for lenders.” The Fed The BOG member of the Fed, Dr. Cook, avoided directly declare how it could be a great income shock, but lately, the Fed speech has been remarkably inclined towards inflationary and low -employment pressures due to unequal commercial policies of the Trump administration.

Dr. Cook admitted that he is “observing the commercial real estate sector” and acknowledged that she is also beginning to see signs of stress in the balance between low to moderate income households. Dr. Cook of the Fed did not reveal much that he was not already known by investors, and the market positioning is greatly maintained without changes in the day while US investors prepare for a long weekend.

Market reaction

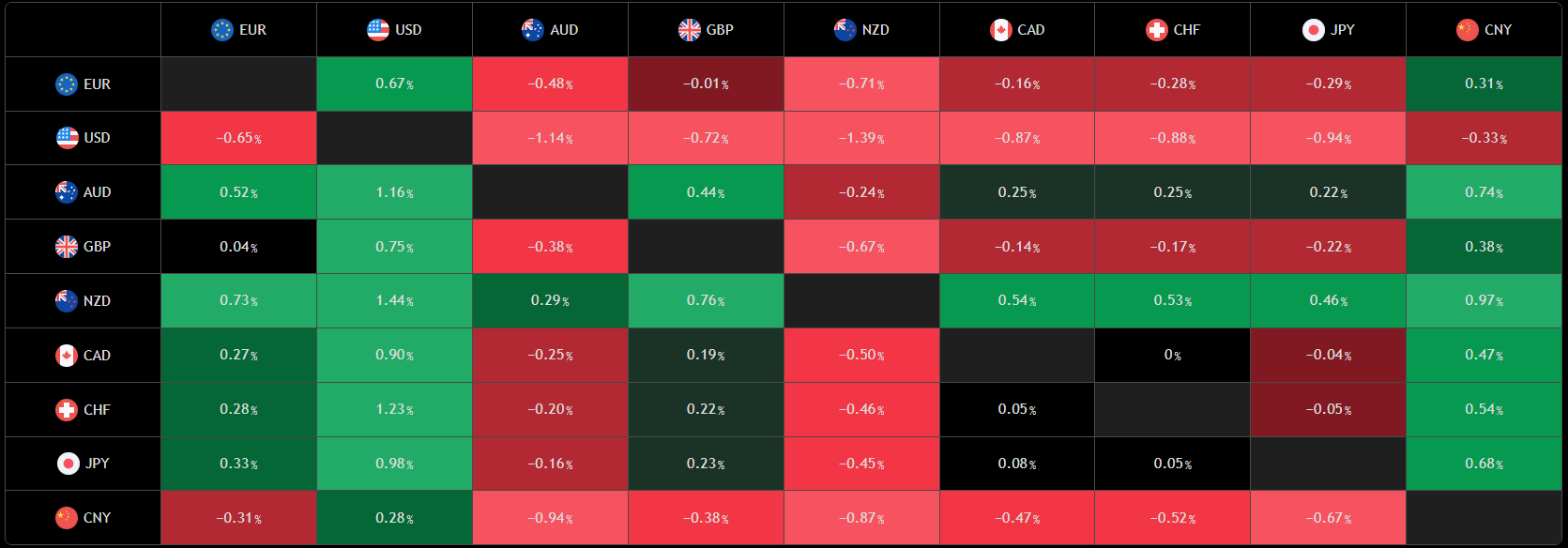

The US dollar index (DXY) is falling abruptly on Friday, lowering about 99.20 at the time of writing, while the dollar falls in all areas.

(Forex heat map of TrainingView, 1D Time Frame)

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.