Federal Reserve officials said last month that the job market was “very tight” and that the US central bank may need to not just raise interest rates earlier than expected, but also reduce your overall asset portfolio to contain high inflation, showed the minutes of the monetary policy meeting from December 14 to 15, released this Wednesday (5).

“Participants generally noted… that it may be necessary to raise the ‘federal funds’ rate sooner or at a faster pace than participants had previously anticipated. Some also pointed out that it might be appropriate to start reducing the size of the Federal Reserve’s balance sheet relatively soon after interest rate hikes begin, the minutes said.

The document offered more details on the Fed’s move last month towards a more aggressive monetary policy against inflation.

Monetary policy makers agreed to speed up the end of the bond purchase program – implemented at the beginning of the pandemic – and issued forecasts that anticipated aggregated 0.75 percentage point increases in interest rates during 2022.

The minutes showed that the central bank not only debated an initial rise in interest rates, but whether it should use a second mechanism to curb inflation by allowing its allocations to Treasuries and mortgage-backed securities to decline.

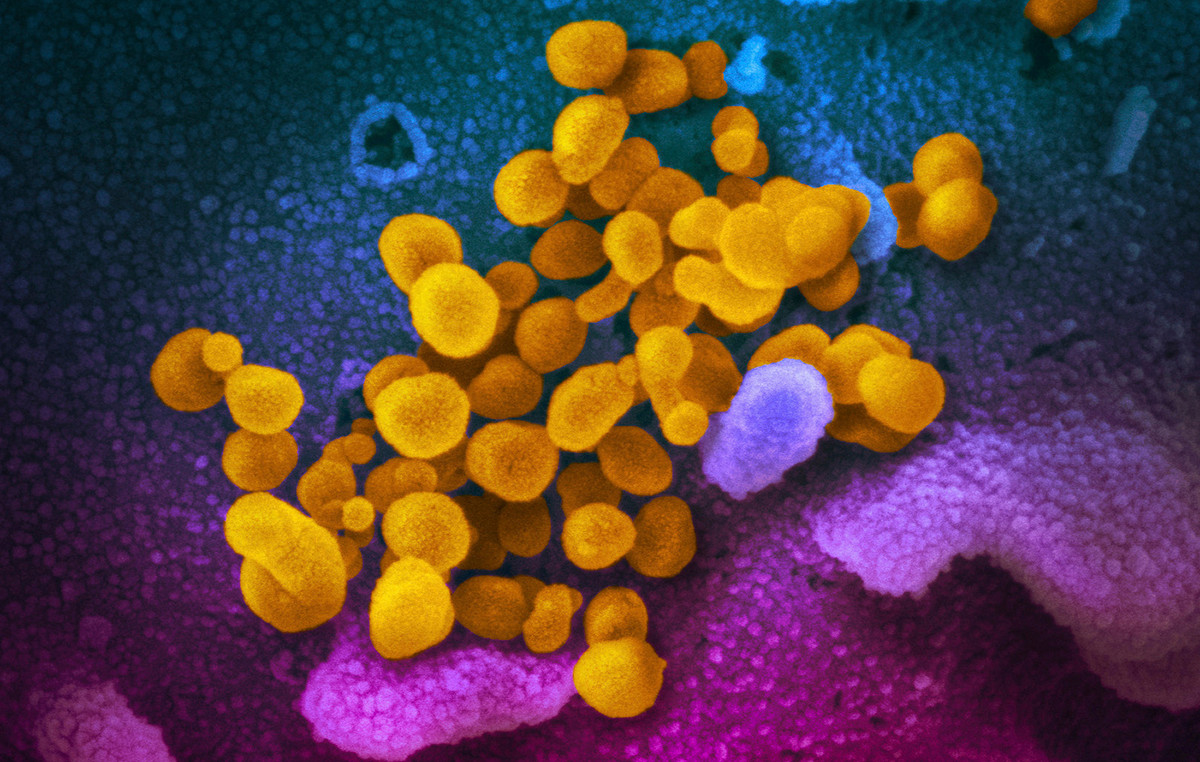

The December meeting was held when the coronavirus case count began to rise due to the spread of the Ômicron variant.

Infections have risen very rapidly since then, and there has yet been no comment from senior Fed officials to indicate whether the change in the health situation has altered their views on appropriate monetary policy.

Fed Chair Jerome Powell will appear before the Senate Banking Committee next week for a hearing on his appointment to a second four-year term as head of the central bank, and is likely to update his views on the economy at the time.

Reference: CNN Brasil

I am Sophia william, author of World Stock Market. I have a degree in journalism from the University of Missouri and I have worked as a reporter for several news websites. I have a passion for writing and informing people about the latest news and events happening in the world. I strive to be accurate and unbiased in my reporting, and I hope to provide readers with valuable information that they can use to make informed decisions.